We’re in the final stretch for 2017.

The S&P 500 is up 15%. The Dow Jones Industrial has tacked on nearly 18%. The tech-laden Nasdaq has soared 17%.

The U.S. market is proving stronger than many European stalwarts, like Germany whose DAX is up less than 14%.

Stocks have even beaten gold, which is up less than 11% this year.

But while U.S. stocks are poised to put a nice bow on the year, there is one major event coming up in December that could derail further gains in 2018 and put a new shine on gold as investors race to the yellow metal as a safe haven in the growing turmoil.

Jobs Falling Short

Pew Research Center reported earlier this month that 50% of surveyed Americans feel that there are plenty of jobs available in their communities. This is the highest level recorded since Pew stared this poll in 2001.

And it’s not really surprising.

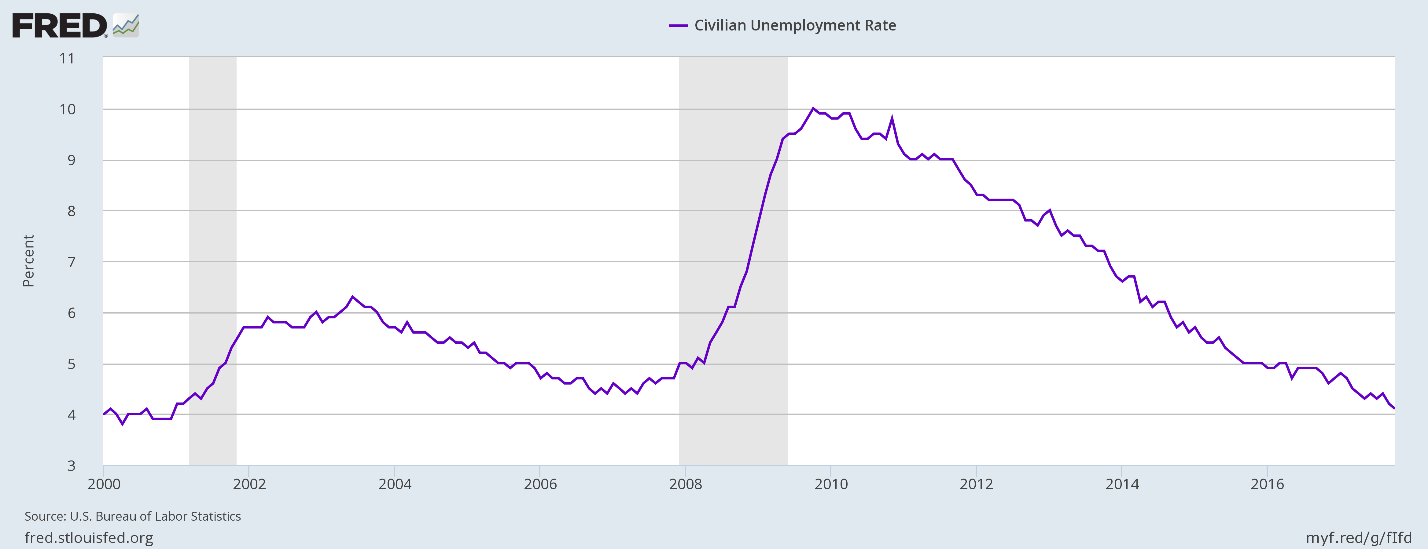

The unemployment rate is now at 4.2% — levels we’ve not seen since January 2001. (And, of course, we all remember how the market fell apart at the end of 2000, but let’s not worry about comparisons to 2000.)

The interesting thing from the Pew Research poll isn’t that people feel that there are ample opportunities for jobs, but that despite those opportunities, incomes aren’t keeping pace with the cost of living.

Just 9% said that they feel like they are getting ahead.

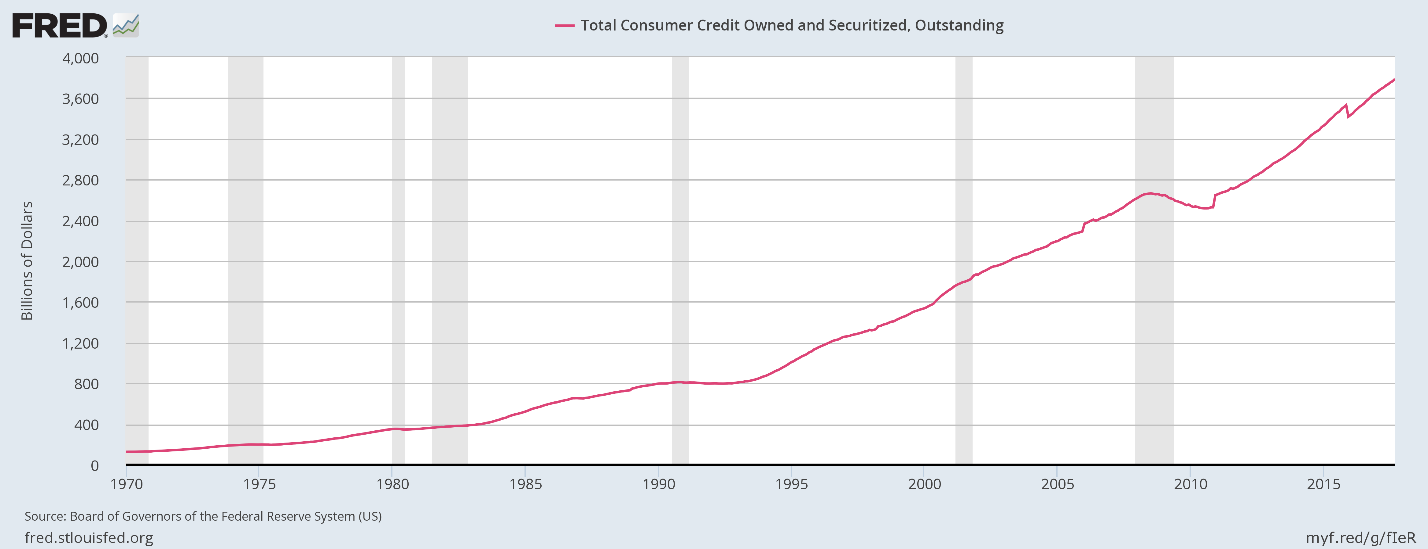

This “falling behind” or even just “staying even” has led America to, once again, take on debt. The Federal Reserve reports that in September consumer credit (aka debt) reached an astounding $3.8 trillion.

Enter the Federal Reserve

It’s clear that Janet Yellen is out as the Fed Chair next year, but that doesn’t mean that she isn’t going to stick to her game plan right up until the end. And that game plan includes another interest-rate hike of 25 basis points at the December meeting.

The Federal Reserve might complain about a disturbing lack of inflation when it comes to this economic recovery, but the latest Consumer Price Index (CPI) came in above the Fed’s favored 2% range.

And so can Pew’s respondents when considering that many are falling behind the cost of living increases.

The point is that the Fed is going to raise rates yet again. It won’t come as a shock to the market, because the Fed has been clearly telegraphing its moves for months now. Right now, Fed funds futures are pricing in a 97% chance of the Fed boosting rates next month.

But it will be the beginning…

The First Step Toward Recession

The Fed’s interest-rate hike won’t shove the market off a cliff in December — the hike is too well orchestrated and obvious at this point to do that and we’re more likely to have the market fall apart if Trump’s tax plan fails to pass Congress.

But the continued tightening will put the market in a precarious position. The cost of maintaining that debt will rise and consumers are already struggling to keep up with the cost of living.

In addition, Michael Carr has already pointed out that the Fed’s next move could put stock in bear mode beginning in 2018.

Take steps now to prepare your portfolio for 2018 and gold remains a great insurance policy against weakness in stocks.

Regards,

Jocelynn Smith

Sr. Managing Editor, Banyan Hill