Americans of a certain age will recall a standup routine from the incomparable Steve Martin.

You can be a millionaire … and never pay taxes. You can have $1 million, and never pay taxes! You say: “Steve, how can I be a millionaire and never pay taxes?” First, get a million dollars. Now … you say: “Steve, what do I say to the taxman when he comes to my door and says: ‘You have never paid taxes.’?” Two simple words. Two simple words in the English language: “I forgot!”

All I can say is, don’t try this at home … especially not this year.

I have a feeling the 2018 tax year is going to be a memorable one for many of us.

Revisions to the tax code rushed through Congress in the dying days of 2017 have implications for almost everyone. And if you haven’t been paying attention, those implications could be unwelcome.

With two and a half months left until the end of the tax year, I can’t think of a better time to remind you of those changes … because there’s still time to avoid costly tax mistakes.

The Good News

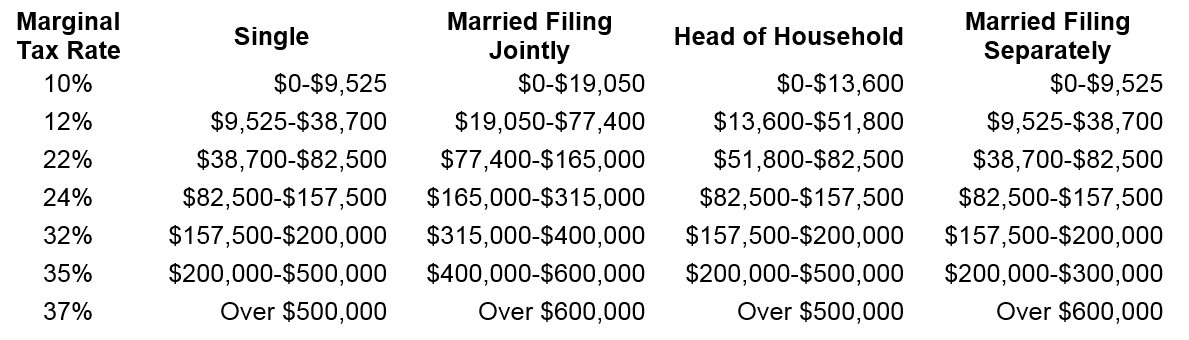

Let’s start with changes to the tax brackets. For many people, that’s the good news:

Good news, you say? That’s right: For a couple making around $100,000 a year filing jointly, the marginal rate has dropped from 25% to 22%.

Good news, you say? That’s right: For a couple making around $100,000 a year filing jointly, the marginal rate has dropped from 25% to 22%.

This downward shift applies to all tax brackets except the lowest … the poorest Americans will still pay a marginal rate of 10%.

Beware the Capital Gains Trap

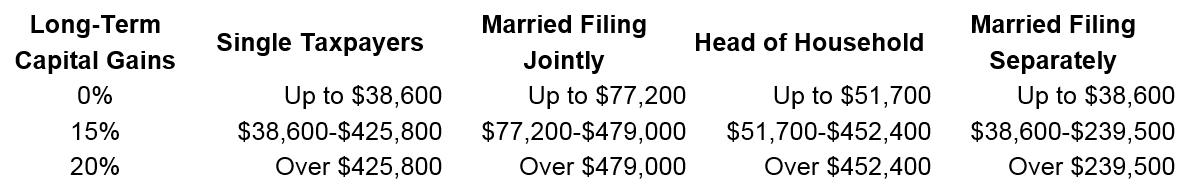

Short-term capital gains are still taxed as ordinary income under the new law. And since the tax brackets applied to ordinary income have shifted downwards, your short-term gains are going to taxed at a lower rate, too.

There are now three capital gains brackets instead of five. But they don’t match up perfectly with the new tax brackets. They are now simplified as follows:

Here’s the first potential pitfall in the new law: Lower capital gains rates mean you won’t be able to harvest losses to the extent you could in years past. It’s important to take that into account when planning your end-of-year portfolio adjustments.

Big Changes to Deductions

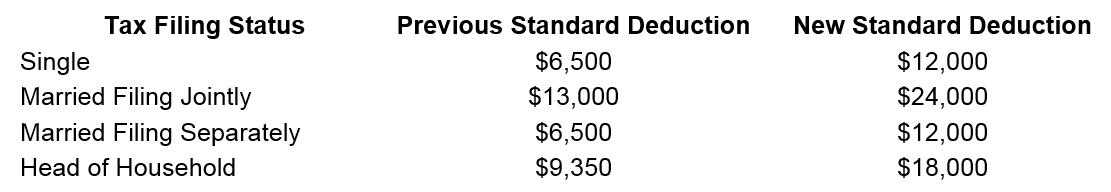

For most of us the most significant changes under the new tax law involve deductions. Instead of itemizing deductions, more than 90% of Americans will now simply take a larger standard deduction.

That’s because the standard deduction has been increased by a little less than double for 2018. The typical joint-filing household can now deduct $24,000 instead of $13,000:

But this comes at a cost for many of us. The most important is that we are now limited to a total deduction of no more than $10,000 for state and local taxes, including income, sales and property taxes.

But this comes at a cost for many of us. The most important is that we are now limited to a total deduction of no more than $10,000 for state and local taxes, including income, sales and property taxes.

This is another hidden trap. For households in high-tax local jurisdictions (like me, for example), the new limitation will mean higher federal taxes for 2018.

Another hidden deductible trap involves miscellaneous deductions. I’ve spoken to many people — including some of my colleagues — who were shocked to learn that many have been eliminated completely. These include:

- Casualty and theft losses (except those attributable to a federally declared disaster).

- Unreimbursed employee expenses, like home office costs.

- Tax preparation expenses.

- Moving expenses, even if for work purposes.

- Employer-subsidized parking and transportation reimbursement.

Three other popular deductions have been overhauled substantially.

First, the mortgage interest deduction can only be taken on debt of up to $750,000, down from $1 million. Mortgages taken before December 15, 2017, are grandfathered in.

Critically, interest on home equity debt can no longer be deducted. Previously interest on up to $100,000 was deductible.

Second, you can now deduct charitable donations of as much as 60% of your income, up from 50%.

Third, the threshold for the medical expenses deduction has been reduced from 10% of annual gross income to 7.5% of your income.

For example, if your income is $50,000, you can now deduct any unreimbursed medical expenses over $3,750, not $5,000 under the prior tax law.

Unlike most other provisions in the bill, this is retroactive to the 2017 tax year, so be sure not to miss it.

Taming the AMT Dragon

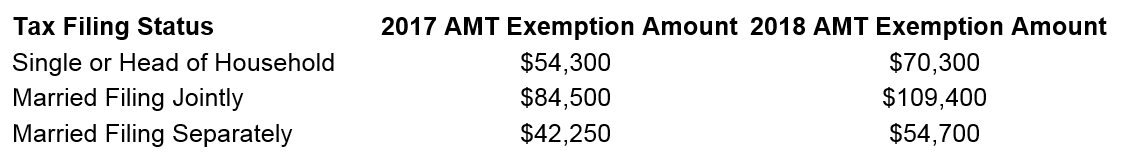

Alternative minimum tax (AMT) is supposed to ensure that high-income Americans pay their share of taxes regardless of how many deductions they can claim.

Higher-income households must calculate their taxes twice — once under the standard tax system and once under the AMT — and pay whichever is higher.

Under the AMT, some of a household’s annual income is exempt from the higher AMT rates. The more income that is exempt, the less tax the household pays.

The good news is that the new law raises the AMT thresholds significantly for 2018:

But another quirk in the AMT system phases out those exemptions once your income hits a certain level. Above that, all income is subject to the AMT rate.

But another quirk in the AMT system phases out those exemptions once your income hits a certain level. Above that, all income is subject to the AMT rate.

Previously, the phase-outs were $160,900 for joint filers and $120,700 for individuals. The new law raises these to $1 million and $500,000.

A Long-Term Trap

These changes to the tax laws will raise the federal deficit to over $1 trillion in 2018. Once that debt is incurred, it’s never going away … we’ll have to pay it eventually.

But some things are going to disappear in the new tax system: most of the changes I’ve discussed above. In order to jam the tax bill through Congress under current rules, almost all of them are set to expire after the 2025 tax year.

But there’s one that isn’t going to change. The IRS is going to calculate inflation in a way that will make more and more of your income subject to higher marginal tax rates over time.

The combination of the temporary nature of the tax cuts and the new inflation measure will eventually mean higher taxes on the middle class compared to previous tax law.

Figure Your Tax Now!

Many of us — especially retirees — figure and pay our own taxes.

It’s critical that you figure how these changes will impact you now. Otherwise you may end up underpaying this year’s taxes and face a potential penalty from the IRS.

If you’re employed, on the other hand, and you claim too many deductions on your W-4 form based on the old tax rules, the IRS can order your employer to withhold federal income tax at the single rate with no deductions!

Because all of this involves how much tax you pay now, during the 2018 calendar year, it’s not something you can wait to address at the last minute before April 15, 2019. By then it’ll be too late … and you may have under-withheld your taxes.

So forget Steve Martin’s advice. Figure your taxes now while there’s still time!

Regards,

Ted Bauman

Editor, The Bauman Letter