There’s a change in leadership coming. And, no, I’m not talking about upcoming elections.

I mean a change in leadership in the stock market. It’s way more certain than any prediction about which way voters will swing … because I’ve seen it plenty of times before.

Now, you could be forgiven for thinking that tech stocks do nothing but go up and energy stocks only go down.

After all, since the end of 2008, tech stocks are up 672% compared to a 27% decline for energy stocks.

But that trend was just the opposite after the tech bubble burst.

From 2000 through the end of 2007 (just before the financial crisis), technology stocks fell by 50% while energy stocks gained 229%.

Those dramatic shifts are just two examples of how long-term leadership in the stock market is constantly evolving.

And recognizing these leadership changes is key to making — and keeping — profits.

Here’s how they start … and what to expect next.

What Causes These Transitions?

There are many reasons these changes in leadership can occur.

Sometimes it’s cyclical powers at work. The rise of emerging market economies in the early 2000s created a huge appetite for commodities, which helped trigger the boom in energy stocks. Then the financial crisis quickly sapped that demand.

Sometimes it’s due to valuations. Extreme valuations in either direction can serve as a catalyst. The sky-high tech stock prices in the late ‘90s are a perfect example.

With the big leadership change in the 2000s, one sector was wildly overvalued while at the same time another saw new sources of demand.

And there are signs that similar dynamics have emerged in today’s stock market, where a massive rally in technology stocks is creating bubble concerns once again.

Take a look at the chart below. It shows the weighting of the technology sector in the S&P 500 Index:

At nearly 26%, the tech sector’s weight is the highest since the 90s bubble … indicating stretched valuations in this leading sector.

Where Will the Next Leaders Emerge?

As Ted outlined in an article here, a lack of reliable information makes smart investment decisions difficult in this environment. That’s one of the reasons we focus on safe and reliable companies providing us with steady income at The Bauman Letter.

But our research has uncovered companies that are emerging as the stock market’s next leaders.

And right now our process tells us to focus on industries that leverage emerging technologies to drive innovation and profit from change … change that’s accelerated by the pandemic.

But unlike the hottest tech stocks that are sporting valuations wildly detached from reality, these pick-and-shovel companies have plenty of room to grow in price.

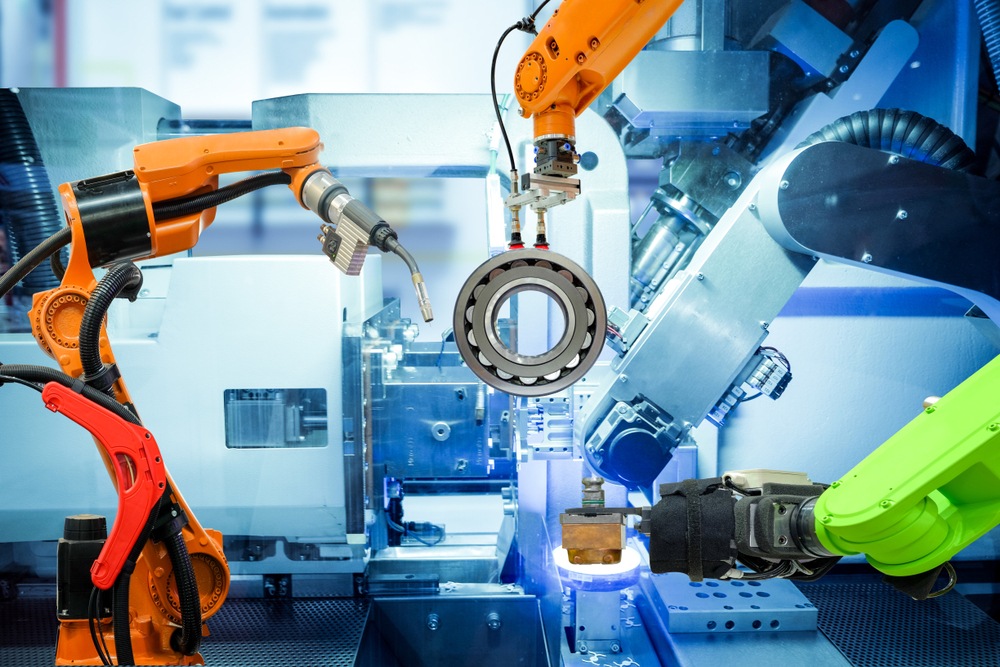

Automation on the factory floor is a perfect example of this combination. That’s why we recommended the Robo Global Robotics & Automation ETF (NYSE: ROBO) … and still do. It is an exchange-traded fund (ETF) that tracks this sector.

So don’t be caught off guard when yesterday’s winners suddenly become tomorrow’s losers. It’s the only sure thing in this uncertain stock market.

Best regards,

Research Analyst, The Bauman Letter