Stir-Crazy Investors

We’re all itching to get out and participate in the U.S. economy’s “Great Reopening.” If reports from the Memorial Day holiday weekend are any indication, some of us are a lot more eager than others … I’m looking at you Lake of the Ozarks partygoers.

As the country reopens, now is an excellent time to reflect on some of our biggest lockdown pastimes — one of which could have a major impact on your investing future.

First up, we have comfort spending.

Shopping is by far America’s most popular pastime, and the COVID-19 pandemic is no exception. It’s good to note that silly little things like travel restrictions and social distancing haven’t slowed down America’s appetite for consumption.

“Surprisingly, Americans are spending more money during this time of social distancing than prior to it,” says WalletHub analyst Jill Gonzalez. In fact, Gonzalez notes: “Forty-three percent of Americans are participating in what is called comfort buying.”

For investors, that means profitable returns for companies such as Amazon.com Inc. (Nasdaq: AMZN) and Shopify Inc. (NYSE: SHOP).

Next up, we have online entertainment. I mean, what else are you gonna do after spending all your money while not going anywhere?

Leading the charge here are video games, which saw sales surge 73% year over year in April. In fact, video game spending hit a record $10.86 billion in the first quarter.

Here, you might want to take a closer look at Activision Blizzard Inc. (Nasdaq: ATVI) or Electronic Arts Inc. (Nasdaq: EA).

Also under the heading of online entertainment, we have video streaming and social media. No one benefits more from the unholy union of these two mediums than TikTok.

This China-based social media sensation provides short, user-generated, looping videos and music clips for lip-sync, comedy and talent displays. And if you’re wondering just how popular this seemingly nonsensical idea is … the TikTok app just hit 2 billion downloads during the pandemic.

Unfortunately for investors, TikTok owner ByteDance is a private company. But Great Stuff will keep a close eye on the situation, as the TikTok “fad” isn’t going anywhere anytime soon.

Finally, we have the most impactful distraction during the COVID-19 quarantine: retail investing.

Yes, dear reader, retail mania is taking over Wall Street, fueled by fractional-share trading, no transaction fees and pandemic stimulus checks. With nowhere to go and nowhere better to spend their money, Americans have funneled a considerable chunk of their stimulus checks into the stock market.

In fact, bank transfers into trading accounts ranked behind only savings and cash withdrawals for Americans with incomes between $35,000 and $75,000.

Now, I have to say that I’m proud of y’all for taking the initiative and jumping into the trading world with both feet.

However, we’ve reached a level of concern when it comes to retail investing. At a time when smart money has almost completely pulled out of the market, y’all lead the charge. And, if you’re not careful, you’ll get burned.

It’s not fearmongering … it’s experience! And why would you want to venture into the market without some experience by your side?

Not in the “Gandalf” kind of way — the “Ian King” way. Ian King stays on top of all tipping-point tech trends, no matter the volatility that gets thrown our way. Plus, the guy started trading mortgage bonds on Wall Street at 21. Where else can you find someone like that?!

Click here to learn more about finding your guide with Ian King.

Good: Get in the Zone

When it comes to car repairs, you’re essentially constrained by two things: money and time. Between the recent economic lockdown and the pandemic stimulus checks, consumers have had plenty of both — much to the benefit of AutoZone Inc. (NYSE: AZO).

The do-it-yourself auto-parts retailer reported fiscal third-quarter earnings of $14.39 per share on revenue of $2.78 billion. Both figures slid easily past Wall Street’s expectations.

But the quarter wasn’t all roses and oil changes. “During the third quarter, we experienced the most extreme fluctuations in sales, both negative and positive, in the Company’s more than 40-year history,” AutoZone said in its earnings press release.

AZO stock initially vaulted more than 5% higher on the news, but uncertainty surrounding the company’s “extreme fluctuations” left some investors leaking coolant. Furthermore, AutoZone said that same-store sales still fell 1% during the quarter.

While the results weren’t as bad as many investors (and Wall Street) feared, there’s still a serious volatility concern lingering over AZO’s head.

Better: Vaccines, Vaccines Everywhere!

Are you ready for another insane vaccine rally?

No? Too bad. Novavax Inc. (Nasdaq: NVAX) returned to the headlines this morning, helping to drive optimism that a COVID-19 cure is just around the corner. The biotech announced that it initiated phase 1 and phase 2 trials for its coronavirus vaccine candidate, NVX-CoV2373.

Phase 1 begins immediately and includes 130 healthy volunteers. If all goes well, Novavax will quickly start phase 2 testing with a much larger patient population.

Honestly, Novavax’s considerable rally today appears a bit overdone. The company is entering phase 1 while both Inovio Pharmaceuticals Inc. (Nasdaq: INO) and Moderna Inc. (Nasdaq: MRNA) are already in phase 2 testing.

I still maintain that NVAX is an excellent stock to short, given its lagging position in the vaccine race and the considerable hype in this niche of the biotech sector. That said, if you like backing the underdog, NVAX may be just the play for you.

Best: Blues Traveling

The travel industry went bonkers today. Airlines, cruise lines and you-name-it lines all rallied across the board.

Delta Air Lines Inc. (NYSE: DAL) surged nearly 10%. Carnival Corp. (NYSE: CCL) added almost 12%. Heck, even the pink sheets for German travel company TUI AG (OTC: TUIFF) surged 52%.

Why? Vaccine hopes and reopening dreams.

On Friday, the Transportation Security Administration (TSA) announced that travelers moving through TSA checkpoints last week hit 300,000 for the first time in two months.

While the TSA news was encouraging, this morning’s announcement out of hard-hit Spain was the real spark that ignited the travel sector. The country announced that it will lift its two-week quarantine regulations for foreign travelers starting July 1.

If Spain can start reopening, then the real danger of COVID-19 must be past its peak … right? Combine that with continued progress on the vaccine front and investors surged to get in early on the travel sector’s expected rebound.

The first rule of hustlin’? You either hustle or get hustled.

And you wanna make some big bucks, huh?

That’s right — my mind is still on Main Street’s leap into the retail market for our Quote of the Week. No matter how long you’ve been banking Benjamins in the market, this sudden rush of cash from newbie investors will affect you.

Even Robinhood’s ads are all about the small-stakes hustle these days:

Got .3 shares of tesla stock today. Little by little.

— Robinhood, via Barron’s

Now, I want to be clear here, since a ton of you fine Great Stuff readers out there are the same new investors we’re talking about today. (Welcome to the *$&% show, by the way!)

But … if you’re going to jump into the market, you gotta jump with our jive, right? You gotta pick up some street smarts before wandering the market’s dim back alleys.

Anyway, the point is that no matter if you have 0.3 shares of your favorite stock or 3 million shares … no matter how long you’ve been an investor…

I have just one titanium-plated rule to stick in your trading tool belt. It will separate you from the retail chaff — and give you a leg-up on all those lockdown gamblers-turned-investors: Don’t buy a stock just because everyone else is buying it. You will hear arguments about how “you can’t miss out if you’re ‘in it,’ man!” See the past decade-long bull run for more details.

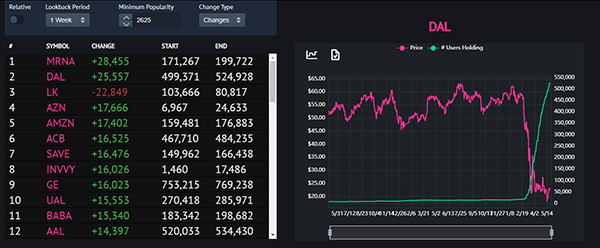

Now, since the Great Stuff team was in a post-cookout coma yesterday, here’s a bonus Chart of the Week for you that shows my point a bit better.

Thanks to Robintrack.net, you can see the retail investor’s Robinhood revolution for yourself. Right here, you can see the past week’s biggest popularity changes, at least as far as Robinhood stock ownership goes.

Check out the huge spike in Moderna and Delta, with some latecomers to the Aurora Cannabis Inc. (NYSE: ACB) rally not far behind. (Plus, here’s an honorable shout-out to any Luckin owners out there left holding the fraud bag…)

On the right, you can see how Delta’s collapse stacks up to a tsunami of share buying in no time flat:

Now … are these half a million Robinhooders about to bring home the bacon (or tendies) while the smart money sleeps? Is this chart a snapshot right before a “pass the flaming turd” disaster?

Stay tuned; we’ll find out together.

Great Stuff: Let’s Get This Bread!

Before I sign off, I want to say thanks for tuning in to today’s edition of Great Stuff!

We’re only two days away from this week’s installment of Reader Feedback — and we’re calling on you. Bring your rants, raves, crackpot schemes and vaccine dreams — it takes all kinds of greatness to make us Great.

Send us a message at GreatStuffToday@BanyanHill.com with any questions, comments or suggestions you may have. You may just see your email in this week’s Reader Feedback! (Unless you don’t want to share your words with the world, of course … simply let us know.)

Remember that you can always catch up with us on social media: Facebook and Twitter.

Until next time, be Great!

Regards,

Joseph Hargett

Editor, Great Stuff