Over the past few years, the subject of robotics has dominated conversations about tech.

We’ve heard them talked about from all sorts of perspectives. One minute they’ll destroy the world, and the next, you’re using the Roomba you just got for Christmas.

But one thing that’s not debatable is that the robotics market is on the cusp of a huge growth phase. We’re seeing the adoption of robots into everyday business across the board.

In health care, robots have begun to help surgeons improve precision during operations. And exoskeleton sales are growing exponentially to help paralyzed people walk.

In agriculture, we’re seeing self-driven tractors and harvesters. And sensors are being used to track disease and pests and prevent them from destroying crops.

In manufacturing, particularly with automobiles, robots are helping workers speed up the production process and reduce overall cost.

Robots can even be controlled by people to do the more dangerous jobs. That way, nobody is put in danger, and the job is done with perfect precision.

Of course, the full capabilities and practical uses of robots could fill a book. These are just some of the ways that robots are already being adopted in the modern world.

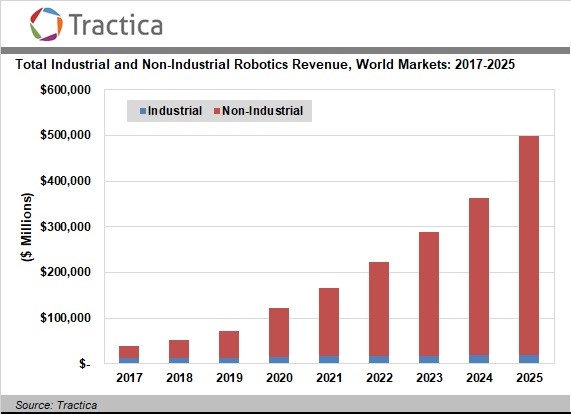

However, the chart below shows that this is just the beginning.

In 2018, the robotics market is about $52.7 billion. By 2025, that number is set to grow by 849%, or about 38% per year.

This mega growth is going to impact one country’s economy in particular: Japan.

Right now, over half of the world’s robots are made in Japan. In fact, four of the top six companies in the world in robot sales are Japanese.

This is reminiscent of another boom in the Japanese economy: the early days of the internet.

In the heart of that boom, from 1986 to 1989, Japan’s stock market (the Nikkei 225) went up by an astronomical 197%. That’s about 31% per year!

And this robotics revolution could create an even bigger wave in its market beginning next year.

Right now, due to the recent correction all over global markets, the Nikkei 225 is about 16% below its high. It’s a great time to get in.

And there’s no easier way to do so than by buying the iShares MSCI Japan ETF (NYSE: EWJ).

Alternatively, you can buy the Robo Global Robotics & Automation ETF (NYSE: ROBO), which holds stock in 90 robotics companies all over the world.

About 24% of ROBO is Japanese stock, including five of its top six holdings.

Regards,

Ian Dyer

Editor, Rapid Profit Trader