Editorial Director’s Note: We’re thrilled to announce that Kristen Barrett, senior managing editor of Winning Investor Daily, is taking the reins of your Saturday messages. She’ll give you a behind-the-scenes look at everything we do here. So we hope you give her a warm welcome. You can say hi to her at winninginvestor@banyanhill.com. Enjoy! — Jessica Cohn

Story Highlights

- One alcoholic beverage’s sales are up 320% in the past year.

- This drink appeals to health-conscious consumers because of its low calorie count, carbs and alcohol by volume.

- By replacing alcohol with cannabis compounds, users can get a buzz without the bloat.

- Pot stocks will soar when these products hit North American shelves in December!

I’m Kristen Barrett, the senior managing editor for Winning Investor Daily. I’m thrilled to start giving you the inside intel on what our experts are saying about booming trends, what’s coming ahead and more.

To kick off today, let’s talk about the latest fad in alcoholic beverages — spiked seltzers. As Matt Badiali and Anthony Planas tell me, it’s another sign of the massive potential in cannabis stocks.

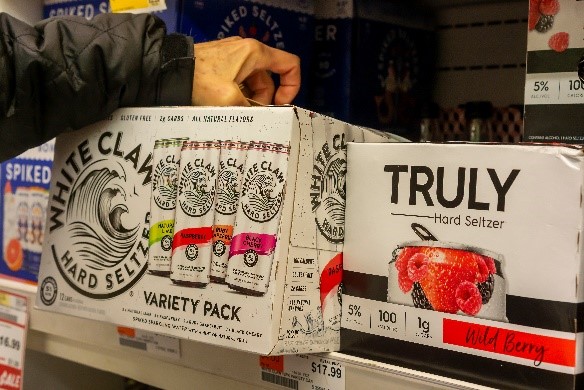

If you haven’t heard of this trend, just know that last week, The Hustle reported that sales of White Claw Hard Seltzer surged 320% in the last year.

Perhaps your favorite grocery store, like mine, has an entire display made of 12-packs of White Claw.

Hard seltzer isn’t new. But there’s a reason that these products’ sales are through the roof right now — and it gives cannabis-infused products another market to tap into.

A $550 million market.

Think of the health-conscious folks who gave up soda in favor of low-calorie, low-sugar options such as LaCroix. They’re looking for drinks with fewer carbs than beer. And they want less sugar as well as lower alcohol by volume than wine or liquor.

A can of White Claw is 100 calories. That’s about as low as you can get with alcohol.

If you remove the alcohol, you get rid of the calories.

And if you infuse THC — a marijuana compound — in seltzer water, you get a buzz without the bloat.

That’s exactly why we think marijuana-based companies stand to profit. There will be huge demand.

Remember, cannabis-infused beverages are already here. For instance, Heineken subsidiary Lagunitas makes a nonalcoholic drink called Hi-Fi Hops. It tastes like an India Pale Ale, aka an IPA — but with no calories or carbs. Right now, you can only buy it in cannabis dispensaries in California.

But on December 16, cannabis-infused beverages like these will hit shelves in Canada. Truss — Molson Coors Brewing Co.’s joint venture with Hexo Corp. — says it has a large supply of drinks ready to meet the demand.

So we want you to be ready.

Yes, these drinks are tricky to market in the U.S. because marijuana isn’t legal at the federal level … yet.

But once they hit Canadian shelves, they’ll take off in North America.

That demand — and revenue — should put more pressure on the U.S. federal government to legalize THC-infused food and drinks.

With all that in mind, Matt Badiali and Anthony Planas have researched the three best cannabis companies to invest in before the THC market takes off.

They are all trading under $10 right now.

You can hear the details during Matt’s Pot Profits Summit, which you can access here.

Now I’d like to hear your opinion about this latest trend.

Many think the recent pullback in marijuana stocks created the opportunity of the decade.

Have you taken the plunge and bought pot stocks yet? Did you cash out for big gains? Or are you holding through the volatility? Reach out to winninginvestor@banyanhill.com to let us know!

Check out 3 New YouTube Videos!

Our experts have new video content to share with you.

1.Internal analyst Anthony Planas’ brand-new Marijuana Markets POTcast:

2. Automatic Profits Alert editor Chad Shoop:

3. Apex Profit Alert editor John Ross:

Read on to see the topics all of our experts are following this week.

Regards,

Kristen Barrett

Senior Managing Editor, Winning Investor Daily

***

This Is a Critical Moment in Cannabis Stocks — Why You Need to Get in Now

Energy drinks exploded in popularity in the early 2000s. Monster Energy’s stock soared over 12,000% in three years. Cannabis stocks will follow a similar trajectory. The big names aren’t trading for $1 anymore, but Matt Badiali explains why you haven’t missed the opportunity to make massive gains in this industry. (2-minute read)

Stay 1 Step Ahead With Seasonality by Investing in Transportation

The ups and downs in the stock market can be intimidating — and it’s scary to try to predict what will happen next. It’s normal to feel that you’re a step behind on what’s going on. But Chad Shoop knows how to overcome the daunting moves in the stock market. He shares his go-to strategy to stay one step ahead of the market’s swings. (3-minute read)

Natural Gas Stocks Will Rebound: Your Opportunity for Massive Gains

Natural gas is at extreme lows. Money managers are more bearish on this natural resource than they were back in 2017. But John Ross knows prices won’t stay low for long, and he sees this as an opportunity to make big money when natural gas prices rebound. (3-minute read)

3 Steps to Turn a Small Investment Into Millions

People think that being successful in the stock market is about having a high IQ and going all in while following big trends. But Charles Mizrahi disagrees, and he shares three simple steps that you can follow to strengthen your investing and enhance your profits. (4-minute video)

Check Your Bills: Beat the Market by Investing in Companies You Use

New investors looking for the next BIG opportunity will overlook these mundane companies. But their performance puts them well ahead of the broader market. Anthony Planas shares what you need to know to build the base of your portfolio. (2-minute read)