Holidays are a time to celebrate or commemorate an important event. But for consumers, it’s also a time to break out the wallet.

Retailers count on holidays to generate big sales figures. Black Friday following Thanksgiving has become an annual tradition.

But for car dealerships, Labor Day may be the most important day of the year. It’s when the auto industry runs huge sales to blow out inventory and clear space for new model year vehicles.

However, car buyers were likely disappointed this weekend. That’s because there’s a massive shortage of products to sell.

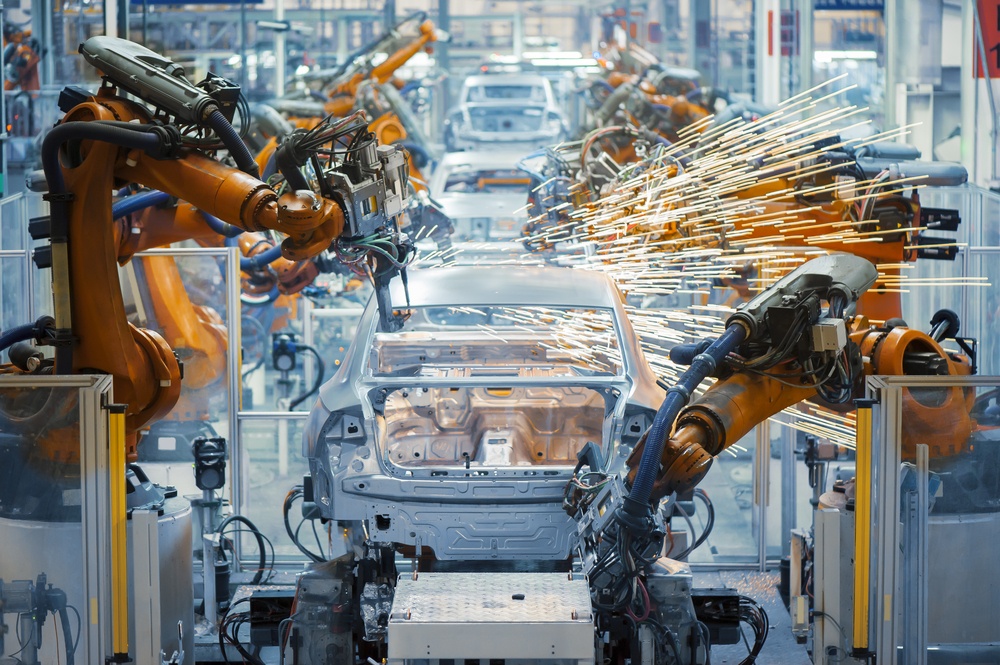

Vehicle inventories across the U.S. are depleted, mainly because of an ongoing semiconductor shortage to power electronic systems. So major producers such as GM and Ford have been forced to cut back production and are stockpiling unfinished vehicles.

Just check out this picture from The Wall Street Journal of nearly finished Ford F-150s waiting for one key component … chips!

But it’s not just auto manufacturers feeling the pain. Supply chain disruptions are limiting output and sales across many industries.

It’s one major factor that’s holding back the recovery, and it’s of paramount importance to stocks.

Here’s why.

Earnings Growth Is Driving the Gains

In 2020, valuations drove the recovery in the stock market. Investors were willing to pay a higher multiple for earnings as they priced in a sharp recovery.

This year, earnings have been driving the gains.

Just check out this graph from JPMorgan:

car

(Click here to view larger image.)

All the gains in the S&P 500 have come from earnings growth this year, while valuations have pulled back from their highs.

With stock valuations still hovering near peak levels, more earnings growth is needed to keep driving stocks higher … just like we’ve seen this year.

But supply chain issues are threatening the outlook and are creating a new class of “haves” versus “have-nots” in the stock market.

Companies that aren’t constrained by shipping delays or component shortages are being rewarded, and there’s one industry in particular that has benefited.

Find the “Haves” in the Digital Economy

Technology firms that deliver “software as a service” (SaaS) aren’t facing the same headwinds as companies that deliver physical goods. Their product consists of computer code, so a missing component or shipping delay doesn’t impact their ability to meet demand.

In recent financial releases, many companies in this industry reported blowout earnings and increased guidance for future sales and profits. Rising share prices have been their reward.

One way to tap into this space is with the Global X Cloud Computing ETF (Nasdaq: CLOU).

But be careful.

Many stocks in the SaaS sector are the very ones seeing dizzying valuations. You must be selective about which companies have the long-term potential to grow into their valuations and avoid the “growth traps” that Ted discussed in Friday’s Bauman Daily video.

Best regards,

Clint Lee

Research Analyst, The Bauman Letter