You’ve just witnessed a 21st century bank run … and the panic hasn’t passed.

It started with mismanagement and social media panic. It was facilitated by apps on smartphones, which saw $42 billion in deposits leave the bank in one day.

By the time it was over, Silicon Valley Bank (SVB) became the second-largest bank failure in history.

Following SVB’s failure, bank stocks had their worst day since the financial crisis of 2008.

But the collapse of SVB and Signature Bank, another bank taken over by the FDIC, are completely different from 2008.

Mr. Market still braced for the worst though, and stocks continued to sell off over the past four sessions.

After moving higher yesterday, stocks resumed their downward fall this morning.

The stock market plunged on the open because of fears the contagion has spread and we’ll be seeing more bank failures.

In fact, oil prices fell to a five-week low due to the fallout from SVB’s collapse.

So why did investors decide … to sell off oil?

Because that’s what happens when fear grips a market. Everything goes down together.

An Energy Opportunity

Over the last few weeks in The Banyan Edge, I’ve shown you how Biden’s energy mandates are simply impossible to meet with today’s technology.

Just mining the materials would be disastrous for the environment.

Not to mention handing over the keys to the global economy to China and Xi Jinping.

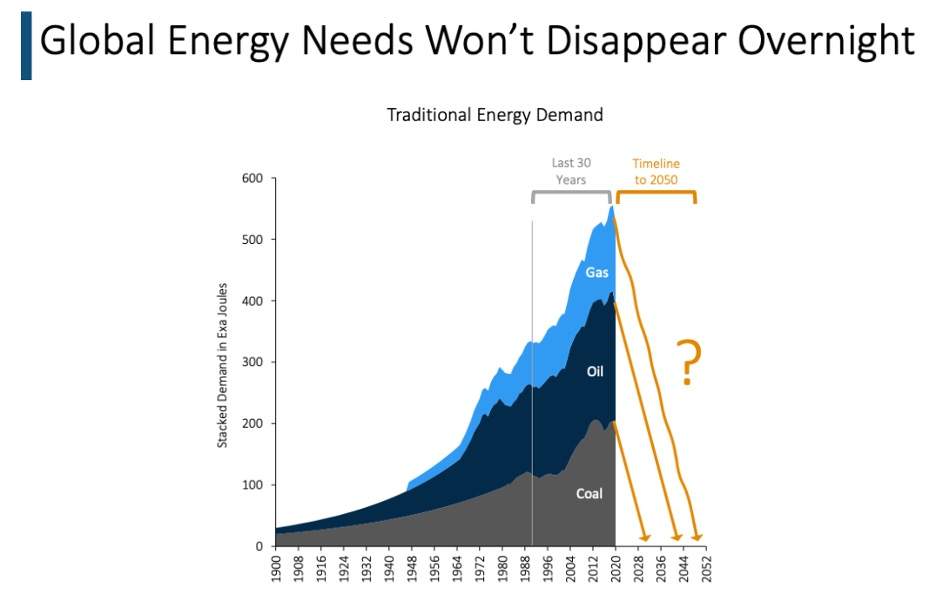

Take a look at the chart below, and you’ll see what I mean. It shows how demand for fossil fuels has skyrocketed since 1900.

The orange lines show how fast we’d have to give it all up to meet Biden’s deadlines:

(Click here to view larger image.)

It looks a lot like pushing the economy off a cliff.

That’s why Washington is already walking back its war on fossil fuels.

On the campaign trail back in 2019, Biden told supporters: “I guarantee you, we’re going to end fossil fuels.”

Then just last week, Biden’s administration approved a new oil-drilling project in the Alaskan Arctic.

That’s a big leap to make in three years. But even Biden knows the writing’s on the wall at this point.

He’s even gone so far as to admit it in this year’s State of the Union address.

In an apparently unscripted moment, he told America that “we are still going to need oil and gas for a while,” and addressed the industry’s concerns specifically.

Meanwhile Wall Street is still somehow behind the curve — which is great news for Main Street investors.

Because it means that we can still lock in some of the market’s best fossil fuel investments at bargain prices…

Bargain Buys: Oil and Natural Gas

Fossil fuel has a long runway ahead of it.

I’ve seen some estimates that oil production will continue to rise until the year 2040!

That’s why I’m long-term bullish on oil and natural gas.

Keep in mind, I couldn’t tell you what the price per barrel for oil would be next week, next month or next year.

But I’m highly confident, based on the simple laws of supply and demand, that oil and natural gas prices will be materially higher 5 and certainly 10 years from now. Materially higher.

One possible way to profit from this bullish energy trend that I see over the next decade, is to buy the largest energy ETF: Energy Select Sector SPDR Fund (NYSE: XLE).

The exchange-traded fund (ETF) owns some of the largest energy companies in the world such as Exxon Mobil, Chevron, Schlumberger, as well as 23 other companies.

And 100% of those companies are located in the U.S.

Like many stocks this week, this ETF has taken it on the chin this week. It’s down 5%.

But that doesn’t mean there’s anything fundamentally wrong with the business. It just makes it an even better bargain.

The path to higher gains will always test investors — to see how much conviction they have in their position in the face of downturns … like ones that follow big events like SVB’s collapse.

And if you’re looking for more direct exposure to oil and natural gas, I just released a new video that details three of the best stocks I’ve found.

- One of the top-five natural gas producers in all of North America.

- An oil 2.0 company in an ideal position for growth.

- A company with 120,000 miles of pipelines across 41 American states.

You can see all the details and find out how to unlock my recommendations by clicking here.

Regards,

Founder, Alpha Investor

P.S. Are you using this time to buy quality companies at bargain prices? Let me know at BanyanEdge@BanyanHill.com.

And if you’re looking for recommendations … check this out below. ⬇️ ⬇️ ⬇️

SVB’s Collapse = Your Opportunity

Bottom line is this…

We focus on the businesses and not the daily gyrations of the stock market.

When you do that, you can sleep better at night and not worry about panics and market disruptions that won’t impact the companies in your portfolio.

In fact, if you have the temperament for it, now is a great time to buy at bargain prices.

If you want Charles Mizrahi’s recommendations, click here now for the details.

Beware the Ides of March: Protecting Yourself From a Bank Run

Silicon Valley Bank’s failure is, of course, the biggest news of 2023.

Or at least it was.

Today, it seems that Credit Suisse is stealing the attention. The Swiss banking giant — which came close to failing in the aftermath of the 2008 meltdown — is now front and center in the headlines.

As I write this, Credit Suisse’s stock has hit new all-time lows.

Why? The bank spooked the market by mentioning a “material weakness” in its financial reporting. This might result in “misstatements of account balances or disclosures.”

No one knows exactly what that means, but it sounds like the vague notices that came out of the banks in 2008. So just like what happened to SVB, investors are selling first and asking questions later.

And it didn’t help that the Saudi national bank loudly and publicly said that it was not interested in bailing out Credit Suisse with a capital contribution.

Well … we’ll see how this shakes out. Personally, I don’t believe we’re looking at a scenario like the 2008 financial crisis.

But we could be looking at a similar situation to the savings and loan crisis (1986 to 1995). And that wasn’t a lot of fun either.

Around a third of all savings and loan associations failed during that period, and it hit my native Texas economy particularly hard. Then, just like now, the root of the problem was a mismatch between short-term liabilities and long-term assets.

The history lesson is great.

But more practically: What can you do to actually protect yourself from a bank run?

Let’s make a list:

- Don’t have more than the $250,000 FDIC insured maximum in cash in any single bank.

Yes, the federal government has promised to backstop the depositors of the banks that have already failed. This effectively raises the $250,000 FDIC insurance maximum to infinity.

But, there is no guarantee they will continue to do so. They arbitrarily raised it, and they can just as easily lower it. There’s just no reason to risk it when you have other options.

- Consider moving any cash savings you don’t need for immediate expenses to the U.S. Treasury itself.

This will make you absolutely bulletproof.

Why? Because TreasuryDirect gives you access to T-bills and an assortment of U.S. government bonds.

The debt ceiling fiasco notwithstanding, you have no risk with the U.S. government. If they fail to safeguard your cash, it means the zombie apocalypse is here and your money has no value anyway.

- You can also sweep any large cash balances in your brokerage account into T-bills.

So far, the panic in the market has been centered around banks. However, that can change in a hurry and spread to brokerage firms.

Keeping your excess cash in T-bills is safe, and the yields aren’t too shabby these days. You can get about 5% in maturities of 6 to 12 months.

You don’t have to run out and sell your quality long-term stocks. As Charles Mizrahi points out, panics like these create good opportunities to add to quality long-term positions — like his recommendations in oil and natural gas.

But with your cash — your cold, hard cash — there’s no reason to take risk when safeguarding it is so simple.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge