The stock market sold off in the past two weeks. From high to low, the S&P 500 Index dropped about 7.8%. Now investors wonder if this is a pullback or the beginning of a bear market.

A pullback is a decline of at least 10%. Bear markets are 20% declines.

Of course, we don’t know if the bear market started yet. We only know that after prices fall 20%.

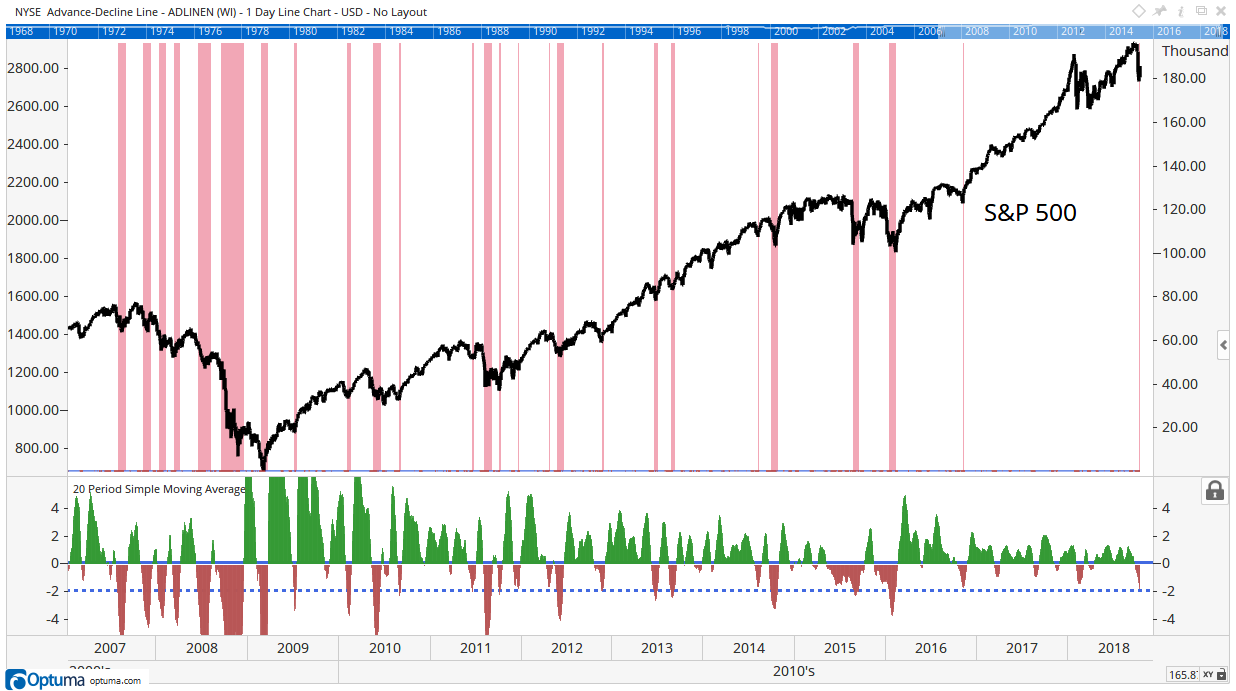

But we do know the decline isn’t over. That’s based on the chart below. This is a complex chart, so I’ll explain it in detail.

Red bars at the top highlight times like we see now. Those are times when the advance-decline line (ADL) is falling rapidly. The ADL’s rate of change just reached its critical level.

The advance decline line counts how many stocks are moving up or down. When the line falls quickly, that indicates many stocks abruptly shifted from uptrends to downtrends. The momentum of that change generally pushes prices down.

The rate of change of the ADL reached this level 25 times in the past 12 years. And there was more downside in 21 of those cases. That means there is an 84% probability of lower prices in the S&P 500 right now.

This is just one indicator. But many indicators are pointing to additional downsides.

It is possible this was just a brief sell-off. But the Advance decline line doesn’t react like this to brief sell-offs. The ADL tells us there’s something significant going on in the stock market – like a potential bear market.

There is good news, even if this is the start of the bear market.

Prices never move straight up or down. There will be brief upturns even in bear markets.

The next upturn could be a chance to close out positions before the bear market destroys significant wealth.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader