Bespoke Investment Group keeps a running tab on market performance. It tracks the monthly, quarterly and year-to-date total returns of exchange-traded funds (ETF).

It’s a quick and easy snapshot to compare the performance of global asset classes and U.S. sectors.

The surprising top performers this month are U.S. Treasurys and precious metals.

That’s a dramatic change. But they’ve always been safe-haven assets during market downturns.

Recent volatility proved no different. Investors moved money into the iShares 20+ Year Treasury Bond Fund, the SPDR Gold Trust and the iShares Silver Trust.

While the rest of the market crumbles, these ETFs are gaining.

Quarter-to-date, only two others did better: an ETF that tracks Brazilian stocks and a natural gas ETF.

Here’s why these winners could keep winning as we make our way into 2019.

- Global growth is fading. U.S. economic uncertainty is adding to concerns for the global economy. Lower growth hurts expectations for corporate earnings and stock prices. Precious metals and bonds are an alternative.

- Interest-rate expectations are changing. Investors believe the Federal Reserve cannot keep hiking short-term interest rates. This adds to doubts about the economy. And it puts downward pressure on long-term interest rates. When Treasury rates go down, Treasury prices go up. Ditto for gold and silver.

- The U.S. dollar is vulnerable. U.S. growth and interest-rate expectations influence the value of the U.S. dollar. Each helped strengthen the dollar this year. But for how much longer? Since gold and silver are priced in U.S. dollars, their prices tend to rise when the dollar falls.

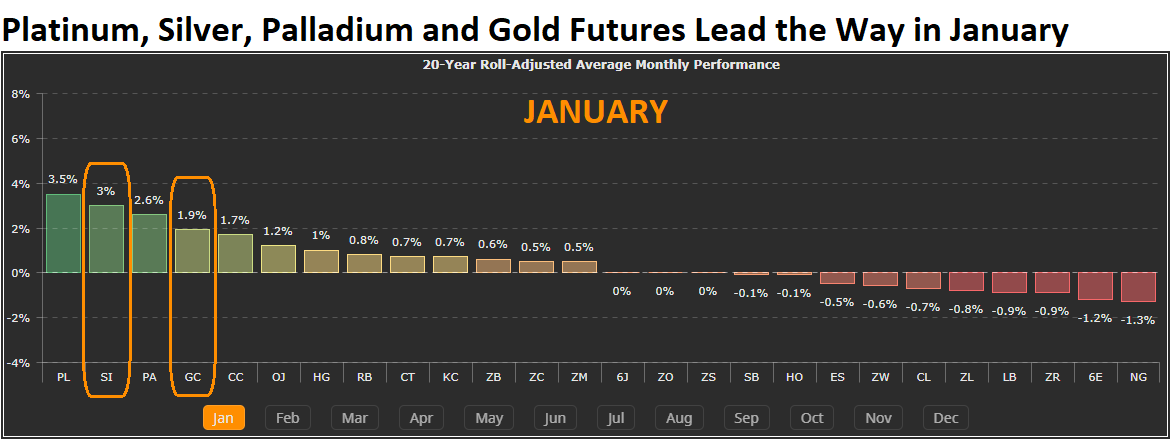

- Seasonal strength is ahead. January and February are good months for precious metals prices. Gold and silver have risen 3% and 1.9% each January, on average, over the last 20 years.

I use these four pieces of analysis only to look forward a couple months.

A nasty feedback loop could derail the bull market. If investors feel the economy will deteriorate, watch out.

That would make for quite the year in precious metals and bonds.

Good investing,

John Ross

Senior Analyst, Banyan Hill Publishing