I’ll never forget my first trip to Las Vegas.

It’s one of the few places in the world that seems larger than life. Everything is over the top, and no expenses are spared when it comes to the lavish décor, lush skyline and star-studded nightlife.

Maybe that’s why during dire economic times in 2008, everything came crashing down — for casino stocks, that is.

Investors were worried that all those expenses would be impossible to make up in revenue with an ailing market. The big companies took on a ton of debt, so investors’ worries were warranted.

The stocks of the big three casino companies — Wynn Resorts, Las Vegas Sands and MGM — plunged more than 90%.

Since those stocks bottomed in 2009, only one isn’t up more than 1,000% … but it could soon hit that mark, and it’s a rally you don’t want to miss.

Win With Wynn

Wynn Resorts Ltd. (Nasdaq: WYNN) is the one stock up less than 1,000% at the moment. It’s still up an impressive 700%, though.

So why do I think it has more gas left in the tank? Well, I honestly think that even Las Vegas Sands — which is up over 5,000%, including dividends, since the 2009 bottom — has more room to run.

The reason is simple: The tide has turned in the Chinese territory of Macau.

The casino sector as a whole struggled since 2014, trying to find its rhythm. With Atlantic City, New Jersey, on the brink of bankruptcy, and revenue from Macau — the next big venture for the industry — on the decline, many had doubts that casino companies could continue making money.

But let’s face it; casino stocks have a lot going their way now:

- The Macau gambling market is bouncing back — up 19% in April after nine straight months of increases.

- The U.S. economy is expected to heat up — President Donald Trump’s promises to boost spending could spur economic growth.

- Earnings are improving — all three casino companies reported better-than-expected earnings.

- An NFL team, the Raiders, is moving to Las Vegas — even more tourism for Sin City.

These are all positive catalysts going forward that will help shares continue carrying higher.

And the company that stands to benefit the most from a rebounding Macau market is Wynn Resorts.

Asia’s Sin City

Wynn Resorts gets 75% to 80% of its profits from Macau. Macau is the gaming capital of the world, now seven times larger than Las Vegas.

That’s why Wynn Resorts’ stock popped 3% on the news that April gaming revenues in Macau were up 19%.

While the stock will continue rising as long as Macau’s revenue stays strong, it has price patterns that are bullish as well.

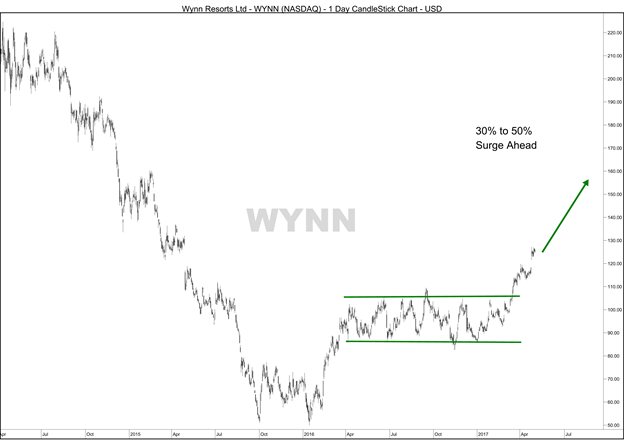

Take a look at this recent breakout:

(Source: Optuma)

For almost a year, the stock traded between $87 and $107. But in March, the stock broke out, and now it’s up to $125 … but the rally isn’t over yet.

The recent jump higher (on the news that Macau’s revenue was strong in April) helps confirm the breakout of the trading range that pinned shares for a year, and is a sign that this rally can continue for another gain of 30% to 50% in just a few months.

A rally like that could get the stock back to being up more than 1,000% since its plunge in 2008.

If you don’t have exposure to the casino industry yet, Wynn Resorts is one of the best bets in this rebounding sector.

Regards,

Chad Shoop, CMT

Editor, Automatic Profits Alert