A few months ago, 8,500 people crammed into the New York Hilton hotel for Consensus 2018 — a crypto conference held by blockchain news site CoinDesk.

The event attracts crypto enthusiasts from around the world. Suited Wall Street types mingle with mohawked teenage programmers from Eastern Europe.

At one of the evening cocktail receptions, I spoke with a couple of Venezuelan bitcoin miners. I’ve read the news and heard the reports of their economic crisis; however, hearing their firsthand account really hit home.

They told me how the prices of grocery staples such as chicken, milk and rice moved higher every week for years starting a decade ago. When the government decided to slap price controls on food, the result was that the grocers just didn’t have food to sell anymore.

The shortage of food led to nationwide malnutrition. I Googled it and learned that the annual “Venezuela’s Living Conditions Survey” found nearly 75% of the population said they had lost an average of at least 8.7 kilograms (19.4 pounds) in weight due to a lack of proper nutrition in 2016. The following year, 64% said they lost at least 11 kilograms (24 pounds).

Expectedly, crime is also rampant. In 2015, the Venezuelan murder rate was among the highest in the world, with 90 murders per 100,000 people (compared to 5 per 100,000 for the U.S).

As if there weren’t enough to worry about already, kidnappings are a common occurrence. Both of these guys anxiously related how their friends were nabbed by gangs, only to be released after their families paid substantial ransom money.

One of the only industries still ramping up production in Venezuela is the government’s printing presses. However, monetary inflation has sparked another crisis of hyperinflation, compounding the country’s already existing problems.

How Did Venezuela Wind Up Here?

This historically significant crisis started in 2010 under the populist government of President Hugo Chavez and continued after his 2013 passing under current President Nicolas Maduro.

Between 2013-2017, Venezuela’s gross domestic product (GDP) dropped at a 20% annual rate, worse than the United States during the Great Depression. Its economy has also fallen faster than Russia’s or Cuba’s after the fall of communism. Almost 90% of the country now lives in poverty.

The Venezuelan bolivar has fallen sharply, and the International Monetary Fund estimates the 2018 inflation rate at 18,000%. If you can find a cafe that will still serve you a cup of coffee, it will set you back 2 million bolivars.

This hit home when one of the Venezuelan bitcoin miners pulled out a 100,000 bolivar bill, handed it to me and said: “This is worth about 15 cents.”

The Value of Bitcoin

Venezuela is experiencing rampant hyperinflation similar to historic episodes in Zimbabwe and the Weimar Republic.

In these instances, the governments thought they could rid themselves of economic problems by printing and devaluing their currency. As there are now more pieces of government paper chasing around the same amount of goods, prices inflate.Throughout human history, dating back to the Roman Empire’s clipping their coins, citizens have always been on the short end of the stick with few alternatives.

One previous solution was to ditch your currency for gold. However, for the hardest-hit rural farmer, there just aren’t many places to buy gold. Gold is also bulky and difficult to store, especially if you don’t have access to a bank (like 2 billion people globally).

However, blockchain technology and the world’s first cryptocurrency, bitcoin, can now provide a way for anyone, anywhere, with a mobile phone to safely store something of value.

And the best part: The value of bitcoin is only tied to the free market, or the price that buyers and sellers are willing to pay for the digital gold.

It can be stored online, on your computer desktop or even on a piece of paper. There is no centralized authority overseeing the network that can devalue or steal your currency.

That’s why Venezuelans, eager to dump their native currency, have sought to store their economic value in bitcoin, with local prices sometimes trading at a 20% to 30% premium over other countries.

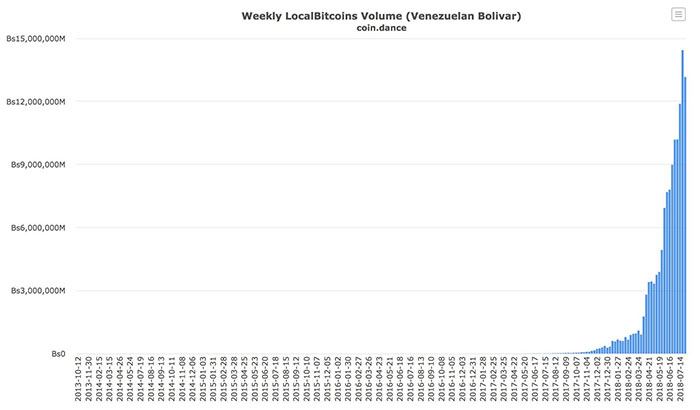

As Venezuela contends with hyperinflation, weekly volume in bitcoin trading versus the bolivar has skyrocketed, nearly reaching 15 trillion bolivars in June.

The Venezuelan economy is only a fraction of the size of the U.S., China or Japan. And this influx of bolivars into bitcoin hasn’t really moved the price.

However, the world is waking up to this new mechanism that can protect citizens from further bouts of deflation and keep governments honest. With the global debt-to-GDP ratio still near pre-crisis levels at 225%, there will surely be more currency devaluations in the future.

While I can’t predict what country will face the next crisis, I can assure you that bitcoin will be an alternative store of value.

Regards,

Ian King

Editor, Crypto Profit Trader