Right now, everyone seems to be focusing on the race to develop a COVID-19 vaccine.

However, our other health problems … heart disease, cancer, respiratory diseases … haven’t gone away.

The Centers of Disease Control and Prevention estimates that more than 1 million Americans die from those three ailments alone every year.

Fortunately, there are pharmaceutical companies working hard throughout the pandemic to develop new treatments for a variety of health issues.

One of these companies is Bristol-Myers Squibb Co. (NYSE: BMY), headquartered in New York City.

The pharma giant received approval from the Food and Drug Administration (FDA) on May 15 to start selling a drug combination used to treat lung cancer.

And in March, the FDA approved BMY’s treatment for multiple sclerosis, a disease that afflicts nearly 1 million people in the U.S.

This is just the beginning, though. BMY has more than 50 new drugs in development as I write this.

That’s why I asked Brian Christopher to share his thoughts on what to expect going forward for this innovative company.

Brian recommended BMY in May 2018, then recommended it again in August 2019. So, he knows what he’s talking about.

It’s Time to Profit From BMY’s V-Shaped Recovery

By Brian Christopher

BMY did the deal to create an “innovative biopharma leader … that will drive sustainable growth.”

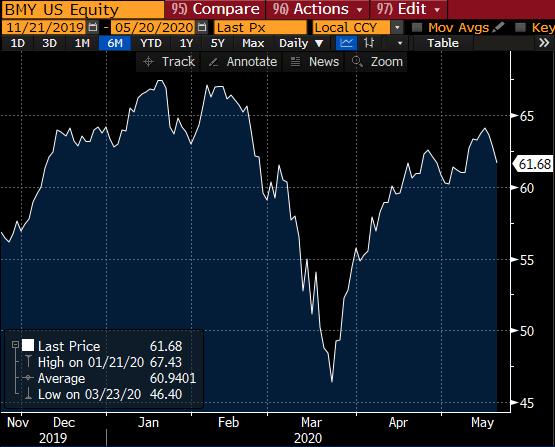

After closing, shares surged nearly 19% to a late-January high:

BMY Is Almost Back to Its January High

Then it got caught up in COVID-19.

Since BMY bottomed in late March, though, its shares saw a “V-shaped” recovery within $6 of its high this year.

Bristol’s second quarter will be weaker than normal. And management cut 2020 sales guidance by 1.2% in its most recent earnings call.

But going forward, it has a solid pipeline of products.

Overall, analysts expect sales will grow by more than $15 billion — or 60% — in the first full year of the merger with Celgene.

In our previous two purchases of BMY we made an average return of 32%, including dividends.

This year isn’t normal for the company. But it’s a $140 billion powerhouse now.

Shares should rise to $70 over the next year. That would give us a 15%-plus return with BMY’s 3% dividend.

— Brian

If you’re interested in other opportunities to profit from the biotech boom, I highly suggest you check out Jeff Yastine’s presentation on the stock that’s revolutionizing health care as we know it.

And even better — it’s drastically undervalued, trading beneath $5 as I write this.

For all the details, click here.

Regards,

Assistant Managing Editor, Banyan Hill Publishing