Amazon.com Inc. (Nasdaq: AMZN) isn’t a regular company. It’s a tech company. But it’s run by Jeff Bezos, a financial engineer.

Prior to founding Amazon, Bezos worked on internet-enabled business opportunities at the hedge fund company D.E. Shaw & Co. This was when the internet was brand-new. He left D.E. Shaw in 1994 to start his own internet-enabled business.

Bezos saw the opportunity for technology to disrupt retail. But he also saw the financial opportunity from a 1992 Supreme Court ruling that exempted mail-order companies from collecting state sales taxes unless they operate a physical location in the state.

It’s the marriage of an investment banker’s mind with technology that makes Amazon unique. It’s also what indicates Amazon stock could increase by 50%.

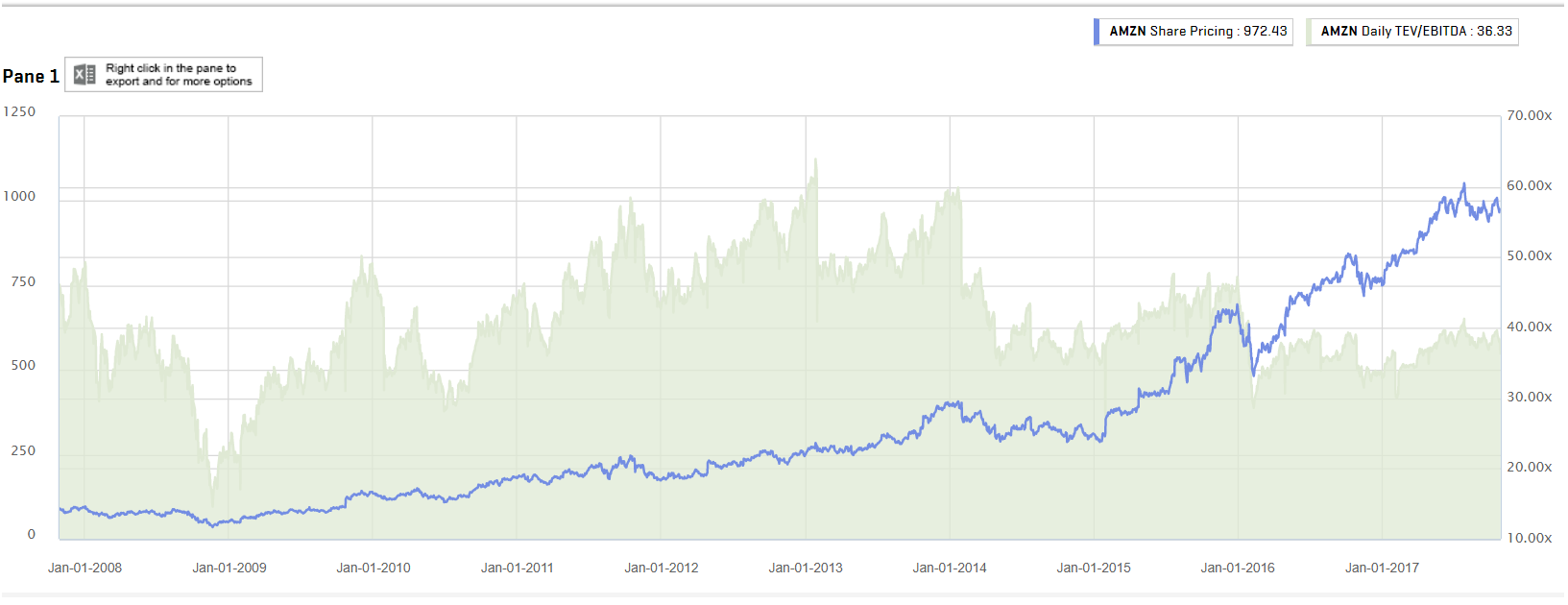

The chart below shows how an investment banker would value Amazon. Price is the blue line.

In the chart, the green area shows the total enterprise value (TEV) to earnings before interest, taxes, depreciation and amortization (EBITDA) ratio. This ratio is about 12% below its 10-year average. It’s 40% below its high.

TEV/EBITDA is how an investment banker values a company. TEV is the price to buy the whole company, considering any bonds that are outstanding and other ownership stakes. EBITDA is a rough measure of the cash an owner of a company allocates.

Bezos knows he wants to allocate cash flow to maximize TEV. He’s the perfect guy to run Amazon. He evaluates opportunities based on cash flow rather than technology.

Ratios like TEV/EBITDA are mean-reverting. That means they move above and below average.

Right now, the ratio is well below average. I expect it to move to an above-average level. That indicates Amazon could rally 50% from its current price.

Using call options could magnify the gains, leading to gains of 500% or more. My Precision Profits readers understand how even small moves in stocks can lead to large returns. They enjoyed a gain of more than 400% in Microsoft Corp. (Nasdaq: MSFT) in less than a week after the stock gained 7%.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader