Today’s Consumer Price Index report has investors freaking out.

Inflation has reached a new 40-year high — hitting 9.1% last month.

And the stock market is getting kicked in the teeth.

From their highs, the S&P 500 is off 20% and the Nasdaq is off close to 30%.

Many investors are selling their stocks and hiding under their beds.

That’s a big mistake — especially if you own quality businesses.

Others have cash on the side and are waiting for the right time to invest.

When do they plan to buy stocks?

They usually say that they’ll wait “until the coast is clear and the market settles down.”

If this sounds like you, I need your full attention.

Because what I have to say will have a huge impact on your net worth…

Back to the Future

Real Talk: When the heck has the future ever been clear?

The future, by definition, will always be unclear.

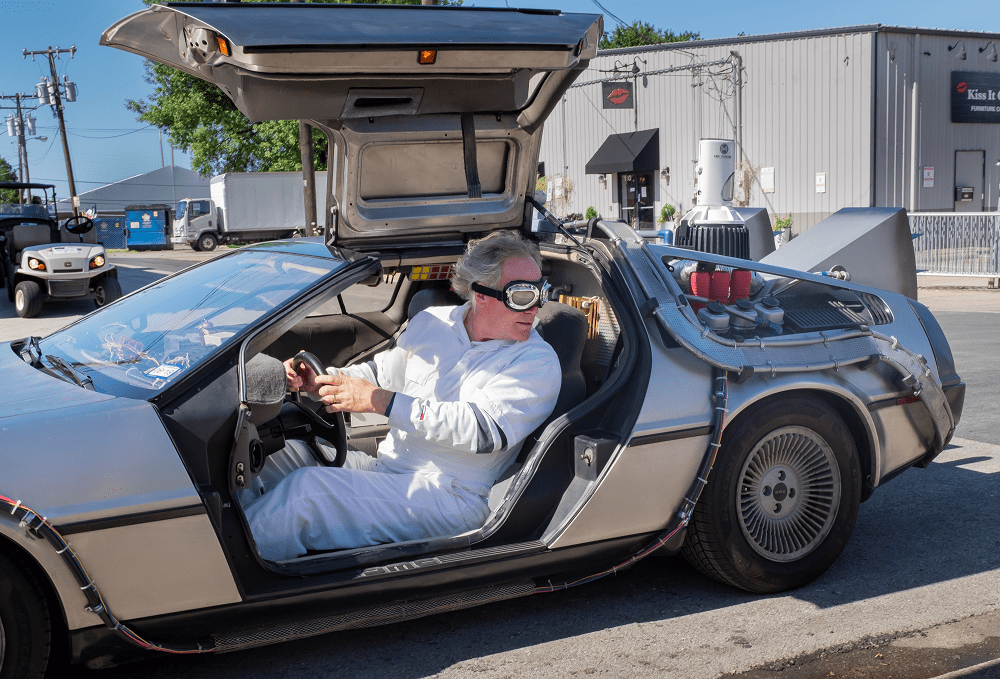

Unless you can travel to the future in a time machine like Doc Brown, the future will always be murky.

Dr. Emmett Lathrop Brown, inventor of a time machine constructed from a 1981 DeLorean

Stocks turn higher before the economy or sentiment changes.

It’s during the darkest days of a bear market that stocks reverse course and soar.

I saw that play out perfectly during the 2008 financial crisis.

During the worst days of it — on October 16, 2008 — Warren Buffett wrote an article.

It ran in the opinion column of The New York Times, and the title was: “Buy American. I Am.”

At the time, the S&P 500 was already down 38%.

The financial markets were at the edge of the abyss.

And comparisons were being made between the current crisis and the Great Depression.

But Buffett said he was putting his money where his mouth was and buying stocks…

Chirr-Chirr

Here’s the thing: Buffett wasn’t calling the market’s bottom.

He said he had no idea where the stock market would go over the short term.

He even admitted that: “Headlines will continue to be scary.”

But the reason he was buying was because of this simple rule: “Be fearful when others are greedy, and greedy when others are fearful.”

For those waiting for things to settle down, Buffett had a message: “If you wait for the robins, spring will be over.”

A few months later, the S&P 500 Index fell even further — close to 30%.

The financial media was making fun of Buffett and his “market call.”

It took until March 9, 2009 — five months later — for the market to stop falling and start to rise.

And from the low of March 2009 to the end of 2021, the S&P 500 soared more than 8X.

Even factoring in this year’s downturn, the index is up 630% from then through June 30, 2022.

I know many investors — and some family members — who didn’t heed Buffett’s advice.

They waited for the robins and missed spring.

They eventually did get back into stocks, but they missed out on easy gains.

Don’t make that mistake…

Planting Acorns

I know the recent headlines are scary.

They scream of the coming recession, a huge hike in interest rates and soaring inflation.

My advice to you is to ignore them.

Because the stock market will likely move higher before the economy or investor sentiment turns around.

Now’s the time to be a buyer, not a seller — especially now that so many quality businesses are underpriced.

Legendary investor Shelby Davis said that you’ll make most of your money in bear markets.

You just won’t realize it until later.

And one area that I’m focusing on because it’s very underpriced is microcaps.

These are companies that have market caps of less than $500 million.

The ones I follow are what I call “acorns” that could one day become mighty oak trees.

Amazon, Berkshire Hathaway and Walmart were all acorns at one time.

And right now, there’s one stock that’s an acorn today. But it won’t stay one for long…

The company’s product is in over 30,000 stores, and it has little to no competition.

I’ll share all about it with you if you click right here.

Regards,

Founder, Alpha Investor