If you don’t know the Law of the Vital Few, you should.

Also known as the 80/20 rule, it states that 80% of an effect comes from 20% of the causes.

Managers are very familiar with this law. Their top few workers deliver the lion’s share of results. Economists point to the fact that a slim minority of people hold most wealth.

Even fishermen are familiar with this law. At the dock, there is always that one boat that seemed to catch all the fish.

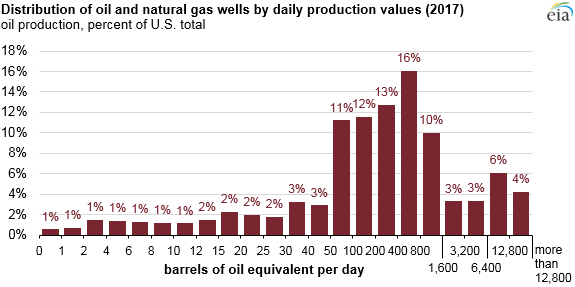

It turns out that oil wells aren’t so different than workers, wealth or fish. Twenty percent of wells produce 74% of the oil.

The graph below shows that most oil comes from wells in a narrow band.

At the Energy Information Administration (EIA) conference last June, I got a glimpse at the tech revolution in shale. Low oil prices from 2014 to 2016 forced drillers and service companies to advance fracking techniques.

Producers expected them to squeeze as much oil from every dollar they put in the ground. The end result was oil service companies that started to look more at home in Silicon Valley than in Midland, Texas.

Exploration adopted artificial intelligence. Drilling largely became automated as robots replaced humans.

America Takes the Lead on Oil Production

A report from the EIA highlighted this effect. Last year, the U.S. produced more oil from fewer wells.

August smashed the record for most oil produced from the U.S. and we continue to see wells producing outsized returns.

The International Energy Agency (IEA) predicts that 20% of all oil will come from American shale basins by 2025. Currently, America supplies about 15% of global oil production.

The same group also believes that current technology will see diminishing returns. It forecasts a plateau in well production.

Based on current technology, the IEA’s estimates are sound. But it is difficult — if not impossible — to predict what breakthroughs in technology the future will hold.

At Real Wealth Strategist, we are keeping an eye on the sector for the right time to get in.

Regards,

Anthony Planas

Internal Analyst, Banyan Hill Publishing