I was a financial reporter when I learned my most important lesson on investing…

My managing editor spied me on the other side of the newsroom. I looked a bit dejected — my story of the day had fallen apart. I checked my contacts, worked through some internet ideas. I had zilch to show totfor my efforts.

“What’s up?” he asked. I told him.

He looked at me. “Well, there’s always a bull market going on somewhere,” he said quietly.

Yeah, I know — probably the world’s oldest financial cliché. We forget just how true it is.

If you look hard enough, chances are you’ll find some undervalued company, or a whole industry, with massive profits ahead.

Like now, in one overlooked market…

An Electric Opportunity

I first identified the energy storage market for you a year ago (“The Revolution Will Be Electrified“).

Energy storage means massive lithium-ion batteries. They store megawatts of electrical power.

Investors don’t have an exchange-traded fund to buy yet. But for readers of my newsletter, Total Wealth Insider, I identified an undervalued stock that pays a steadily rising stream of profits and dividends as this trend took off.

Since then the stock is up double digits.

And the opportunity for companies in this overlooked sector is just getting started.

Utilities have been the main market. They need a way to store power from their wind and solar energy assets for later use. They send it out later, when prices are higher (or at night or on windless days).

Deployments of energy storage installations rose 27% last year, to 431 megawatt-hours’ worth of systems. According to researchers, that number should nearly triple this year.

By 2030, we’ll be storing the equivalent of 305,000 megawatt-hours of electricity in giant batteries around the world.

Batteries for the Home

Lately, the residential market for batteries is coming on strong.

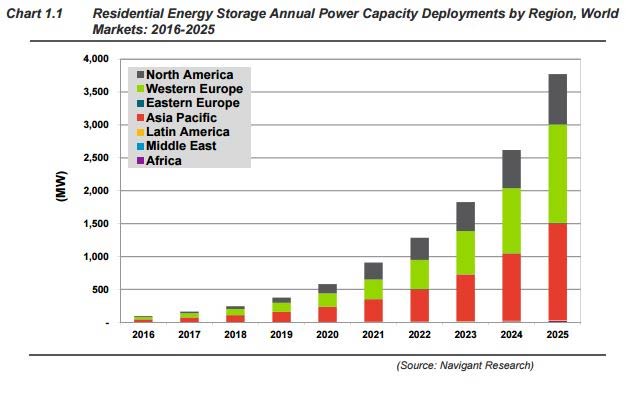

In fact, homeowners installed more batteries than utilities did in the first quarter of the year, according to analysts at GTM Research. And as this chart shows, there’s still a lot more to come:

In 2016, Elon Musk’s Tesla had this market largely to itself.

But as I noted a year ago, Daimler — the parent of Mercedes-Benz — started building home energy storage systems. More recently, Samsung, Panasonic and Sweden’s ABB, along with Nissan, Audi and others, are all horning in on the same residential market.

However, my point isn’t that the residential market presents a better opportunity than the utilities market. My point is this trend is right there staring us in the face…

Alongside lots of ways to make money from undervalued plays in this sector.

Kind regards,

Jeff L. Yastine

Editor, Total Wealth Insider