Handle the Market With Care

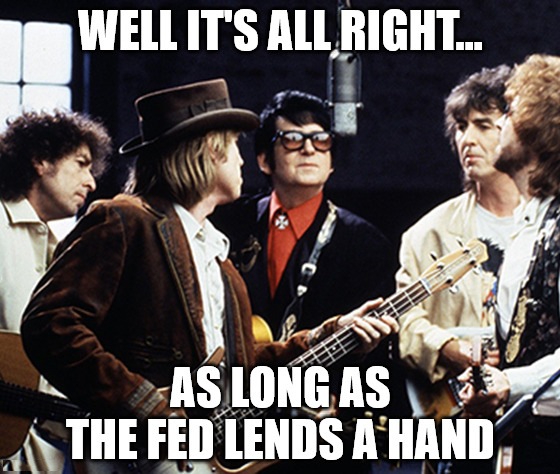

Well it’s all right, trading around in the breeze. Well it’s all right, you can trade however you please.

Well it’s all right, doing the best you can. Well it’s all right, as long as the Fed lends a hand.

That really is the key to this market rally, isn’t it?

Over the weekend, several analysts and research firms came out to push an overall bullish take on the market — and the U.S. Federal Reserve was there, at the end of the line.

UBS cited the Fed’s “unambiguous” support of the market in its bullish take. In comments to MarketWatch, UBS Chief Investment Officer Mark Haefele said that the “Fed story” would win out in the end over the second-wave story and the U.S. election story.

Elsewhere, Evercore ISI’s Dennis DeBusschere pushed the idea of a “sharp rebound” in the market … but that American investors could lose their nerve due to near-term “violently flat markets.” Now that’s an accurate description if I’ve ever read one — violently flat markets.

The overreaching story here, dear reader, is that the U.S. economy will continue to struggle. It’s been stuck in airports, terrorized. Sent to meetings, hypnotized. Overexposed, commercialized.

But, since the Fed backstops literally everything under the sun, investors aren’t handling the market with care. (Yes, I switched songs. It’s still the Traveling Wilburys. Deal with it.)

As both Evercore and UBS accurately noted, investors don’t have to take care. The Fed has it covered.

But I don’t believe that, and neither do you. And, if we’re being real, neither do UBS, Evercore or Wall Street as a whole. It’s why we continue to see violently flat markets.

We’re being sold a V-shaped recovery, when, in reality, we’re probably getting a “W” regardless of what the Fed does. Why? Just look at the rising daily COVID-19 infection rates. This situation will come to a head sooner or later. It has to.

But even if you completely believe in the V-shaped recovery that UBS and Evercore pitched, you should still plan for a W.

If you don’t believe me, believe White House trade adviser Peter Navarro: “We don’t necessarily expect a second wave but prudence dictates that we plan for it. There is no contradiction.”

See? Even the ever-bullish White House plans for things to take another dip. It’s just common sense.

I know you’ve been beat-up and battered around. You’ve been sent-up, and you’ve been shot down.

Just remember that Great Stuff is the best thing that you’ve ever found … handle this market with care!

Editor’s Note: Everybody’s got somebody to lean on. With the right trading strategy, you can shrug off volatility and dream on.

That’s why Mike Carr developed his One Trade strategy. With it, you can make one trade on one single investment every week, targeting 100% returns every time you trade it. Last week, Mike closed out a trade for a 105% gain, but readers wrote in to say they made 100%, 292%, 338%, 412% … and even 650%!

Click here to learn more about the One Trade you need.

The Good: Learning to Fly

NASA astronauts want to learn to fly. The only problem is that they ain’t got wings. Well … they do, but that doesn’t fit the song lyrics does it?

To get those wings, NASA just signed a deal with Virgin Galactic Holdings Inc. (NYSE: SPCE). I bet you expected a Red Bull joke here, right?

Under the Space Act Agreement, Virgin Galactic will “develop a new private orbital astronaut readiness program” designed to train passengers for trips to the International Space Station. The deal is huge for Virgin, as it allows the company to leverage its space tourism model and branch out.

“We are excited to partner with NASA on this private orbital spaceflight program, which will not only allow us to use our spaceflight platform, but also offer our space training infrastructure to NASA and other agencies,” Virgin Galactic CEO George Whitesides said.

Luckily for Virgin, you don’t have to have actually flown into space to train astronauts. The highest a Virgin craft has flown is 55.9 miles. The official international definition for space starts at 62 miles. Just saying.

Investors began the day sending SPCE into the great wide open, but the shares’ gains moderated by the close. It looks like the $17.50-$18 area will hold the stock in check for a bit longer.

The Bad: Leaving on a Debt Plane

The “Great Reopening” and Congressional bailouts apparently weren’t enough for the airline industry.

Today, American Airlines Group Inc. (Nasdaq: AAL) announced a $2 billion junk-debt offering in a move to keep the cash flowing and the company flying. The debt offering is part of American’s $3.5 billion financing plan, one that includes selling $750 million in new AAL shares.

Additionally, United Airlines Holdings Inc. (Nasdaq: UAL) will reportedly launch its own debt offering.

Per people who shall not be named (due to the private nature of the talks), United is working with Goldman Sachs to sell $5 billion in new debt. Both parties declined to comment on the report.

The news underscores the troubles still plaguing airlines despite the economic reopening.

Wait … new debt offerings right after the Federal Reserve said it will buy corporate debt? Coincidence? I think not.

The Ugly: Wanna Bet?

Sports betting company — and purveyor of annoying online pop-up ads — DraftKings Inc. (Nasdaq: DKNG) was quite the speculative bet early this morning. DKNG shares initially surged higher after Jefferies initiated coverage on the stock with a buy rating and a $55 price target.

According to Jefferies, DraftKings is “best positioned to capitalize” on soaring demand for digital sports betting. “We expect that post-COVID, the engagement with digital leisure, the pent-up appetite for sports and political realities should position DraftKings to accel,” Analyst David Katz said in a research note.

I really want to agree with Katz’ analysis of DKNG. I just have two small, teeny-weenie problems:

- There are practically no sports to bet on right now. Yes, there are plans to bring back the NFL, NHL, MLB, etcetera. But, by and large, no one’s playing anything. So, while there’s plenty of pent-up demand, when that demand will be unleashed remains to be seen.

- Will those gamblers come back after getting a taste of market trading? Barstool Sports Founder Dave Portnoy famously quipped that “I’m just printing money” by trading stocks. Have these sports gamblers found a new addiction? Will they come back to sports when the games resume?

That’s the ugly truth to investing in DraftKings right now. Yes, the company is probably the best sports betting investment on Wall Street right now. But when can customers start gambling in earnest again? And will they put down their Robinhood accounts to do so?

Today’s Chart of the Week comes courtesy of The New York Times, reporting on a cracking cheese squeeze, Gromit! This week, we’re talking about the Feta freak-out … the Wensleydale Wipeout. Cheese prices, people.

Now, we don’t often cover the commodities market here in Great Stuff. Honestly, outside of the occasional oil field day — anyone remember negative oil prices? — things can get a bit tedious at the Chicago Mercantile Exchange.

Your average day’s trading action is seldom more than corporations, large-scale farmers and industry producers trying to mitigate risk. For example, an airline may hold oil futures as a hedge against fuel costs if prices were to skyrocket.

But after a deep cut in March, the price of cheddar is now pepper jacked up, following a sharp rally that put prices whey over $2 a pound:

What?! $2.50 per pound of cheddar? But my Costco has it for…

These are cheese futures, i.e., the “options on crack” that dairy farmers and other ingredient processors trade to keep the forces of supply and demand a-churning. These daily “spot” prices are for 40-pound blocks of cheddar — the unit upon which all cheese options are priced and based on, from provolone to parmesan.

In the chart, you can see how cheddar prices shot over 160% from their mid-April lows around $1 per pound. Phil Plourd, president of a Wisconsin dairy commodity consulting firm, said what could’ve been our Quote of the Week: “It’s the most volatility that we’ve seen in the cheese market ever … if there was a cheese VIX index, it would have been spiking.”

The VIX, as regular Cheese Stuff readers know, is the index that relates market volatility. This time, the Romano Rally predated the VIX’s mid-June spike by about two or three trading days., which leads me to fantasize about cheese futures as a predictor of market volatility.

Now, I’m not saying we should use cheese commodities to time the market, but I’m not discarding the idea of a Brie Barometer either…

Great Stuff: Dairy Goes Again…

I hope you’re ready for another week of stock memes and groan-worthy market jokes. Me? I’ve got my phasers set to “pun,” and you’re on the receiving end, my friend!

Thank you for tuning in today. If you haven’t already, take a second to check out the One Trade strategy you need to take advantage of market volatility. Seriously — this one strategy might convince you that your grandpappy’s buy-and-hold stock strategy is dead…

Questions? Comments? Concerns? Send them our way: GreatStuffToday@BanyanHill.com. You can also use our social media to keep track of this ever-slipping time warp: Facebook and Twitter.

Until next time, stay Great!

Regards,

Joseph Hargett

Editor, Great Stuff