Google and Facebook Want Your Money

Despite my robust internet presence, I’m a bit of a privacy nut. Maybe it’s because of my internet presence.

Yes, I know you can find articles I’ve written online dating back to 2006. But stock market articles are about all you’ll find … probably.

(Don’t forget to like and follow Great Stuff on Facebook, Twitter and Instagram!)

More specifically, you won’t find much in the way of my personal information on social media. I keep my presence on those platforms locked down tight with ad blockers, virtual private networks (VPNs) and privacy-based email clients.

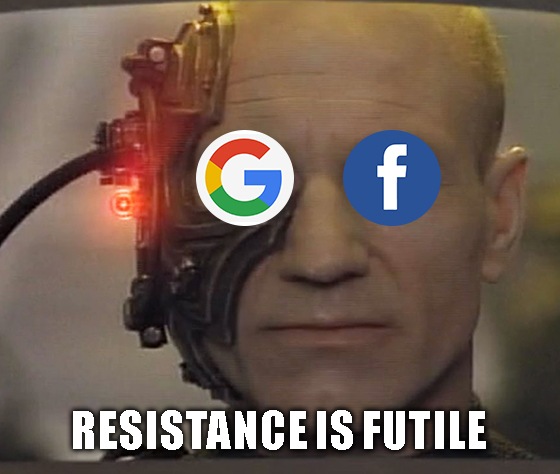

Despite my efforts, I’m sure that both Facebook Inc. (Nasdaq: FB) and Alphabet Inc. (Nasdaq: GOOG) — aka Google — have an uncomfortable amount of information about me.

One thing they will not have, however, is my banking information.

Both Facebook and Google announced this week that they’ll broaden their reach in the financial payments and banking sectors.

Facebook Pay is the company’s answer to the financial technology market. The service will consolidate payments across Facebook, Messenger, Instagram and WhatsApp, allowing users to pay for pretty much anything via Facebook.

Google, meanwhile, will reportedly offer checking accounts next year. According to a report in The Wall Street Journal, the Google checking accounts will be run by Citigroup Inc. (NYSE: C) and the Stanford Federal Credit Union.

The Takeaway:

That’s all the information on both Google checking accounts and Facebook Pay I’m going to give you. There are links above if you want more information.

Why?

Because I don’t believe anyone should use either service.

Facebook already has way too much user information — information that it’ll share with the highest bidder, regardless of your wishes. What’s more, Facebook is far from secure. Cambridge Analytica anyone?

Meanwhile, Google has completely given up its former moniker of “don’t be evil.” The company is gobbling up data like crazy. Google recently acquired wearables-maker Fitbit Inc. (NYSE: FIT) just to gain access to reams of user health data.

The company has also entered a cloud computing deal with Ascension Health that gives Google access to health information on millions of patients. U.S. federal regulators are currently scrutinizing the deal.

If security and data greed wasn’t enough to dissuade you (Seriously, you want to trust Facebook or Google with your banking information after all that?) just take a look at what these companies do when they don’t get their way.

Facebook CEO Mark Zuckerberg went political on Chinese rival TikTok. You may have heard of TikTok, the Chinese video social media company that just hit 8 billion downloads and 1.5 billion monthly users — in a fraction of the time Instagram took to get the same following.

You see, back in 2016, Facebook couldn’t reach a deal to acquire Musical.ly (which became TikTok), so it’s taking its fight to Washington, D.C. Zuckerberg has called TikTok a threat to democracy and accused the platform of censoring content.

Censorship and a threat to democracy? That’s rich coming from Facebook. We’re way beyond “pot meet kettle” here.

And Google? Just like Facebook, Alphabet has so much cash, it can literally afford to pay any fine and not blink an eye. Why pay fines when you can buy the system with record levels of lobbying?

Now, I’m not calling for a boycott of either Facebook or Google. I know full well that’ll never happen. Both are too ingrained in our culture at this point. They’re key platforms for research and staying connected with friends and family.

What I am saying is that you should minimize your exposure to both. Limit what you share. Use a VPN, private email service, secure password system, ad blockers … etc.

And, for God’s sake, don’t let them manage your banking or financial information. Facebook Pay and Google’s checking accounts aren’t a good deal for anyone but Facebook and Google.

Good: Sentimental Marijuana

Welcome to part two of cannabis week here at Great Stuff. Yesterday, we highlighted Cronos Group Inc.’s (Nasdaq: CRON) note that the stock held its ground despite a ho-hum earnings report.

Today we have Tilray Inc. (Nasdaq: TLRY), which finds itself floating in the same stale bong water. The Canadian cannabis company missed earnings expectations by $0.06 per share, though revenue beat by rising fourfold to $51.1 million.

Tilray highlighted its European strength (especially German sales) and talked up 2020 expectations. The company believes it will capture a “sizeable share” of the global cannabis market with gross profit margins of about 50%.

The rosy outlook just barely managed to assuage TLRY investors, who remain focused on supply and distribution concerns.

As with Cronos, Tilray shares should be down a lot more than the 1.4% they shed today. However, sentiment on cannabis firms is so negative that even little positives like German sales are helping to buoy TLRY’s stock.

Better: Luckin Good

Bigger than Starbucks. That’s the projection for upstart Luckin Coffee Inc. (Nasdaq: LK) — in China, at least.

The uncanny caffeine company reported a narrower-than-expected loss of $0.32 per share in the most recent quarter. Wall Street was looking for a loss of $0.37 per share.

What’s more, Luckin saw revenue skyrocket 540% to $215.7 million, as net revenue per store spiked 79.5%. And that even accounts for the number of Luckin locations tripling in the past year!

Luckin projected fourth-quarter revenue above expectations and said that it’s on track to reach its goal of being China’s biggest coffee player by the end of the year.

Specifically, Luckin plans to have more than 4,500 locations by the end of 2019, compared to just 4,125 for Starbucks Corp. (Nasdaq: SBUX).

LK shares have surged more than 12% so far on the news.

Best: Atomic Dog

After blowing out its first quarterly earnings appearance as a publicly traded company, Datadog Inc. (Nasdaq: DDOG) is definitely in the house.

Earnings rose 88% to beat Wall Street projections, and the company’s profit of less than a penny per share was considerably better than the $0.14 loss the consensus expected. Datadog also put current-quarter and full-year guidance well above analyst projections.

“Datadog has established itself as the leading monitoring and analytics platform and we have continued to extend our capabilities during the quarter,” said CEO and co-founder Olivier Pomel.

The cloud software firm is one of the few initial public offerings (IPOs) this year that has outperformed. After today’s post-earnings rally, DDOG traded more than 50% above its IPO price of $27 per share.

I feel a bit of a rant coming on… Full disclosure, I vape. I’m not proud of it, but it is what it is.

The funny thing about those Juul ads aimed at teens? They look a lot like alcohol ads aimed at teens.

I know what you’re thinking: “Whom else are flavors like melon, crème and fruit for if not teens!”

Let me answer that hypothetical question with this: “Whom else is whipped cream, chocolate, melon, fruit, etc. flavored alcohol targeted at, if not teens?”

This argument does not hold water, at all. You don’t stop liking sweets, candy or fruits once you become an adult. It’s a silly argument. Stop using it.

“But what about the health risks and all the people dying of mysterious lung diseases?”

I rebut: What about alcoholism? What about drunk driving?

The fact is, a lot of products on the market pose health risks. Everything from Big Macs, to deep-fried anything to artificial sweeteners (which you know darn well are directly advertised to kids) are bad for you. And yet, these products are not banned. The president isn’t talking about potentially banning Coke or fast food for health risks.

What’s more, both e-cigarettes and alcohol are illegal for teens to purchase. Both clearly target younger consumers — just as many of the products I just listed are. And yet, e-cigarettes are the devil. Alcohol and those other goods are not.

The difference is that those products are socially acceptable, and e-cigarettes are not. We tried prohibition once. It didn’t work. Banning e-cigarettes will not work.

I’m not saying that e-cigarettes don’t have health risks or aren’t bad for you. What I am saying is that teen vaping is not a Juul or e-cigarette problem.

It’s a cultural and regulatory problem that retailers need to take seriously. After all, they’re the ones breaking the law by selling e-cigarettes to minors or adults giving them to minors — not Juul.

Now please let me have my nicotine in peace.

Great Stuff: Trade Smarter, Not Harder

I don’t talk about Banyan Hill expert John Ross here on Great Stuff that often. And that’s a shame.

John has helped literally tens of thousands of independent investors navigate the market. He also co-edits Apex Profit Alert with fellow Banyan Hill alum Matt Badiali — he’s the magic metals guy!

Today, John has a simple trading strategy that can help you make the most of your trading day. After all, time is money, and the smarter you use both, the wealthier you can become.

John is targeting triple-digit gains after identifying a trend in the Indian market. To find out more on this opportunity, read today’s article: A Simple Options Trading Strategy: Make the Most of Your Time & Money.

Or, click below to watch John’s latest video:

Finally, to get the best that John and Matt have to offer, you need to subscribe to Apex Profit Alert. Click here to find out how to get started now!

Until next time, good trading!

Regards,

Joseph Hargett

Great Stuff Managing Editor, Banyan Hill Publishing