Do you know that old saying in stocks: “Don’t try to catch a falling knife”?

It refers to stocks that are in free fall. You see, stocks tend to continue to move with momentum. That’s why a falling stock tends to continue to fall.

When it comes to falling knives, the oil services sector is a particularly large one today.

The VanEck Vectors Oil Services ETF (NYSE: OIH) holds some of the world’s best oil service companies. Schlumberger Ltd. (NYSE: SLB) and Halliburton Co. (NYSE: HAL), the architects of the shale revolution in the U.S., make up over 36% of the exchange-traded fund.

The fund is the perfect way to play big moves in oil services … like the one happening right now.

A Colossal Fall

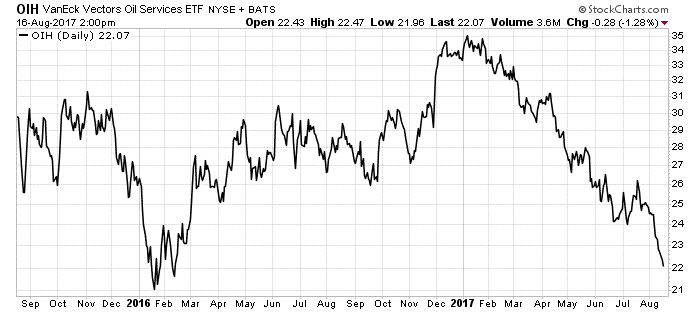

As you can see from the chart below, OIH is down 37% in eight months. It’s at its lowest price since February 2016. That is a colossal fall for this sector.

You look at this chart and see pain. I look at this chart and see dollar signs.

You see, I know that this can’t last. These are the companies that drive oil exploration and production all over the world. I ran into them halfway around the world in New Guinea and Iraq.

These are the companies that provide the engineering services that ensure the oil gets from a hole in the ground to your car. They aren’t going out of business.

And the oil business isn’t shutting down anytime soon. That means these stocks are valuable, even though their shares are plummeting right now.

If we look at Schlumberger, we see that it had a great second quarter. It generated its most earnings since the first quarter of 2016. Halliburton had its best earnings quarter since the end of 2015.

That tells me emotions are responsible for the sell-off. It isn’t in response to a fundamental shift in oil production or due to bad earnings.

How to Play OIH

That doesn’t mean you should go buy OIH today. Far from it.

This sector hasn’t found a bottom yet. That’s OK. The further it falls, the more profit potential we get.

Put OIH on your watch list. Wait for it to stop falling.

After it finds a bottom, give it a week. If it hasn’t started falling again, jump in.

That’s a straightforward way to make 30% to 40% as the oil services sector recovers from this too-deep fall.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist