It’s not about you … it never was.

The stock market is just not that into you.

In fact, it really doesn’t care what price you paid for the stock.

Or how much you lost, or that you missed your mortgage payment … it doesn’t give a hoot.

So don’t take it personally.

The main reason I see most people not making money in the stock market is because they get too emotional.

The first step in making big money in the market is to control your emotions.

Click below. Because what I share with you in this video will be a game changer. I guarantee it.

I want to share with you something that you might not be 100% comfortable with. Here it is: When it comes to investing, it’s not about you.

To be more blunt: The stock market doesn’t care. It doesn’t care about the price you paid for the stock, how much you went down or what your breakeven point is. You see, the stock market isn’t all about you, and it’s not out to get you. It doesn’t care about your feelings or your thoughts on what should happen or why it didn’t happen.

Sorry, folks. The stock market doesn’t give a hoot. It’s just not into you.

And that’s the problem I’ve seen with many people that don’t make money in the market. They take investing too personally.

Now, the way I found that helps people to cure themselves of this emotional tie with the market is to figure out who you are. Are you an investor or a speculator?

And let me tell you, folks, there’s a big difference between the two. As the old saying goes, if you don’t know who you are, the stock market is an expensive place to find out.

So first, what I want to do is share with you what a speculator is. A speculator focuses on price. A speculator is focused on what the stock price is going to do. They believe that past price movements hold the key to future stock prices, and they try to predict the behavior of irrational and emotional people.

Now, I have a confession, folks. I started out more than 37 years ago as a speculator.

I was a floor trader for a good part of the time, also when I ran my money management firm. I was a speculator. Let me tell you, folks, it’s a very, very tough way to make money and to live a life.

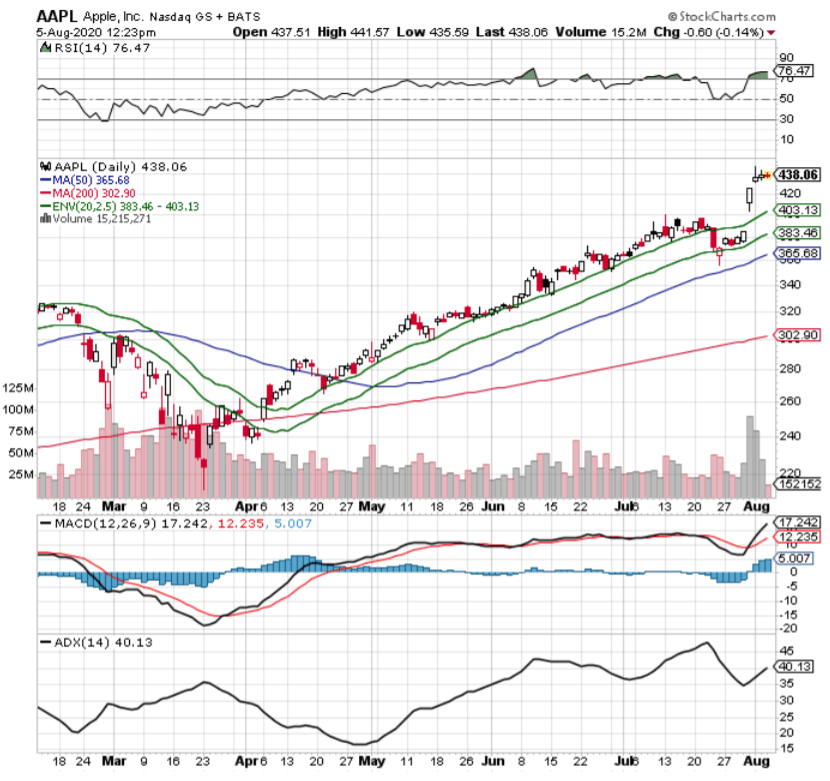

You see, when you’re a speculator, price is the sole reason you’re buying or selling. It dictates every investment decision. So you use charts or technical analysis using the formulas to figure out where prices are going. You don’t even need to know what the company does. Who is the CEO? How strong is the balance sheet? To a speculator, $1.3 trillion Apple looks the same on a chart as $300 million VSC Corporation.

All you look at is the stock. You look at the stock price and the patterns it made in the past and use that to figure out where it’s going in the future. That’s it.

In addition, you have to make decisions based on the behavior of people that are driving prices through the floor during panics, during downturns and bidding up prices during market booms after the 2000 dot-com bubble burst.

I realized there had to be a better way to make money in the market.

And fortunately, folks, there is.

So any time there’s a big problem — a big challenge — I’m really blessed to have colleagues and friends who are a lot richer than me and a lot smarter than me to go to. So what I did is I went to these smarter and richer, people, colleagues and friends. Some of these people managed billions of dollars of money and had outstanding performances. And some of them even appeared on the Forbes 400 list, which is the richest people in the world. And I found out how they made money in the market.

What they told me was simple. They said, Charles, stop being a speculator. Instead, be an investor.

And when I did, it made all the sense in the world and all the difference in my returns.

So instead of seeing stocks in this example, Alphabet the parent of Google, like this:

That’s just a stock chart of prices, they told me to see stocks as what they really are, pieces of a business such as this:

So Alphabet, the parent of Google, is made up of a whole bunch of companies such as Nest and YouTube and Android and several more. They have revenue. They have earnings and cash flow. They have products. They have employees.

Look at stocks for what they really are. They told me investors, those that look at stocks as what they really are, pieces of a business, have a very simple three-step process to make money in the market:

No. 1: They determine the underlying worth of the business. How much is the business worth to the private investor?

No. 2: They buy the stock when it trades at a big discount to the worth of the business. And then, here comes the hard part…

No. 3: They sit on their ass and wait. That’s it.

And doing that, folks, made all the difference in my net worth. It was much easier. It was a much easier way to make money in the market instead of trying to guess the direction of every wiggle and jiggle on the chart. That was insane.

Every month in my newsletter, Alpha Investor Report, I analyze one business and then tell my readers if the stock price is trading at a significant discount to the business. If it is, I give a recommendation. It’s nothing more complicated than that.

You can either be a speculator or an investor. The choice is yours. Investors, like blondes, have a lot more fun and make more money with less stress.

Regards,

Charles Mizrahi

Editor, Alpha Investor Report