If you’re going to make money as a natural resource investor, you must jump on those opportunities when a resource is truly hated.

In the industry, we call it “contrarianism.” It’s the art of going against the crowd, and it’s how you make a lot of money in this sector. You need to buy when everyone else is selling … and sell when everyone else is clamoring to buy.

That’s why I’m so excited right now. We have an opportunity to make a big, fat gain on silver.

Gold’s Bouncy Little Brother

Silver is the volatile little brother of gold. The precious metal seems to bounce up and down constantly.

Silver will move in one direction for months, and then suddenly break out … which is what appears to be going on right now.

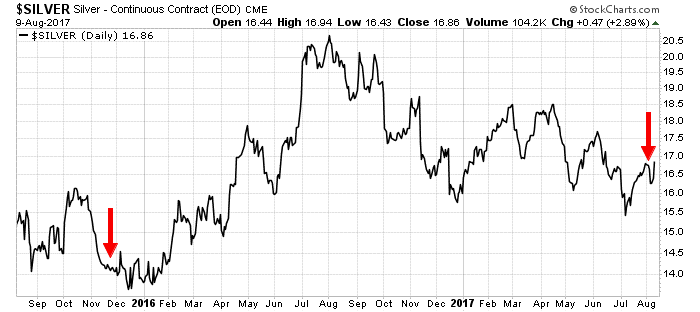

Look at this chart of silver:

The red arrows show periods when a rare silver signal indicated a buying opportunity. On July 14, silver flashed a buy signal per Jason Goepfert’s excellent sentiment tracking service, SentimenTrader.com. The last time we saw this indicator was at the end of November 2015 … right before the silver price bottomed.

If you bought silver the last time this indicator said “buy,” you made 46% on your money. However, if you bought silver mining companies like First Majestic Silver Corp. (NYSE: AG), you made over 500% on your money.

There are several great ways to speculate on a rally in silver. You can buy mining companies like First Majestic, SSR Mining Inc. (Nasdaq: SSRM) or Pan American Silver Corp. (Nasdaq: PAAS). You can also buy the metal on the stock market through the iShares Silver Trust (NYSE: SLV). Those are the best ways to speculate on this move.

And remember, while indicators like these are often correct, they aren’t 100% accurate. Make sure you use stops on your positions.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist

Editor’s Note: A previous version of this article recommended buying Silver Standard Resources Inc. (Nasdaq: SSRI). This company changed its name and ticker symbol to SSR Mining Inc. (Nasdaq: SSRM) on August 1.