Interest rates are a key topic in the markets right now.

Higher rates are meant to slow our economy since they encourage consumers to save more money. Lower rates, on the other hand, help stimulate our economy by encouraging spending.

Interest rates could very well be what cause the next bear market, or help fuel the continued bull market.

One sector we can look at for a guide on interest-rate expectations going forward is the financial sector. Specifically, the Financial Select Sector SPDR ETF (NYSE: XLF).

The financial sector gives us an idea on what to expect from interest rates because as rates rise, financial stocks benefit.

They benefit because these companies earn more income on their savings balances thanks to higher rates.

Also, when it comes to lending in a higher interest-rate market, financial stocks still benefit. The spreads between short- and long-term rates will expand, allowing banks to generate a greater profit on that spread.

Overall, higher rates are generally good for financial stocks. But right now, the sector is underperforming.

This tells us that investors believe the path for future interest-rate hikes is lower than expected after the recent stock market correction.

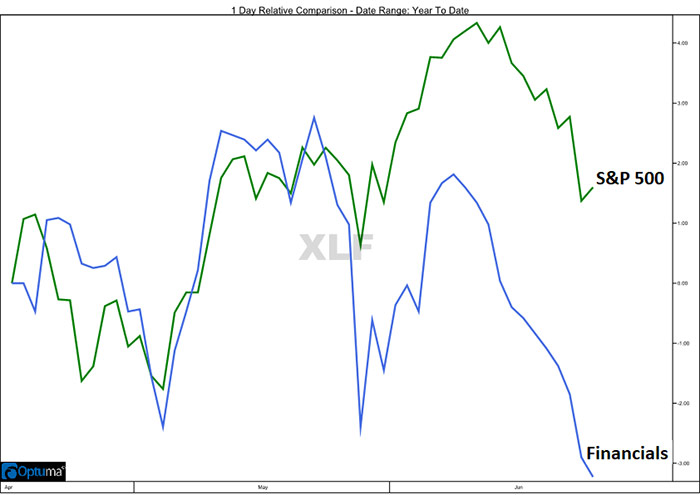

You can see the S&P 500 Index, in green, has steadily climbed higher since the correction, while the financial sector is starting to tumble lower once again.

Our takeaway is that if rates stay lower than expected, as this chart suggests, it’s good news for the broader stock market.

And don’t worry about the financial sector. It will settle down and turn higher soon. The short-term underperformance is what we are paying attention to today, but don’t expect it to continue.

There are plenty of factors at play that will help financial stocks as well.

A few are looser regulatory pressures, the fact that many banks are finally able to give money back to shareholders in the form of dividends, and consumer spending is at record levels, which will continue to boost the sector.

So now’s not the time to short the sector. Just use the financial sector as a gauge for interest rates and the potential impacts that they will have on the stock market and our economy.

For now, the bull market rages on.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert