Mr. Market is pricing many stocks as if there was a bear market right now.

From their peaks, the S&P 500 is only off about 5% and the Nasdaq is down about 10%.

But many stocks are feeling worse pain and taking it on the chin.

More than 200 companies with market caps above $10 billion are down at least 20%.

And despite the Nasdaq Index still being near all-time highs … we haven’t seen this many tech stocks fall so far since around the dot-com bubble.

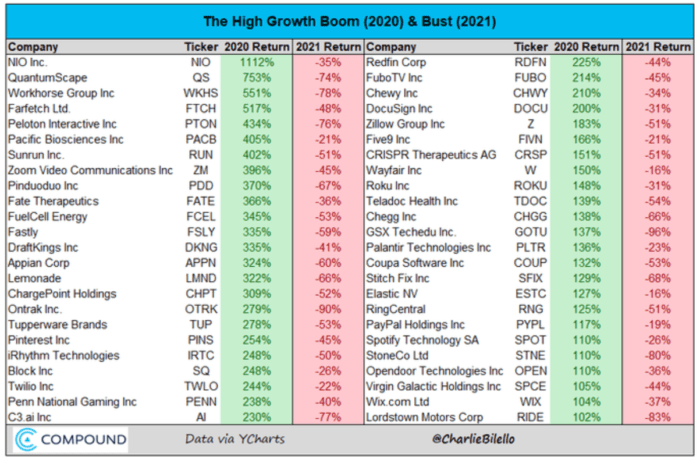

Close to 40% of stocks — like the ones in the table below — have been cut in half from their highs.

Many investors are freaking out at this volatility.

In fact, I even got a call from a close friend the other day who wanted my advice on what to do about it…

Dumb Reason

“Charles, should I hold them or sell?”

His voice was tense when he asked me about RingCentral’s and DraftKings’ stocks.

He’d bought them near the high in 2021. But now, both stocks are down around 50%.

My reply was: “How the heck should I know?”

Because I didn’t follow those stocks. I knew nothing of their businesses or who was running them. And I quickly found out that neither did he…

When I asked why he’d bought them, his reason was: “They were going up.”

As a Real Talk reader, you know that wasn’t an answer I wanted to hear…

Further to Go

Buying stocks just because they’re going up is not a game I play. In my book, that’s a pretty poor reason for buying anything.

A stock is simply a piece of a business. If I can’t understand the business, I can’t value it. And if I can’t value it, I have no business investing in it.

I actually use RingCentral, as well as DocuSign and Zoom. And they work. But as for buying their stocks in 2020 … fuhgeddaboudit.

Their stock prices have been trading at prices way above the underlying worth of their businesses.

Right now, I have several businesses like that on my wish list. Their stocks are still selling at too high a price relative to their businesses.

But while most investors are hiding under their desks freaking out while stock prices fall … we wait.

Because the intelligent investor is a realist who sells to optimists and buys from pessimists. That’s the way you make money in the stock market.

The prices of the stocks on my wish list could fall further very soon. And that would let us buy great businesses at great prices. So, stay tuned for more opportunities ahead.

Regards,

Founder, Alpha Investor

P.S. Looking at stocks as a piece of a business is one way to stay calm during volatility. But there’s another way to dampen the downside, too…

Warren Buffett originally came up with a strategy for it 60 years ago. And I recently found a way to replicate it — using microcaps.

These are companies with market caps of $500 million or less. And their small size means they have very little in common with the market indexes.

But not all microcaps are created equal. So, I put together a special broadcast to give you all the details you need to know about the best microcaps out there: Super Stocks.

Keep in mind, it’ll only be available to watch until tomorrow at midnight. You won’t want to miss out on my Super Stock insights. Check it out here right now.