The stock market consists of buyers and sellers. At the end of the day, the number of shares bought equals the number of shares sold. But one side is always more motivated than the other.

When buyers are more motivated than sellers, prices go up. Prices dip when sellers are more motivated. That’s why it’s often said that a bull market ends when we run out of buyers.

Well, the biggest buyers of this bull market are scaling back their purchases. This will hurt the bulls.

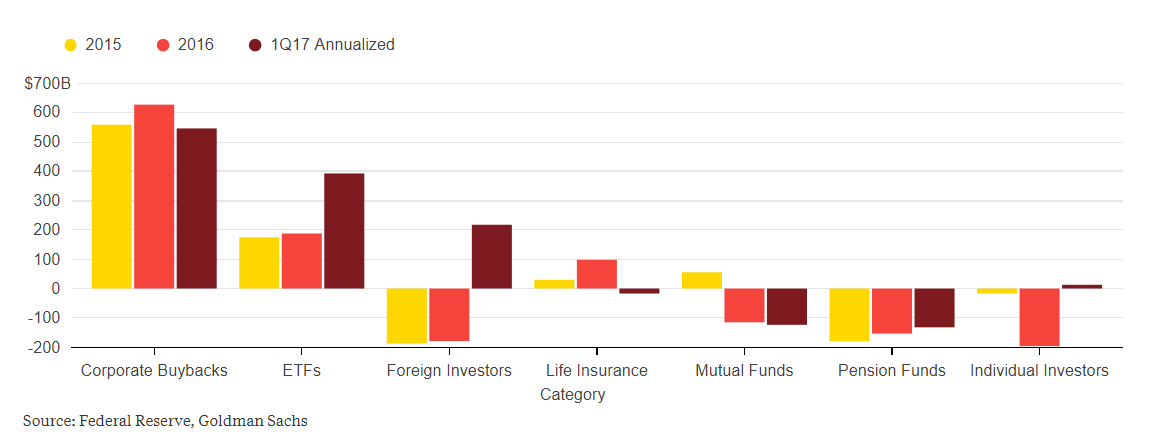

In the chart below, we see corporate buybacks were the biggest source of funds in the last two years. Now, they’re pulling back.

(Source: Bloomberg)

According to S&P Dow Jones Indices, companies in the S&P 500 bought about $120 billion worth of their own stock last quarter. This was down from a year ago. It’s the fifth consecutive quarter that the amount spent declined compared to a year ago.

This is the longest streak of declines since the market meltdown in 2008.

Once a company announces a buyback, they’re motivated to buy the shares. Reducing that source of demand for stocks puts the bull market at risk.

Ending buybacks benefits shareholders in the long run. Companies should be using cash to build factories and expand their business. So buying back shares cheats shareholders in the long run.

But, in the short run, buying back shares pushes prices up. For now, it’s possible that foreign buyers will replace share buybacks to keep the bull market alive. However, they will not continue buying if prices start to fall.

For now, this is something to watch. If the S&P 500 or Dow Jones Industrial Average fall by 5%, it will be time to sell.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader