The Cost Of Being Chewy

Is there any sweeter sound for an investor than “surprise profit?”

Umm, how about an extra hour of sleeping in? Or another Monday off? Or the phrase “I just made some churros, want any?”

OK, you got me there… If I were a Chewy (NYSE: CHWY) investor, I’d probably take you up on some celebratory churros this morning — and it’s not even 10 yet, sheesh.

(You have your breakfast of champions — I have mine.)

Anyway, what’s the deal with Chewy, the so-called Amazon of Pets? The purveyor of pet products for picky pooches and puddy-tats?

Now you’ve gone full Looney. Cut the Tunes … what’s going on?

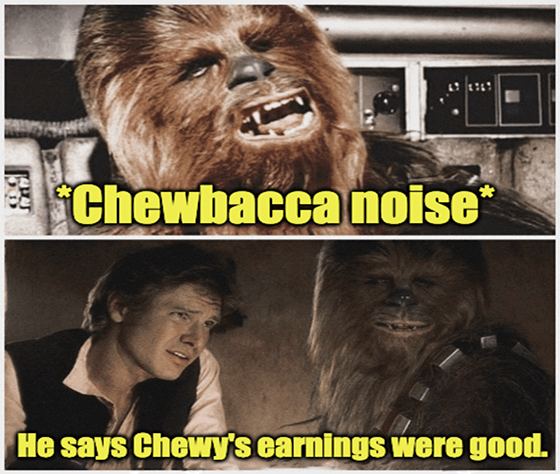

Judging by Chewy’s earnings report, it’s rabbit season … and the season for every other kinda pet too!

Chewy saw a surprise (not the door-to-door evangelical kind) profit of $0.04 per share. And you better believe CHWY investors were counting every one of those four pennies.

The “surprise” part comes in on the analyst side, where Wall Street’s negative Nancies expected a loss of $0.11 per share. Sales barely crept past those analysts’ estimates, but hey, a double beat is still a double beat.

Best of all? Chewy is now selling churros. (OK, that’s a lie and a pipe dream at best — dogs can’t have the obligatory chocolate sauce.)

Wall Street’s worries didn’t stop Chewy from affirming its current-quarter sales estimates — and that’s the real surprise for CHWY investors.

Why? Well, last we checked in on Chewy stock, people were using its nonfood sales as an inflationary gauge. Yeah … you read that right.

As the logic goes, people aren’t buying their pets all that extraneous junk when money is tight. No more cat condos or basketfuls of dog toys — y’all are just getting the usual food, and you’re gonna like it. At least, that’s how the Fluffy Puppy Indicator goes.

Guggenheim Partners Analyst Steven Forbes put it best:

Erm … alright, maybe Forbes didn’t put it best. But somewhere in that crockpot of corporate crock is one simple thing: lower discretionary spending. The average person’s purchasing power is slipping — and fast.

Did you … did you just wake up to this whole “inflation” thing?

No, no, but I point this out for two reasons.

On the one hand, analysts are finally starting to account for consumer sentiment — and how much people are willing to spend with ever-so-inflated prices. But on the other hand … those same analysts are way off on how that churning consumer sentiment turns into earnings.

What do we always say around here? Never underestimate the American consumer’s desire (or compulsion) to overspend!

The jury’s out until earnings season’s finished, but Chewy’s double beat might show that e-commerce isn’t dead. It’s not all that lively, to be sure … but it’s not dead. And it sure isn’t as profitless as analysts expected.

So where is all this analyst fear coming from in the first place? And how does one feel out the fear in the market?

Let me answer that question with another question: Have you heard of the Greed Gauge? No? I thought not. It’s not a story Wall Street would tell you.

It’s the newest stock market indicator from Michael J. Carr, a financial mastermind revered throughout the investing world as one of the top traders in the business.

Whereas the VIX or “fear gauge” can only give you a read of investor fear on the overall market after the fact … the more powerful Greed Gauge can identify the precise levels of investor greed for each stock in the S&P 500 in real time.

In other words, it can tell you when to buy AND sell any stock that you want.

Is it possible to learn this power?

Not from a Jedi…

Lucky for you, Mike just released the full details to the public for the first time ever. In this video, he reveals the exact formula he used to create it — and why the Greed Gauge may be the ultimate trading weapon in the current environment, bear market or otherwise.

To see the unstoppable power of the Greed Gauge in action, click here.

There are only two ways for the Fed to tame rising inflation — and you’re not gonna like either one of them.

1,000% Trades? In THIS Market?!

Using his brand-new 10X Fortunes formula, Adam O’Dell has created a brand-new way to profit from fear and volatility in the stock market. (No options trading — we promise.)

The market doesn’t make mistakes, just happy little accidents. And Mike Carr will teach you how to profit from them.

This Crypto Baron Could Bury Bitcoin

Ian King just revealed his No. 1 crypto play of the year — a coin experts say will become 20X bigger than Bitcoin and mint a new wave of crypto millionaires.

AMC, Paramount & Housing Prices Hit Mach 10

Paramount is revvin’ up its filmmaking engines, listen to her howlin’ roar. With 𝘛𝘰𝘱 𝘎𝘶𝘯 in theaters, AMC and Paramount might be shovin’ into overdrive.

Write to us whenever the market muse calls to you! GreatStuffToday@BanyanHill.com is where you can reach us best.

In the meantime, here’s where you can find our other junk — erm, I mean where you can check out some more Greatness:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Until next time, stay Great!