You cannot just pack up a gold mine when trouble starts. Sometimes it is a new political regime or a new law or heavier taxes or war. That’s a problem facing miners all around the world. All of those have destroyed mining companies in the past.

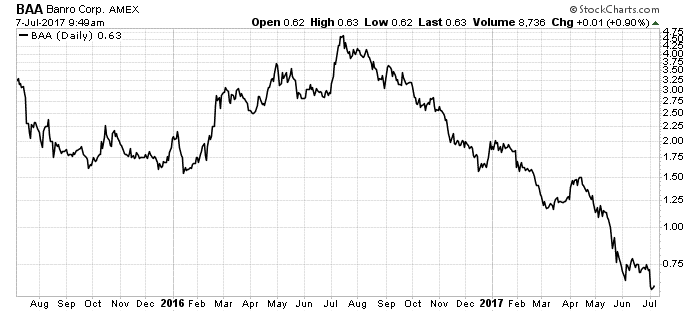

War is destroying one right now, as you can see from the chart below:

Banro Corp. (AMEX: BAA) is a gold miner operating in the Democratic Republic of Congo (DRC). In 2011, this was a $732 million gold miner. It found and developed two excellent gold mines there.

On paper, Banro is a successful gold miner. It grew revenue from $0 in 2011 to $237 million over the last 12 months. Its earnings soared too. The company banked $70 million over the past 12 months.

However, shares are down 86% since mid-2016 … the politics of the DRC are killing the company.

A series of clashes between the DRC government and rebel forces began back in 2012. The war began to affect the stock immediately. Shares fell from $49.50 at their peak in 2011 to $26.70 by the end of 2012 … and continued to slide.

The recent low of $0.61 per share (a 99% loss from 2011) comes after a 23-truck convoy heading to Banro’s Namoya mine ended up in the middle of a firefight. On July 4, rebel forces took the truck convoy hostage. Banro evacuated the Namoya mine.

The problem is that there is no solution. Rebels and government forces are active in the area. While the mine is back in production now, there’s no telling when the next event will happen. It’s that risk that crushed Banro’s shares.

Its current market value, $69 million, is actually less than its earnings.

Because of the risk, Banro’s trading at a discount to its earnings. This could be an opportunity for speculators willing to take a big risk since there could be a big gain if things get a little better. However, that if could cost you your entire investment.

For most investors, Banro is a cautionary tale about how political risk can destroy your investment.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist

Editor’s Note: The rarity of precious metals helps drive their value and potential significance to your portfolio. But you don’t have to rush to metals. EverBank has unearthed an exciting and equally rare investment alternative. With their automatic purchase plan, you can start mining metals at your pace.

Choose from gold, silver, platinum or palladium. You can fund your account for as little as $100 a month, and there’s no annual account fee.

Available only with the non-FDIC insured Metals Select® Unallocated Account, this is a rare opportunity to utilize dollar-cost averaging to grow your metals ownership from one month to the next. Click here to learn more.

For the sake of full disclosure, we receive a marketing fee based on our relationship with EverBank. But, honestly, we’d work with them regardless.