Breakin’ Options Part 2: The Debit Spread Boogaloo

Welcome to Reader Feedback day, Great Ones!

What, just because a certain Mr. Joe Hargett decided to take a vacay, y’all thought we’d miss out on the chance to catch up? Oh, nay nay! We’re not missing another chance to talk (read: rant) your ear off.

Today’s edition of Reader Feedback, however, is a lesson in temperance … self-discipline on the trading floor … and your way to control greed before it controls you. With one single trading tactic, you will become a black belt in the masterful art of making options work for you.

But what is this mystical trading power we speak of — this “secret sauce” of the options market? And how can we use it to play Advanced Micro Devices’ (Nasdaq: AMD) earnings this quarter?

We’re not pulling any punches today — no SpongeBob SquarePants lyrical shenanigans here, no sir! We’re jumping right into today’s featured presentation:

Mikey P. in the house! Welcome back, it’s good to hear from you again, Great One.

As you’d expect, I have a not-so-short answer to your quick question. I mean, you did kick us off on options trading, which is like asking Charlie Munger for a “brief summation” of his thoughts on crypto…

Anyway, here’s when you close those options we recommended on AMD last weekend:

If you just bought the straight call, you exit when you hit your target gain … which you should have set before making the trade.

I know, how absolutely barbaric of me to expect someone to set a target gain as an exit strategy — and stick to it! I thought we just let these options ride — BANG, zoom, to the moon!

Temperance? In my options market?! It’s more likely than you think. That’s … kinda why we also recommended the spread as another option.

If you bought the AMD August 20 $92.50 call and sold the AMD August 20 $95 call, you exit when AMD trades or holds above $95. That’s the maximum return you can get — when AMD trades above $95. You’re in and out — a quick options trading adventure.

Sound good? Cool, because I’m using your email as a springboard to ramble about options some more — specifically, to answer the one question that’s probably on everyone else’s mind:

Why would we even wanna trade a … *checks notes* … debit spread anyway?

I’m glad you asked! Erm … I’m glad I asked myself!

By this point, if you’re still scratching your head wondering what an option is … don’t feel bad, we’ve just got some ‘splaining to do. You can catch up on how to trade options using our handy dandy options 101 guide right here!

If you’ve already traded options, trading spreads isn’t that much different. As I said, this is pretty much the perfect secret sauce strategy for your portfolio for a number of reasons. Starting with the pros:

- Your maximum loss is the money you put into the trade.

- You know exactly what your maximum profit will be.

- You can lower your overall cost to enter the trade — potentially putting options on expensive stocks within your reach.

- Since your profit is capped when the stock hits your sold strike, your trade has a definite exit point. There’s no greed to tempt you to hold longer and potentially lose everything! Take the money and run.

- You can get significant gains on smaller moves in a stock.

- You still hit your profit target even if the options get exercised.

Of course, in the interest of fairness, here are the cons:

- No exposure to extended rallies or declines in a stock — i.e., “opportunity cost.”

As you can see, debit spreads have quite a few benefits. However, our personal favorite is also the biggest downside to using this strategy. Unlike buying basic calls and puts, no matter how high a stock rallies or how low a stock falls, your maximum return on a debit spread is already set in stone.

Now, I can already hear sighs from the more experienced options traders out there. But debit spreads are boring … that’s your big secret?

Yes … for all the reasons I listed above. Debit spreads accomplish one critical thing for options traders of all walks of life: They remove greed from the equation.

We are living in a society … in an age where any Joe Schmo on a Reddit message board (you know the one I’m talking about) can throw darts at a wall … and end up with godlike, bazillion-percent gains through sheer. Dumb. Luck.

It’s gambling with extra steps. When was the last time you heard from a lotto scratch-off loser?

Like I said above: Temperance, my friends, will make you more money than any one-off trade. Everyone loves the “ooh, flashy!” 1,000% trades. And those setups do happen … sometimes. But they’re as rare as I like my steak. (If it ain’t mooing, I ain’t chewing!)

Therein lies the beauty of debit spreads. Once you know what to look for, you can bank on these trades again … and again … and again … and again…

A debit spread is like buying a put or a call on a stock, but adding a little insurance … just in case. That insurance comes in the form of selling another option at the same time.

When you sell an option by itself, yes, that can have serious repercussions — if you’re not careful. However, when you enter a debit spread, the option you buy covers for the option you sell.

And like I mentioned when we first recommended the AMD trade, entering this debit spread does two critical things.

The first is it limits your upside potential. By selling the August $95 call, you do not make any additional gains if AMD rallies above this strike. None. Nada. AMD at $95 is your cap. However, this debit spread also lowers your breakeven and increases your potential returns on a smaller move in AMD stock.

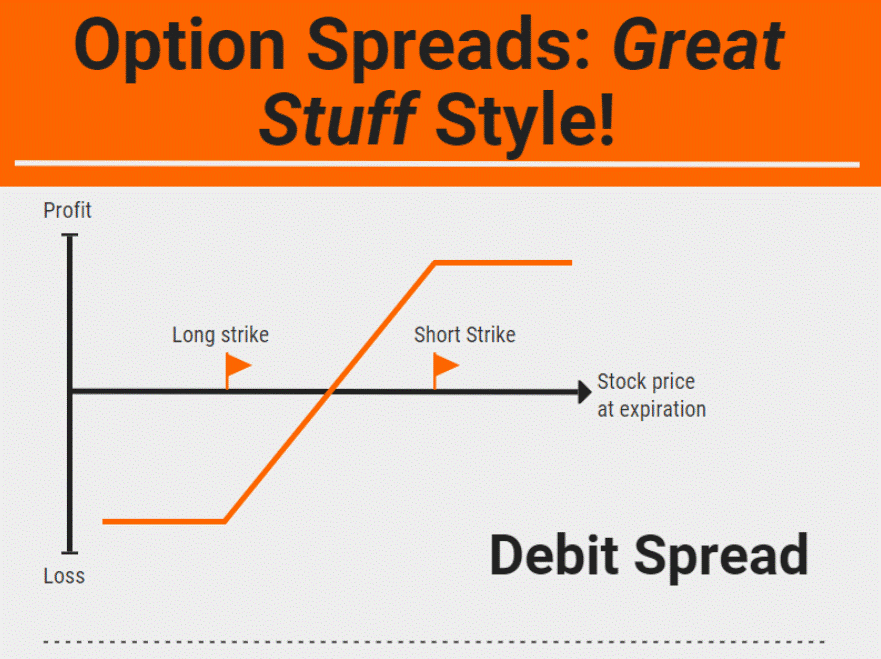

But I know some of y’all like pretty pictures and charts to go along with your daily dose of options wisdom. In that case, check this chart out.

That orange line is your profit or loss, depending on AMD’s price when your options expire.

The long strike price is the option you bought: the AMD August 20 $92.50 call. The short strike is the option you sold: the AMD August 20 $95 call. Bada bing, bada boom — that’s all there is to it.

So, thank you for coming to my AMD options TED Talk (again)! I hope this has answered your questions on debit spreads — or at least whet your appetite for more options trades within these virtual pages.

Of course, if you ever have more questions — options-related or otherwise — always feel free to write to us here. We’ll get back to you as soon as humanly possible!

GreatStuffToday@BanyanHill.com is your one-stop shop for ranting, raving or just sharing what you’re up to these days.

Editor’s Note: This Could Be The Stock Of A Lifetime

One tiny tech company — still nearly unknown to Wall Street — is setting up to be a bigger story than Tesla, Zoom or PayPal have been in the last year.

It’s at the forefront of an industry that is growing incredibly fast — faster than electric vehicles, wearable tech and even the Internet of Things. This company’s growth is already at a breakneck pace, with sales and cash reserves doubling in the last year — and that’s just the beginning.

You made it through the deep, murky waters of the options market — congrats!

Old-school Great Ones, you know what’s up next: It’s time for that Reader Feedback action you all know and love. The time we turn diatribes into dialogues … distill complex stock market matters down into clear-as-crystal moonshine.

Want to join in on the fun for yourself? Hit up our inbox sometime with your pressing investing questions and tales of trading treasure: GreatStuffToday@BanyanHill.com. Or just rant away about the state of things. We get a lot of that too. But without further ado…

DNA Uhhh Finds A Way

Man, we’re getting all the OG, longtime Great Ones writing in this week! You and Mike P. up there, we go way back. Remember that one time? With the … thing? No? Just me?

I knew my paranoia on genetic data in the age of 23andMe (Nasdaq: ME) was bound to garner a few write-ins, so thank you for reaching out again, Susan — seriously. Though, I will forever live in rapt wonder at what the rest of your message said; you’re reaching Thomas Harris levels of literary suspense here. Way to leave me in antici…

Short and sweet, this is what every argument about privacy — of any kind — will eventually boil down to.

Sure, there might not be much differentiation between my DNA and Joe Schmo’s on a technical level. (I know we keep mentioning that guy; there’s no relation, I swear.)

But … and this is the crucial “but” … it’s my information. It’s your information. Information that, while limited in its scope of uses if you yourself are not a biotech cranking out vaccines or new drugs, many people would rather keep private.

What’s more personal than the building blocks and code that make you, well … you?

So, for the sake of discussion, let’s say that how your genetic information is used by Big Pharma doesn’t bother you. That’s OK. But what about how that information is held?

The other side of this privacy coin is security. And frankly, that’s where my trust runs out — rather quickly, might I add. From pipelines to Peloton bikes, what isn’t hackable nowadays? If someone wants to access certain data desperately enough, they will.

Oh, Stop It, You… (JK, Keep Going)

Joseph, this is an excellent article, be it a Saturday or otherwise.

You lead the reader steadfastly, though cautiously — and perfectly informatively — into the arena of options investing. Highly educational and, at the same time, ideally actionable. Just the ticket to broaden the “options” of the alert, learning investor. And fitting in the Chad Shoop program availability is as smooth (and genuine) as silk.

I remain somewhat spellbound by your authentic professionalism. Very special indeed. — KB.

Who’s cutting onions in here? Can the team accept such glowing praise on behalf of Joe? ‘Cause I plan to anyway…

Thank you for the kind words, KB! Your email’s going right up on the break room fridge — as I, for one, am spellbound by the diction therein. Steadfast leadership? Who am I, Shackleton?

That’s very polite of you. I have no joke here (for once), just genuine appreciation. Thank you for writing in, and I’m glad you dig the options trades, KB. We’ll keep ‘em coming. But if you want some more earnings season greatness from the options market — right here right now — well, just click here.

And Y’all Say I’m Candid

Well… Umm… You might’ve finally left me speechless here.

Let me ask you then: What do you feel like doing today, Sara?

Wanna trade debit spreads? Make sure your genetic information is secure and safe? Grab a festive drink of your choosing and chill by the lake? Kick back and relax? You deserve it just for being a Great One and writing in.

Why not write us back and we can help you figure out what you needed to do? Help me help you?

Heck, maybe you can help me figure out what I needed to go do this morning because it totally escaped my mind once we started talking about AMD options again…

One & Don

…with your mind on your money and your money on your mind? Rollin’ down the street? What, you started it…

I’m glad you’re laid back … I guess? Thanks for sharing, Don. I hope you and the rest of the Great Ones remain laid back and have a tremendous Thursday. Let’s wrap it up here on a positive note — what do you say?

If you don’t see your name up there in bright, bold virtual print, you might’ve cursed way too much — we can’t publish that $%&* here!

Or … did you not write in to us this week? Let’s remedy that for next week’s edition of Reader Feedback, shall we?

Write to us whenever the market muse calls to you! GreatStuffToday@BanyanHill.com is where you can reach us best.

In the meantime, here’s where you can find our other junk — erm, I mean where check out some more Greatness:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Until next time, stay Great!