It’s that time of year: deal season.

You’ve no doubt seen the great sales online and brick-and-mortar retailers have for the holidays.

But the deals are available outside of retail stores, too.

You see, the S&P 500 Index has fallen 14% since it peaked on September 20. But that is tame compared to the nearly 22% fall of the small-cap-focused Russell 2000 Index.

I’m not rubbing it in. Your portfolio has likely not been immune from these down moves. I know mine hasn’t.

The thing is, the more the market falls, the more deals you can find. Here’s what I suggest you do…

Make Your Wish List

Prepare to take advantage of these deals … just like you are going shopping the day after Christmas.

First, honor your trailing stops. If one of your stocks hits your pre-established stop, sell it.

This will help you to have the “dry powder” you need for the next steps.

Next, create a list of the names you want to own.

There may be some stocks that you want to own, but never thought you could get for today’s prices.

For example, you may have had your eye on health care company Johnson & Johnson (NYSE: JNJ). If you didn’t pick up shares when it traded for $120 in May, you may find today’s sub-$130 price appealing.

Create a System to Find Deals

Another way to create a list is by running a screen to find beaten-down names.

There are lots of stock screeners out there. For example, Yahoo! Finance and CNBC both offer free versions.

These are great tools for generating ideas. They allow you to enter your own criteria or to choose from preselected inputs. For example, the CNBC screener offers canned versions like “Small Cap Value” and “S&P 500 Dogs.”

I created one myself.

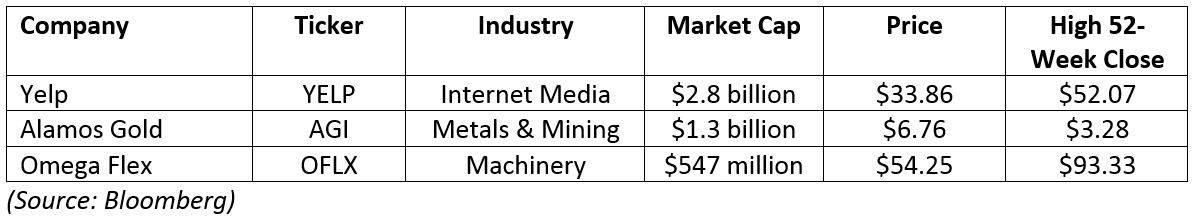

First, I searched for U.S. and Canadian stocks with a market cap above $300 million that had fallen at least 25% since September 20.

The size of stocks is up to you. I wasn’t looking for micro-caps, but I wanted to make sure the pool of candidates was large enough, too.

I removed companies that had debt or didn’t generate positive free cash flow.

We don’t know for sure how long this downtrend will last. So, I want to find stocks that can make it through. It is rare for companies that don’t have debt to go bankrupt.

I also sought companies whose revenue had increased over the past year and traded at a reasonable valuation.

The search returned three names. Here they are, sorted by market cap.

This article is not a recommendation to buy any of these stocks. And before you can even consider buying any of these names, make sure they have stopped falling.

The stock that looks most intriguing to me is online review site Yelp Inc. (NYSE: YELP). The company is a cash cow with $800 million of cash and no debt. It has generated positive free cash flow in every quarter since 2015.

There are rumors on Wall Street that it could be a buyout candidate as well, given its price decline.

This makes some sense. Internet companies have been hit hard this year. Vultures are circling. I wouldn’t be surprised to see several deals in this space next year.

Next Steps

So, go ahead and create your own stock screen(s). This will help you create a list of stocks you would like to buy when the time is right.

And do it today … before stocks move up again.

Good investing,

Brian Christopher

Editor, Insider Profit Trader