The countertops in doctors’ offices and hospitals, the belt at the grocery store, the handrails on mass transit systems and the buttons in elevators — all house the coronavirus, the cause of the current pandemic, that lives on these surfaces for up to three days. Material science will take a huge step forward in the wake of this pandemic.

The age of steel and plastic surfaces may be coming to an end.

However, there is a substance that kills viruses within four hours — including the coronavirus. It’s a substance that used to be prevalent all throughout hospitals. But, it was replaced in the 1980s.

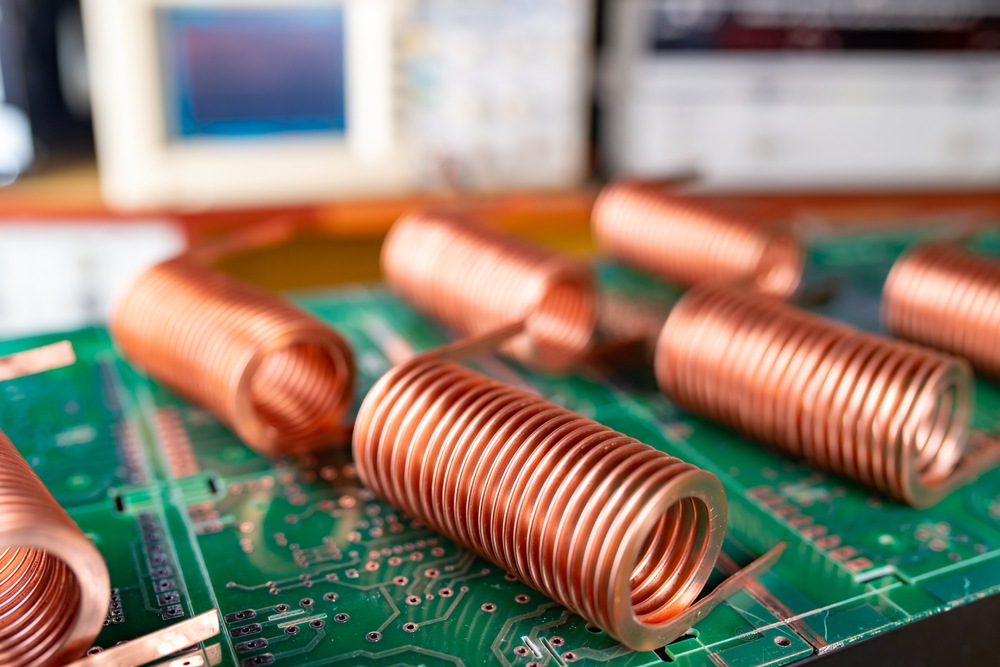

I’m talking about copper. And its use as a material, to slow the spread of viruses, is about to skyrocket.

Medical Researcher Phyllis Kuhn observed, back in 1983, that even tarnished brass (a copper-zinc alloy) kills bacteria, while stainless steel does nothing.

She said back then:

“If your hospital is being renovated, try to retain old brass hardware or have it repeated; if you have stainless steel hardware, make certain that it is disinfected daily, especially in critical-care areas.”

Unfortunately, almost no one took her advice. Stainless steel is easy to clean and has a shiny appearance. It makes hospitals look impressive, but it has zero anti-microbial properties. In the post-coronavirus era, that won’t fly.

Surface spread certainly contributed to the current pandemic. The U.S. Centers for Disease Control issued strict hand-washing directions, due to the coronavirus’ ability to linger on some surfaces. Copper surfaces and copper plating could solve that problem.

One change, going forward, will be swapping brass for steel surfaces and microprinting copper on metal touch surfaces.

Hospitals don’t even need to do a whole overhaul of their countertops. A small Australian company, Spee3D, plans to 3D print copper onto metallic surfaces. Testing shows that just adding copper kills 96% of the COVID-19 virus in just two hours.

But this revolution isn’t the only spike in demand we’re going to see for copper. The green revolution and electric vehicles (EVs) are on the horizon. And they’re going to bring a wave of copper demand with them…

Copper Is the “Do Everything” Metal

In 2019, the copper market looked strong and about to get stronger.

Market analyst Fitch Solutions projected demand growth from 23.6 million metric tons in 2018 to nearly 30 million metric tons by 2027. To put that in perspective, the world’s largest copper mine, Escondida, produced 1.2 million metric tons in 2018. In order to meet that growth, we need to add more than five new Escondida’s in the next seven years.

It’s impossible.

But copper supply can’t keep up with that kind of demand. Too many new technologies need copper … a lot of copper. Just the changes to electrical demand will require much more copper.

Green energy, EVs and large scale batteries all project huge growth and huge copper demand. Remember, a lithium-ion battery should be called a copper-lithium battery, because of how much copper is in them. And it isn’t just the batteries.

The generators used in EVs and green energy use massive amounts of copper.

For example, a megawatt of wind power needs nine metric tons of copper. According to the Federal Energy Regulatory Commission (FERC), wind power in the U.S. will grow by 27,128 megawatts by 2022.

Solar power uses 5.5 tons of copper per megawatt. And the FERC forecast is 16,303 megawatts of new solar power by 2022.

That’s just in the U.S.

Around the world, EV sales will add another 75,000 tons of demand by 2023.

The list is long … but with emerging demand for copper surfaces thrown in as well, demand could climb much higher. If we look out to 2030, the world needs 10 times the amount of copper it produced in 2018.

The problem is, there just isn’t enough new copper in mines to meet that need. That’s why I expect copper prices to do what every price does when demand exceeds supply — go up.

As you can see from the chart below, copper prices are well below their 2011 highs today:

The current price doesn’t reflect the coming demand surges. And the lack of new mines (supply) isn’t being factored either. That’s great news for the few of us paying attention to the sector.

It’s too cheap today, and that’s your opportunity. In my Real Wealth Strategist newsletter, I let my readers know exactly how to play the coming spike in copper demand. We have identified the best copper suppliers. We know these companies’ existing production will soar in value. And we know their future production will be worth far more than it gets credit for today.

So, you could go out and buy a handful of copper miners to play this trend. But if you want the best copper miners for new investment today, stay tuned. We’re finalizing a presentation that we plan to send you very soon.

Good investing,

Editor, Real Wealth Strategist

P.S. Another metal could soon experience the greatest supply crunch in history … an event that could launch its price to levels never seen before, which could send the stock of certain mines soaring. Read about this opportunity here…