There are thousands of market indicators. I test these indicators all the time. Most, in all honesty, are worthless. Among the few that work well is volatility.

Volatility Indicators

The idea for volatility indicators is simple. Almost always, when volatility rises, stock prices fall. This is because traders grow fearful when prices fall and sell orders rush in. Increased selling makes markets less orderly, and volatility rises.

That’s why many investors follow the VIX Index, or the fear gauge. This popular index is based on the price of options on S&P 500 futures. It shows spike highs when prices bottom. But it only applies to the S&P 500.

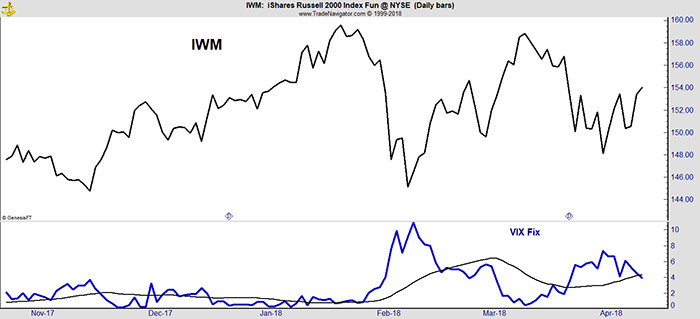

The chart below includes the iShares Russell 2000 Index ETF (NYSE: IWM) and an indicator known as the VIX Fix. The Russell 2000 Index tracks small-cap stocks. That indicator shows volatility is falling, and small-cap stocks are a buy.

Small-caps lead the market. They fall the most in bear markets, and they gain the most in bull markets.

That makes signals in small-caps important to watch. If small-caps give a buy signal, the S&P 500 Index should also move higher.

The VIX Fix, the indicator in the chart, “fixes” the VIX. In technical terms, it’s a stochastic of the lows. But that’s not important.

What’s important is that when the VIX Fix rises above its moving average (the thin line at the bottom of the chart), it provides a sell signal. That’s because volatility is rising. Buy signals occur when the VIX Fix falls, indicating volatility is declining.

This indicator applies to any stock or exchange-traded fund (ETF). That makes it more useful than the VIX Index. This indicator also gives trade signals in real time. When the VIX Fix moves above or below its moving average, that’s a trading signal.

The idea behind the indicator is the same as the VIX Index. When volatility is rising, prices are falling. The moving average shows whether volatility is higher or lower than average.

The VIX Fix can be hard to find. That’s because it’s not popular. But I have a fix for that.

You could add a moving average to VIX and get the same information for the broad stock market. I used a 20-day moving average above because there are about 20 trading days in a month.

This idea is useful, and profitable, probably because it’s not popular.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader