Last summer, my family and I visited London.

I’m not much of an Ikea customer in the States, but there are a handful of the iconic retailer’s giant stores in the London area too.

In the name of research, I wandered into one. The way I figure, if you want to know what “mainstream” looks like, Ikea — with more than 300 stores on both sides of the Atlantic — is a good place to start.

What caught my eye?

Ikea’s “energy storage system.”

Basically, it’s a big ol’ battery that, when hooked up to a handful of solar panels (which Ikea also sells), allows a homeowner to store electrical power for use at night and on cloudy days.

As I’ve written before, energy storage — for utilities and homeowners — is a gigantic opportunity for investors. We ignore it at our wallet’s peril.

Energy Storage = Profits

It’s the missing link in our “electrified” digital economy.

Fossil fuels are easily stored, of course, but provide an increasingly smaller mix of America’s energy needs.

Wind and solar provide an ever larger share — but what does a utility (or homeowner) do when there’s no wind, or no sun?

Energy storage is the answer.

In the Total Wealth Insider model portfolio, I already have one stock in this sector that’s up more than 40%, with more on the way.

Investors like ValueAct’s Jeffrey Ubben describe a 21st-century electrical grid — with energy storage at its center — as “an Amazon-like opportunity. You haven’t had electricity as a growth business in a long, long time.”

It’s worth noting that the world’s largest solar energy storage plant was just switched on in Hawaii.

With the ability to store 100 megawatt-hours’ worth of power for up to five hours straight, utility executives say the plant provides as much as 40% of the island’s evening peak power via stored solar energy.

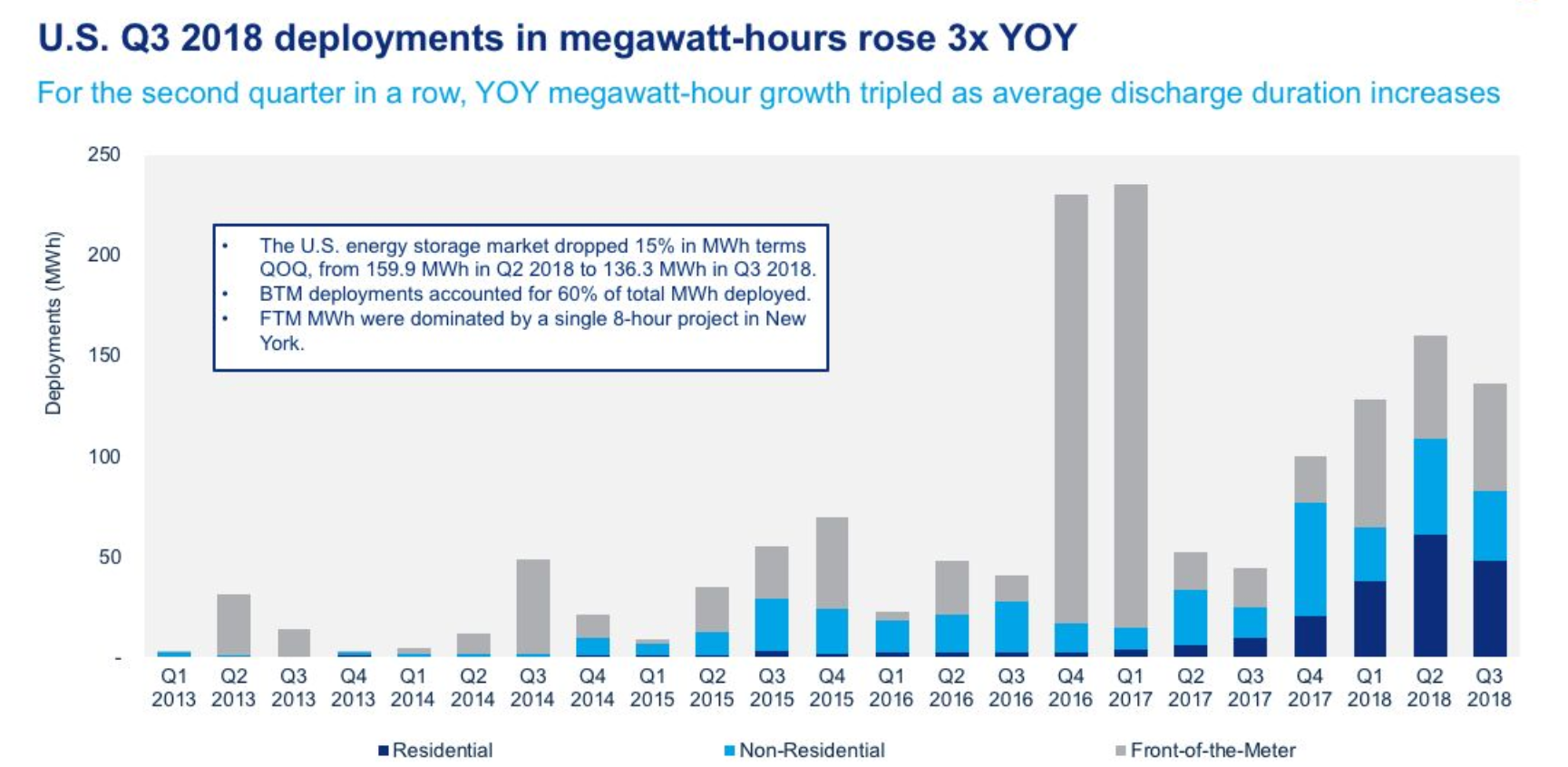

According to researchers at Wood Mackenzie, the amount of energy-storage deployments tripled on a year-over-year basis for two quarters in a row.

In Q3 last year (Q4 numbers aren’t out yet), utilities and homeowners together deployed roughly 150 megawatt-hours’ worth of energy storage.

(Source: Wood Mackenzie)

A close look at those figures shows that most of America’s energy storage systems are in California. That’s where the fast rise of wind and solar generation pushes regulators and utilities to figure out a practical way to store the energy.

But projects in Massachusetts, New York, Nebraska, New Mexico and elsewhere point the way.

Wood Mackenzie predicts energy storage will be a $4.5 billion market in the U.S. by 2023. After seeing 338 megawatt-hours’ worth of batteries deployed last year, researchers expect that number to nearly double to 659 megawatt-hours in 2019.

When you invest, you want to put your money where there’s growth that’s faster (preferably much faster) than the overall 3% to 4% annual growth of the overall U.S. economy.

Energy storage promises that in spades for the years ahead.

Kind regards,

Jeff L. Yastine

Editor, Total Wealth Insider