“I love it when a plan comes together.”

In the 1980s action series The A-Team, the group’s leader, Col. John “Hannibal” Smith, would often say that after a successful mission.

Hannibal and the rest of the crew — “Face,” B.A. Baracus (played by Mr. T) and “Howling Mad” Murdock — devised plans to help folks in need. Then they carried them out.

This is a lot like what you do when you are investing. Like the people who hired the A-Team, though, sometimes you need help.

I often enlist the help of institutions and hedge fund managers. They file a Form 13F 45 days after the end of each quarter that lists their holdings.

Last week, I gave you an example of one of these trades. This week, we’re following a successful hedge fund into another.

A Billionaire Investor Superstar

I expect you can make 20% over the next year in this stock.

And so does one of the hedge fund managers I like to follow. Billionaire Investor, Ken Griffin runs Chicago investment firm Citadel Advisors. The firm manages $28 billion. Its flagship funds obliterated the S&P 500 Index and other hedge funds in the first quarter.

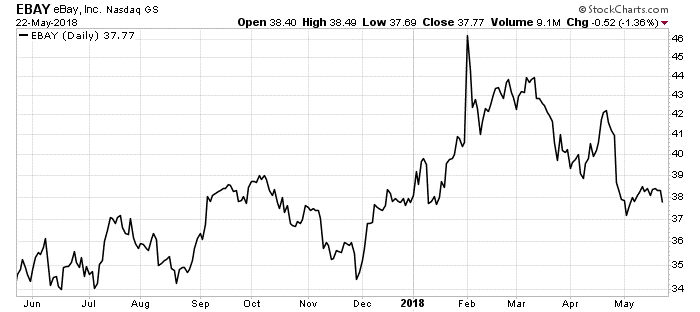

Griffin’s firm likes e-commerce pioneer eBay Inc. (Nasdaq: EBAY). Citadel more than doubled its stake in the name in the first quarter.

The beauty of the situation is we can buy shares for even less than Citadel:

EBay’s share price has fallen recently … and that offers us our opportunity today.

EBay Is a Cash Machine

The company has 170 million active buyers … and more than 1.1 billion listings at any given time. EBay gets a piece of each of those sales.

It has increased its sales every year since 2013. Management expects they should grow about 8% this year to nearly $11 billion.

And eBay is a cash machine. It has more than $4.8 billion in cash … and generates more than $2 billion more in free cash flow each year.

It doesn’t pay a dividend, so it uses its extra cash to buy back stock. It has decreased its share count by more than 20% since 2013.

It will have some extra cash for buybacks this year as well. You see, eBay owns 5.44% of Indian e-commerce company Flipkart. Retail giant Walmart just agreed to buy 77% of Flipkart for $16 billion. EBay will sell its stake for about $1.1 billion.

This deal will also end Flipkart’s license to use the eBay brand in India, so eBay plans to relaunch its India site. The company sees solid opportunities for growth in this market.

This is no surprise. EBay has been growing outside of the U.S. for years. Since 2013, its non-U.S. sales have increase from 52% to 57% of the total.

Finally, don’t forget eBay’s willingness to reward shareholders. In 2015, it spun off PayPal Holdings Inc. (Nasdaq: PYPL). Investors received one share of PayPal for every eBay share they owned.

The combined value of these two entities is more than $50 billion greater today than before the spinoff. PayPal shares trade for more than $80 per share today.

If it was so inclined, eBay could spin off online ticketing service StubHub to investors.

Its earnings are more volatile than the core business since the popularity of important sporting events changes from year to year. But StubHub should still be worth about $3 billion. Not bad given eBay paid $310 million for it in 2007.

What to Do

I suggest you take advantage of eBay’s recent price weakness. You don’t have to rush in. Given the share price weakness, you can wait for shares to trade above $38.70 before you buy.

Then sit back and wait. You should be able to quote Col. “Hannibal” Smith.

Good investing,

Brian Christopher

Senior Analyst, Banyan Hill Publishing

Editor’s Note: There are numerous solid investments right now primed and ready to spin off huge windfalls that could put millions in your pocket. In fact, research has shown that every year, on average, 43 stocks rally 1,000% or higher! That means there are 43 opportunities every year to turn $1,000 into $10,000, or turn $10,000 into $100,000. To learn about Paul ’s three-phase strategy for pinpointing stocks on the verge of soaring 1,000% or more, click here.