“The worst way to think about economic cycles is with a stopwatch.”

In other words, take a deep breath. The recent market turbulence is not the end of the world.

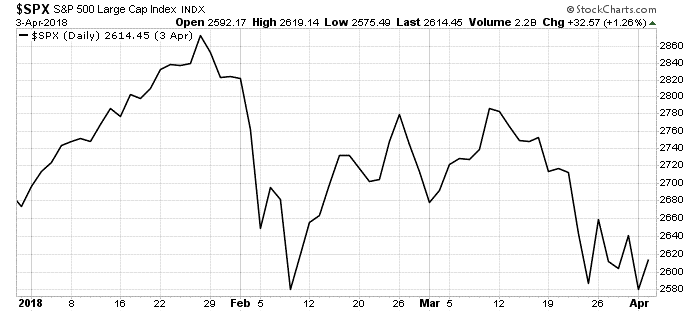

But how could this be? The S&P 500 looks like a roller coaster this year. And most of the ride has been down:

The tech-filled Nasdaq 100 chart looks about the same.

Overall, the largest 100 Nasdaq stocks are up just slightly so far this year, and the S&P 500 is down about 2%.

The Facebook controversy has investors’ attention in a negative way. So do tariffs and the possibility that the Federal Reserve will raise rates three more times this year.

The S&P 500 closed at its low for the year on Monday, while the Nasdaq hit its second-lowest price.

The quote that I cited at the outset was by Carl Riccadonna. He is the chief U.S. economist at Bloomberg Intelligence, the research arm of Bloomberg. I recently heard him speak at an invite-only event the firm hosted for some of its clients.

His logic resonated with me. And though we are likely closer to the end of this bull market than the beginning, there are many reasons why we should remain calm. Read on to learn why…

Don’t Panic – It’s An Economic Cycle

An economic cycle is the period from the start of a recovery to the start of the next recession.

From 1991 to 2001, we saw a record-long 10-year economic cycle. The length of our current uptrend is almost nine years.

Riccadonna believes our current recovery that began in 2009 will set the record a little more than a year from now.

But growth shouldn’t stop just because that happens.

He notes: “This does not look like a super-long-in-the-tooth economic cycle. Cumulative [gross domestic product] gains remain well below average … so we are not overheating.”

By not overheating, Riccadonna means we are not seeing too much inflation.

He confirms full employment will be a “game-changer” … eventually. Today, though, he says the labor market is looser than the 4.1% unemployment rate suggests.

Help Wanted

The issue is the poor labor force participation. The percentage of the population that has been looking for a job fell for most of this recovery.

This distorts the unemployment rate. You see, if you stop looking for a job, you are no longer unemployed. If you’re not unemployed, the unemployment rate falls.

It likely makes sense to you that retired people are not unemployed. Importantly, neither are folks who aren’t working and aren’t looking for a job.

As the retirees and nonworkers leave the workforce, the unemployment rate falls. However, we know the nonworkers could re-enter the workforce.

(Perversely, the return of these folks to the workforce could raise the unemployment rate. Hence, Riccadonna’s comment that the unemployment rate isn’t as low as it seems.)

Riccadonna believes nonworkers will re-enter the work force as wages rise. And we’re beginning to see signs of that.

Average hourly earnings had either been falling or growing at less than 2.2% for most of this recovery. They’re beginning to grow at a faster pace. Earnings grew at a 2.5% annual rate in February.

As wages increase, we will approach the end of this economic cycle. But we’re not there yet.

So remain calm, and remain invested. There will be some bumps in the road, but we should see more growth ahead.

Good investing,

Brian Christopher

Senior Analyst, Banyan Hill Publishing

Editor’s Note: Investing with Chad Shoop’s Automatic Profits Alert trading system is like investing in an eternal bull market. Not only does it help you avoid those devastating market crashes that cut the average investor’s portfolio in half … it will help you make up to 171 times more than if you had just “bought and held” the market over a 10-year period. To learn how Automatic Profits Alert lets you double, triple or even quadruple the stock market’s returns over the next year, click here now.