Heads Or Tails For Crypto COIN Flips?

Great Ones, it’s time to address the elephant in the room.

Which one, man?! The room is full of elephants right now!

I hear you. It’s ugly out there.

More specifically, back on January 5, Great Stuff recommended buying Coinbase (Nasdaq: COIN). That position is now down some 30% … along with the rest of the cryptocurrency market. In fact, Bitcoin (BTC) fell more than 20% last week, while Ethereum (ETH) dropped roughly 30%.

Suffice it to say, the crypto market isn’t all that pretty right now.

The biggest reason for crypto’s recent staggering weakness is that Wall Street is in “risk-off” mode. What this means is that any asset even remotely tied to “growth” is getting hammered … which includes cryptocurrencies and Coinbase stock.

Furthermore, there are at least two other drivers for crypto’s sharp decline.

The first is that Russia’s central bank is calling for a ban on using and mining cryptocurrencies. While Russia isn’t a major player in the crypto market, it did become a major player in crypto mining after China banned the practice.

The second is that the U.S. Federal Reserve just released its “white paper” on central bank digital currencies (CBDCs).

According to the paper: “The Federal Reserve’s initial analysis suggests that a potential U.S. CBDC, if one were created, would best serve the needs of the United States by being privacy-protected, intermediated, widely transferable and identity-verified.”

This is standard fare for most cryptocurrencies. But crypto traders are worried that an official U.S. dollar-based crypto would not only undermine current cryptocurrencies but make them either illegal or severely regulated.

It’s an understandable panic, but there was one tidbit in the Fed’s white paper that leads me to not worry all that much:

Clear support? From both the U.S. president and Congress? Ha. Good luck getting that. They can’t even agree on how to preserve democracy, let alone agree on cryptocurrencies.

At the center of all of this rigmarole is Coinbase — you know, the stock Great Stuff Picks recommended?

Coinbase is a crypto exchange. It’s crypto coin agnostic. The company just needs people to trade on its crypto exchange … and people are doing that in droves this quarter. Granted, the trading isn’t bullish. But it’s still trading, meaning that Coinbase is making money since it gets most of its revenue from transactions.

Now, there are two ways this crypto situation could end.

It could end with the U.S. government banning or severely restricting crypto in lieu of launching its own CBDC. This is the crypto market’s biggest fear. But I don’t see this happening, as there is way too much money and too many big-time players tied up in the crypto market.

I mean, the same banks that the Federal Reserve wants to handle any official U.S. CBDC are the ones snapping up bitcoin and Ethereum and offering dedicated (and very expensive) investment advice on cryptocurrencies.

However, the way I believe the crypto situation is gonna play out is the way it played out before.

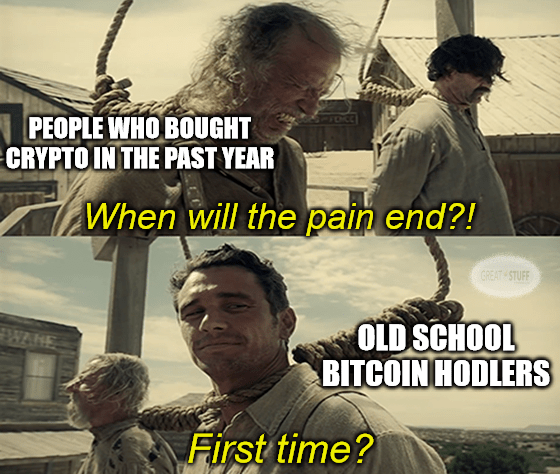

Bitcoin hodlers and long-term crypto investors are all too familiar with today’s crypto action. After all, cryptocurrencies have “crashed” at least three times before, and each time, the mainstream financial news has touted the “end of times!” for cryptocurrencies.

As my therapist likes to say: “This too shall pass.” And it will. Bitcoin, Ethereum … and Coinbase will all come back.

The only way they won’t come back is if the U.S. government bans cryptocurrencies. And the only way they’d even consider doing that — in my opinion — is if they launch one of their own. And to do that, they’d need Congress and the president to agree on something for the first time in, like, 50 years.

To sum things up, I don’t think crypto is going anywhere — legally speaking. All this panic is pushing prices down artificially. Cryptos will rebound eventually, but this will be a bumpy ride.

And as for Coinbase? The company is making money off crypto transactions as we speak, and it will make more money off crypto transactions when the rebound comes.

Great Stuff’s COIN stock recommendation was based on a long-term outlook, not a short-term reactionary investment. As such, we will hold COIN stock amid this broad-market insanity, and I even recommend adding to your position at these prices if you have the available capital.

But I get it. Holding COIN stock might be too painful for some portfolios. Always take care of yourselves first, Great Ones. If you don’t, no one else will.

If you need to sell COIN stock … then do what’s right for your portfolio and your investment strategies.

On the other hand, if the crypto crash has you looking at bitcoin like a bargain shopper eyes the clearance rack … you’ll want to hear what Paul has to say:

You heard the man! For the complete details on Paul’s crypto capers, just click this link.

Going: Snap Out Of It

Snapchat parent Snap (NYSE: SNAP) stumbled on a Wedbush downgrade this morning, which stomped SNAP stock down from market outperform to market neutral.

The reason for the downgrade? Surprise … it’s rival social media time killer TikTok.

According to the investment firm: “TikTok’s audience is the most similar to Snap’s, which means it puts both Snap’s engagement/time spent and ad dollars at risk.”

You see, Snap’s primary audience is people ages 13 to 34 years old, which is roughly the same as TikTok’s demographic … minus all the dads out there who started using TikTok to keep an eye on their kids. (That’s my story … and I’m sticking to it.)

The problem is that Snap is the social media app for young people that never really caught on, at least from a monetization point of view.

And by the time the company figures out how to make money off its Gen Z user base, TikTok will have already pushed Snap out the door … if Apple’s (Nasdaq: AAPL) advertising headwinds haven’t done that already.

This monetization meltdown is the main reason I’ve never been jazzed enough about Snapchat to recommend SNAP to Great Stuff readers. But then again, there aren’t too many social media stocks I would recommend right now.

Instead, I’m more focused on the tech that’s helping to power today’s leading social media moguls.

Ian King says that without this one critical component, nearly every modern-day tech convenience we’ve come to rely on wouldn’t be able to function properly … and heaven forbid we lose our social media escapisms.

Click here to learn more about it.

Going: Peloton Gets A Paddlin’

Just when you start to think things couldn’t possibly get any worse for the people over at Peloton (Nasdaq: PTON), in walks activist investor Blackwells Capital like an unwanted Undertaker.

Blackwells Capital, which owns about 5% of Peloton’s overall shares, has come up with a grand idea to get PTON stock back on the right bike path, so to speak: Fire Chief Executive John Foley and sell the company to someone who knows what they’re doing:

For once, I couldn’t agree more.

I’ve said this before, and I’ll say it again: Peloton isn’t a company — it’s a product. And with the help of a much larger company that has a proven track record of success, it might even become a successful product … time and takeover targets willing.

I mean, PTON stock has fallen more than 80% in the last year and now trades for a measly $26 per share. If that’s not a bargain buyout price, I don’t know what is.

What do you think, Great Ones? Is Peloton past its prime? Will another company swoop in and save this sinking ship … and if so, who do you think it will be? Let me know: GreatStuffToday@BanyanHill.com.

Gone: Canary In A Kohl’s Mine

If certain department-store suitors get their way, Kohl’s (NYSE: KSS) might soon find itself under new supreme leadership.

I say “might” because Kohl’s has been the apple of many an acquirer’s eye this past year, though it has yet to accept anyone’s hand in merchandising bliss.

But with two different investment firms vying for the sleepy suburbanite storefront, maybe one of Kohl’s latest admirers will finally seal the deal.

The first of Kohl’s beaus is private equity firm Sycamore, which offered to buy the retailer at $65 per share — a 39% premium to where KSS stock traded when the market opened this morning. Sycamore’s offer came just two days after Acacia Research, backed by activist investor Starboard Value, put a bid in to buy Kohl’s at $64 a share.

Whether that dollar difference is enough to sway Kohl’s in Sycamore’s direction remains to be seen. But either way, that’s plenty of Kohl’s Cash for the company to play with.

Now, while Kohl’s has sworn up and down that it “will determine the course of action that it believes is in the best interest of the company and its shareholders,” I can’t see an acquisition as anything but good for Kohl’s investors … and bad for Kohl’s customers.

After all, the best way for either Sycamore or Acacia Research to boost shareholder value above and beyond Kohl’s own efforts is to break up the company and sell it for parts.

If that happens, the mall retailer we all know and tolerate will inevitably cease to exist … at least in its present form. And then where will I go to get marked-down department store digs? Macy’s (NYSE: M)? Meh.

The time is nigh, Great Ones. Yesterday’s prophecy has come true — the biggest week in earnings is overdue!

Never have I ever seen a week so packed with Dow delights and Nasdaq nuggets (well, except for last earnings season).

An array of airlines, some insurance stalwarts and a cache of chipmakers and consumer goods companies — just marvel at this week’s earnings confessional lineup, courtesy of Earnings Whispers on Twitter:

All you Great Stuff Picks investors out there already know what we’re looking at this week: NextEra Energy (NYSE: NEE) and Boeing (NYSE: BA) … in that order, obviously.

This month’s sell-off hasn’t been kind to NextEra, which is one of your many ways in on the new energy hoopla (it’s kinda in the name), which makes NEE’s report that much more of a must-watch.

Boeing ramped up product deliveries all through 2021, and if earnings are as glowing as the deliveries it teased, Wall Street might finally have to admit that Boeing’s business is booming. As such, Boeing decided to kick the week off with some hype about *checks notes* air taxis!

Self-flying cars? Maybe the Jetsons didn’t lie to me after all…

Come Thursday, we’re off to Sherwood Forest to check in on Robinhood’s (Nasdaq: HOOD) band of not-so-merry men. And if you thought the trading volatility was lucrative for the likes of Coinbase, oof, let’s see how much bank Robinhood’s skimmed off its users last quarter.

And who could forget ol’ Apple (Nasdaq: AAPL) in the lineup? Granted, it’s been literally forever since Apple’s reports were worth waking up for if you’re not an Apple fanboy or AAPL perma bull … but let us know if you’re looking forward to the iCompany’s iReport.

Last (and probably least) is Intel (Nasdaq: INTC), which we might cut a break given the fact it’s actually trying to boost its production capabilities … a few years too late. Oh, who am I kidding — if Intel’s earnings are anything like its past shortfalls, well, let the meme-slinging begin.

Are you not gonna mention Tesla, or…?

Ugh, fine. But don’t say we’re talking about Musk and company too much when Tesla (Nasdaq: TSLA) drops its report this week. Because y’all know it’s only a matter of time before we have to talk about Wall Street’s reaction to Tesla’s earnings, and Elon’s reaction to the Street’s reaction, and the Street’s reaction to — you get the idea.

What reports are you looking forward to most this week? Let me know in the inbox if any of your personal picks are entering the earnings confessional.

GreatStuffToday@BanyanHill.com is your one-stop shop for hot takes and spit takes, earnings trades and options plays, rants, raves, questions … and everything in between. Come join in the fun for Friday’s edition of Reader Feedback!

In the meantime, here’s where you can find our other junk — erm, I mean where you can check out some more Greatness:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Until next time, stay Great!

Regards,

Joseph Hargett

Editor, Great Stuff