The cryptocurrency universe is like a bag of weasels. It’s full of furious energy and you never know what will pop out when.

Here are a few of the weirder things that have happened recently.

Point No. 1: A company called Qarnot (yeah, no “U” after the “Q”) is selling a cryptocurrency mining rig that’s also a wall-mounted radiator. So, you can heat your home and mine Ethereum at the same time. According to Qarnot, the QC-1 should earn you about $120 per month based on a recent price for Ethereum.

Qarnot doesn’t take into account how much you’ll spend on electricity. Probably because it would ruin its sales pitch. But speaking of electricity prices…

Point No. 2: Rural Washington State has some of the cheapest electricity on Earth, due to a gigantic surplus of hydroelectric power. So, it attracts cryptocurrency miners. Crypto-mines of every size are cropping up everywhere. Often in repurposed buildings. Fruit warehouses. Hardware stores. That’s not the weird part.

See, it was weird even for rural Washington when crypto miners from Asia flew their private jet into the local airport, rented a car, drove to a local dam and politely asked: “We want to see the dam master because we want to buy some electricity.”

Really? I guess we’ll just wrap that electricity up for you. Talk about Asian takeout.

Point No. 3: I probably don’t have to tell you that cryptocurrencies have been correcting hard and fast recently. But do you know that bitcoin is coming back to Earth so hard that this newest form of money is fast losing its premium to the oldest form of money? By that, I mean gold.

Here’s a chart I snagged from Bloomberg, showing bitcoin’s premium to gold…

And according to experts, this premium is likely to continue to fall a bit longer. Rate hikes seem to drag on bitcoin’s value. Trying to figure out exactly why is a good way to start an argument.

So, I guess one way to play this is to go long gold, short bitcoin. But that’s not why I’m writing this article today. In fact, I think we are coming to a buying opportunity in select cryptocurrencies.

The Fall of Cryptos

Now, why are cryptos falling? There are four basic reasons…

- Regulators are clamping down. The U.S. Securities and Exchange Commission is issuing subpoenas. Japan suspended two crypto exchanges. Other watchdogs are growling. Bank of England Gov. Mark Carney said cryptocurrencies were “failing” and urged a global crackdown. This sends a chill through the industry.

- Google shmoogle! Google said it would ban ads for initial coin offerings and digital currency trading platforms. Ouch! Why? Because of reason No. 3…

- The industry is rife with crooks. Speaking of weasels. In a recent study by Bitcoin.com, $1.36 billion worth of cryptocurrencies were stolen by fraudsters during the first two months of 2018. Some estimates say that $9 million per day is lost in cryptocurrency scams.

- The number of cryptos is booming. In December 2014, there were about 500 cryptocurrencies, with a total market cap of $5 billion. Recently, there were over 1,500 cryptos, with a total market cap of over $500 billion. And that’s down from $823 billion at its peak in January.

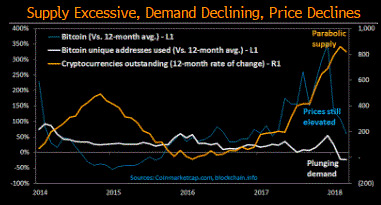

Indeed, as this chart from Bloomberg shows, supply of cryptos has gone parabolic.

So, that’s all the bad news. But I did say there was good news, right? A buying opportunity.

One interesting thing is that bitcoin is outperforming the broad cryptocurrency market. Since the end of January, the MVIS CryptoCompare Digital Assets 100 index is down about 28%. Meanwhile, bitcoin is down only about 10%.

Bitcoin is 42% of the market, sure. But it’s obviously become a store of value in the crypto world.

This tells us that people will pay for quality assets. Including quality crypto assets.

Crypto Ratings

Now, I think bitcoin may have some other problems. Growth problems. It’s not as easy to use as some other cryptos, and it doesn’t have the growth potential of some other great coins.

For example, Weiss Ratings gives bitcoin a B-. That’s the same rating for Ethereum. Yet Ethereum is up this year while bitcoin is down.

Another crypto, NEO, has a B rating. That’s higher than bitcoin. And NEO is up 33.8% so far this year.

Indeed, the Weiss Ratings on cryptocurrencies offer a treasure trove of useful information.

How does Weiss grade cryptos anyway? Each grade is made up of four indexes: Risk, reward, technology and fundamentals.

For example, reward includes factors like price appreciation and performance, both absolute and relative to a benchmark. Risk has similar metrics.

Technology is graded on underlying software, blockchain technology, speed, difficulty, efficiency and more.

Finally, fundamentals are graded on usage, security and real-world on-chain transactions. And some other factors.

Do Your Research

Now, you may think I’m talking my book. After all, I write for Weiss (about mega trends and natural resources).

But I also know it’s best to use every helpful tool at your disposal. And the Weiss ratings are helpful. I’m using them myself in my own crypto investments.

And to get Weiss Cryptocurrency Ratings sent straight to your inbox every Thursday afternoon, click here.

My point is, I believe we’ll come to a bottom in quality crypto assets. They’ll be on sale. The kind of sale you haven’t seen in months!

Do your research and get your shopping list together. There are a lot of weasels rumbling around in that bag. And the next weasel to pop out could send select cryptos much higher.

All the best,

![]()

Sean Brodrick

Editor, Wealth Supercycle