The first six months of 2018 are in the history books. And it was a historically unusual start to the year.

From the beginning of January through the end of June, the S&P 500 Index gained just 1.67%. That’s a below-average price move. On average, the index delivers a gain or loss of more than 9.5% in the first six months of the year.

There were only five years in the past 55 when the index ended that six-month period with a price move of less than 1.7%.

The most recent example was 2015. In July of that year, China devalued its currency, and the S&P 500 dropped 10%.

Other low-return years include: 2000, when the internet bubble was bursting, 1990, as a recession was beginning and 1978, the beginning of the double-digit inflationary period and a double-dip recession.

The only gain after a slow start came in 1965. The S&P 500 gained 10% over the next six months before beginning a 16-year bear market.

History says it’s time to expect a big move in stock prices. Obviously, the question is whether the move will be up or down.

I think we’ll see an up move.

Is This Year Different?

In the long run, earnings drive the stock market. That’s easy to forget when trade wars and slow economic growth dominate the headlines. But we just started earnings season, and the numbers from large companies look promising

In fact, analysts expect earnings growth of 20% for the quarter.

If that projection is accurate, it will mark the second-highest earnings growth for S&P 500 companies since 2010, trailing only the previous quarter’s growth rate of 24.8%. It will also mark the third straight quarter in which the index has reported double-digit earnings growth.

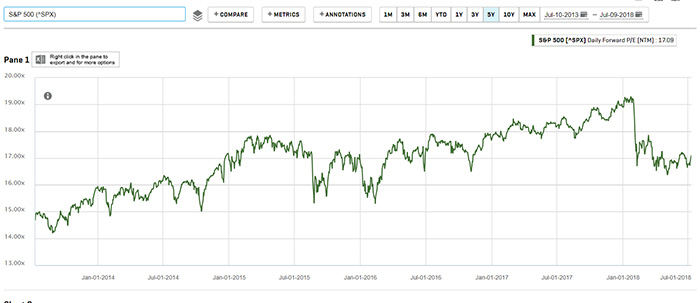

However, the forward-looking price to earnings (P/E) ratio is still below average.

(Source: Standard & Poor’s)

Stock prices are forward-looking. In other words, today’s price is based on what investors believe earnings in the future will look like.

The P/E ratio is one way to measure value in the stock market. The forward-looking P/E ratio uses price and earnings estimates for the next 12 months.

When the P/E ratio is above average, investors are pricing in better-than-average growth. Low P/E ratios indicate investors are pessimistic.

The average forward-looking P/E ratio over the past five years is 16.9. Right now, the chart shows the forward-looking P/E ratio is below average.

That low P/E ratio is based on the news. In the first half of the year, there were constant threats of a trade war. Higher oil prices added to investor concerns.

A Strong Earnings Season Is Ahead

Trade wars are a serious threat to the bull market. So are higher oil prices.

But before we see a major breakthrough on a trade war or oil prices, we get earnings season. And earnings growth should be strong. That means we should expect a sharp move higher in the stock market.

Higher prices will increase the P/E ratio and move it toward the average. That means stocks have two sources of gains — higher earnings and higher P/E ratios.

If a trade war starts, or oil prices surge higher, a big down move will follow. But those are distant threats. For now, investors should enjoy the bull market for as long as it lasts.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader