Since the start of the year, my team and I have worked tirelessly to uncover stocks trading under $5 per share with the potential to grow 500% or more over the next year.

There’s a good reason to focus on this particular number. Due to an obscure and frankly arbitrary SEC rule, large institutions cannot buy stocks that trade under $5… And in fact, they’re effectively forced to sell them if they cross below that level.

That provides a huge opportunity for small investors in this niche space. But finding the best stocks to buy is no small task.

There are hundreds of $5 stocks. And as cheap as this “price of entry” sounds, very few are worth that $5…

Most are hardly worth anything at all. I wouldn’t buy them and you shouldn’t either.

However, a rare handful of them are worth so much more than the market understands.

But how to find them?

It comes down to six special factors that, when brought together, can help you identify high-potential buy candidates to outperform the market — whether we’ve seen the worst or not.

Let me show you the most favorable metrics I look for when selecting the best $5 stocks to buy…

The Makings of a Strong $5 Stock

Those six factors I just mentioned make up the Green Zone Power Ratings system. It’s at the heart of nearly everything we do at my research firm Money & Markets.

The ratings system analyzes a majority of the stock market universe on six factors — three based on a stock’s price action, three based on the company’s fundamentals — which combine into a simple 0 to 100 score.

The higher the score, the more likely that stock is to outperform the market over the next 12 months. If a score doesn’t rank 60 or above … it’s not likely to beat the market.

Anything below 40, and you’re looking at a Bearish stock. And below 20, we flag it “High-Risk” — no place for hard-earned money.

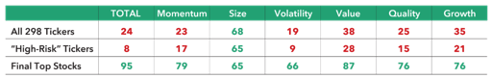

Recently, I ran every stock that traded under $5 through the Green Zone Power Ratings System. Below, you can see the results organized into three rows along with the overall score and each of the six factors.

The first row shows the average rating for all the stocks trading under $5 that passed the “first check” of my system — which filters out over-the-counter stocks, pink sheets or other “penny” stocks that aren’t liquid enough to trade.

As you can see, there’s not much to be desired here. The list averaged a Bearish score of 24, and none of the six factors averaged 70 or higher.

That just goes to prove that most $5 stocks are not worth your investment.

I will note the Size factor averaged 68 for the “All” list. That’s not surprising, since a small share price and a small market capitalization tend to go hand in hand. And my ratings system generally favors smaller stocks for their growth potential.

Next up are the “High-Risk” stocks that trade for $5 or less. You can see that group of stocks rates poorly on every factor except for size. These are definitely the stocks to avoid, or even consider trading against if you’re a more advanced investor.

Lastly, the “Final Top Stocks” list. This group rates extremely high on each of the factors, earning “Bullish” or “Strong Bullish” ratings across the board.

These are the small, high-quality and favorably-priced $5 stocks I want to reveal to you. They are fantastic buys that I expect will trounce the market in the coming years!

Now, I’ve picked the very best of the best of these stocks to share with subscribers of my premium investment advisory, 10X Stocks.

There, in addition to the top five $5 stocks on my watchlist, I share a new idea every month with the potential to 10X your money over the long haul.

For example, we recently took partial profits on an under-the-radar tech stock, web browser company Opera (OPRA), for a 100% gain in less than three months. While OPRA wasn’t a $5 stock (we bought it at $9), that should help illustrate the value of the research we publish in 10X Stocks.

You can get the full details of how to become a member right here, and access a detailed special report that outlines my top five $5 stock opportunities.

However, that’s not where I’ll leave you today…

I deeply understand the desire to go it alone and do your own research to find winning investments. It’s the path I took to founding my own research firm in the first place.

So if you’re the type who’s happy to do the legwork and uncover incredible $5 stock opportunities yourself, read on for a helpful guide on how to start your search.

6 Quick and Easy Ways to Screen $5 (or Any) Stocks

You can see in the table above that the very best $5 stocks rate highly on each of the six factors that have been proven to deliver market-beating returns: Momentum, Size, Volatility, Value, Quality and Growth.

We’ve put a ton of work into making the Green Zone Power Ratings system accessible, so you can know how a stock scores on these all-important factors easily.

And you can search any of the tickers you have in your portfolio at Money & Markets.

As much as I’d love to tell you everything that goes into this system… We’d be here all day if I did. Not to mention, the years of work my team and I have put into this system would be unduly exposed.

But what I can do is provide a simple rule of thumb to help you discover stocks that rate well on these factors…

- To find stocks with strong Momentum, look for the stocks participating in, and exceeding, broader trends. Looking at a stock’s trailing returns over the last several months to a year is a good place to start here.

- To find stocks of a small Size, market capitalization is a simple and easily accessible measure. Stocks below $1 billion are considered small caps, and they can provide the best balance of growth and acceptable risk.

- Stocks with low Volatility are a little trickier to screen for, but you can look for names with low beta, a measure of volatility as compared to a market benchmark like the S&P 500. If you can find a stock with a beta of less than 1, you can be confident it’s generally less volatile than the overall market.

- To find stocks with a good Value, look for companies that carry a price-to-earnings ratio less than the average ratio in that sector. If you find that, and the stock is fundamentally sound otherwise, chances are high it’s a good value.

- To find stocks with high Quality, look for stocks that deliver strong cash flows compared to their peers, as well as higher return-on-equity metrics.

- To find stocks with market-beating Growth, I like to look at a company’s year-over-year growth rates in both revenue and earnings.

I hope this gives you a good baseline on where to start your search.

Most investors feel this is a difficult market to invest in, but I see the bear market as the ultimate “gift” to us.

It’s making a trove of opportunities available, particularly among the small, high-quality and cheaply-priced stocks I love to find … especially if they’re trading below the arbitrary $5 per share price that makes them off-limits to large investors (for now)!

There are never any guarantees in the market, but you can be confident that the old ways of buying any large-cap tech stock and waiting for the profits to roll in are long gone.

It’s going to take a lot more work, but my team and I are committed to helping you make the most of this hugely important time to find the best stocks out there.

To good profits,

Adam O’Dell

Adam O’Dell

Chief Investment Strategist, Money & Markets