When you lose money on a stock investment…

Do you quickly forget about it and move on to the next trade?

Or do you spend time thinking through what went wrong?

How you answer that tells me all I need to know about how successful you will be.

I’ve found that the greatest investors I know spend a lot of time thinking through what they missed. And trying to figure out where a mistake was made.

Novice investors, on the other hand, do the exact opposite … they pay them no mind.

Mistakes made when investing are the price we pay for an education on what not to do.

If you don’t focus on them, it’s like you just flushed money down the toilet.

And there is a much higher chance you’ll make the same mistake again.

I learned early on in my career to dwell and learn from my mistakes.

It came naturally to me because all the smartest and best investors I knew always talked about theirs. Much more so than how little they talked about their winning trades.

Warren Buffett’s business partner, Charlie Munger, spends a considerable amount of time going over his mistakes … I know I’ll perform better if I rub my nose in my mistakes.

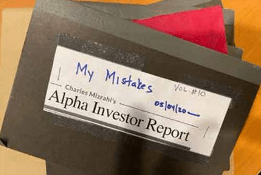

I take keeping track of my mistakes very seriously.

In fact, over my past 40-year career, I have several notebooks full of mistakes I’ve made.

I’m happy to say that as time has passed, there have been fewer entries.

But as the day is long, I’ll continue to make mistakes.

And that’s because the great thing about mistakes is what I learn from them.

In fact, the lessons learned from my mistakes have turned out very well for us…

D’oh!

Over the past few years, mistakes made by commission — ones when I took action and was dead wrong — have shown up in the portfolio as losing trades. There’s no hiding from them.

Right before the COVID pandemic shut down the world, I recommended Delta Air Lines in February 2020.

The pandemic shut down China and other Asian countries. Delta flies mainly in the U.S. and I figured the impact of China would be minimal on its revenue.

Boy, was I wrong. I quickly learned that I could not invest around a global pandemic.

Shutting down a global economy was something that no one had ever modeled.

Why I thought I was smart enough to do so, is beyond me.

I must’ve been taking stupid pills that week.

I quickly learned my lesson and went back to buying businesses with one-foot hurdles instead of 10-foot ones.

Going forward in 2020, I only recommended companies that were not going to be impacted by the lockdowns. And their goods or services were vital for businesses and consumers.

Learning from that mistake, I recommended…

- Hardware cloud provider, Arista Networks — up 275%.

- The largest hospital chain in the U.S., HCA Healthcare — up 200%.

- Insurance broker, Aon — up 60%.

All three are still in our portfolio and should be materially higher over the next several years.

One mistake of omission — missing out on the upside by not doing something was not starting a microcap research service when I founded Alpha Investor back in 2019. Instead, I started Microcap Fortunes in 2022.

Money Good: Underestimated Microcap Stocks

Microcaps are companies that have market caps less than $500 million.

They are too small for most money managers to invest in.

Since professionals have no interest in them, Wall Street analysts don’t follow them.

And that’s where we find the greatest opportunities because most of the stocks are mispriced.

Microcaps are mainly traded by retail investors that have little to no idea about the company or its valuation.

What I really like is that most microcaps are run by the founder who’s also the CEO.

Founders have a different mentality when it comes to running a business they bankrolled.

They are committed to developing customer loyalty, have their own money on the line and their business is a passion, not a job.

Partnering with the right founders is money good.

Because with microcaps, the person running the business is the most important asset the company has.

It’s how I found a Connecticut-based financial company I recommended to my readers last December.

A Gap a Mile Wide

I really like this company because of how few people have ever heard about it.

It’s focused on specialty business insurance … the kinds of coverage other providers don’t pay much attention to.

And the founder owns more than 25% of the business.

This is an industry with strong tailwinds driving earnings higher — which are now growing at 26% per year over the past five years.

Right now, the company’s market cap is right around $500 million. But a recent corporate event valued its business at $800 million.

Mr. Market is underpricing the business by around $300 million!

There’s a huge disconnect between the stock price and the worth of the business. I mean, there’s a gap so wide, you could drive a truck through it!

In a nutshell, here’s why we recommended it … it’s in an industry with a strong tailwind, run by a founder and is trading at a bargain price.

And since I recommended it around six months ago, the stock price hasn’t moved much.

Mr. Market continues to underprice the stock. But here’s the thing — I have no idea how long the stock will stay at a bargain price.

One company we recommended stayed at a bargain price for several months after we added it.

And then … it started soaring. So far this year, the stock is higher by close to 150%!

I’ve always found I made more money investing early and waiting, rather than chasing the stock as it started to soar.

You never know how quickly Mr. Market will play catch-up.

To unlock the companies I mentioned today and see where the biggest opportunities are right now, watch this.

You can thank me later for keeping it off your list of mistakes.

That’s all for today!

Regards,

Founder, Alpha Investor

Stupid Purchases Can Teach You Risk Management

My son is learning how to play the saxophone.

And while I was never a particularly good saxophone player myself, watching him play has awakened something in me.

I dusted off my own alto and tenor saxes with every intention of having a jam session with him.

There was just one thing missing.

We lacked a baritone sax.

So in a moment of nostalgia-fueled stupidity, I ordered one!

Now, for those who don’t know much about musical instruments, a baritone sax is friggin’ huge. It’s 48 inches of brass, and with my shoulder blown out the way it is, I’m not even sure I can safely carry the case.

But it’s mine! Or at least, it will be once it ships.

(I promise you there is a point to this story.)

I didn’t buy the baritone sax new. That would be insane (or at least even more insane). A professional-class baritone can easily set you back $25,000.

I’ve made some asinine purchases in my life, but I’m not willing to spend the equivalent of a modestly priced car on a casual hobby.

I bought it used for $2,700.

If my son and I get bored with it in a few months (or if my wife justifiably throws a fit over the massive hunk of metal in the family room), I can easily sell it for roughly what I paid. I might even turn a profit on it.

This way, it’s an “investment” with extremely limited downside and potentially unlimited upside.

If the “trade” goes bad, I exit at around my purchase price. But if it works, my son and I might really enjoy playing the thing!

This is how you should approach the investing process.

Risk vs. Return

Yes, you have to take risks in order to earn a return — or at least earn a return above and beyond the risk-free rate on U.S. government bonds.

But a good investment strategy will always have asymmetry. Meaning, your upside potential should be much larger than your downside.

There are different ways to skin that cat, of course. Ian King’s latest research is on the virtually limitless potential of AI technology, and which AI stocks you should invest in this year.

Mike Carr’s Trade Room is currently exploring the best short-term trading strategies for this market.

And meanwhile, one of the industries Charles Mizrahi is invested in is EV batteries. Specifically, the technology that could push electric vehicles into the mainstream — and surge 1,500% or more over the next four years.

Want to learn more about investing in this opportunity? Go here for all the details.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge