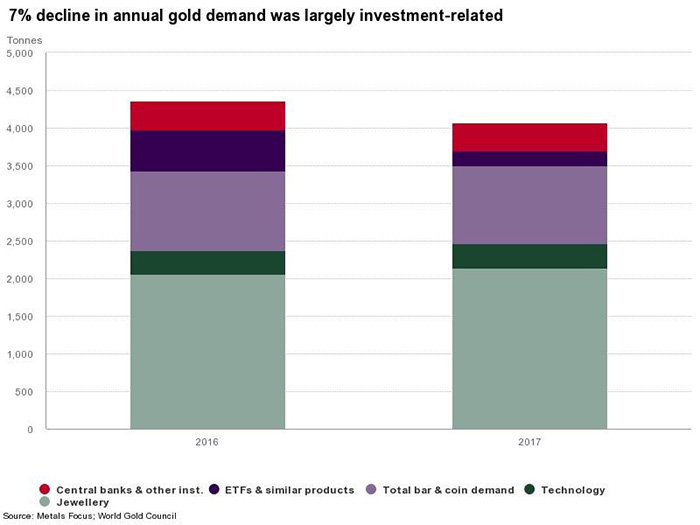

Gold lost its luster among investors in 2017. The World Gold Council reported that year-over-year gold demand dropped 7% to 4,071 tons from 2016 levels.

Gold demand was down across the board. Inflows into gold exchange-traded funds dropped from 2016 levels. Central bank purchases declined 5% from the prior year’s levels. Bar and coin demand even slipped 2% in U.S. retail investment.

But it’s not too surprising.

Gold is a safe haven in times of uncertainty or a weak market.

And the party on Wall Street raged on in 2017. The S&P 500 climbed more than 19%, and the Nasdaq Composite finished the year up 28%.

It’s important to remember that all parties come to an end. All of them.

Gold Weathers Turbulent Markets

We got our first taste of volatility earlier this year when stocks suffered a brief 11% pullback. Too many investors have forgotten what it was like for the market to suffer significant consecutive losses.

Sure, this pullback has proven to be a good “buy in the dip” opportunity in stocks as the S&P 500 is drawing close to record highs made earlier this year.

Wall Street pundits have sounded the all-clear. Investors are piling back into the market, snatching up supposed bargains and pushing indexes back toward record levels.

Now is a great time to rebalance your portfolio. You may find that some fast-moving stocks are now claiming a larger percentage of your wealth than you may have intended.

And while you’re rebalancing, check to make sure that your portfolio has an allocation of physical gold.

No, speculative miners don’t count as a hedge against market volatility. I’m talking about the actual, physical gold bullion. The metal weathers turbulent markets and can even gain ground where stocks falter.

Don’t miss your opportunity to prepare for the next market pullback. The bounce back might not happen as quickly as we’d like.

Regards,

Jocelynn Smith

Sr. Managing Editor, Banyan Hill Publishing