What’s The Deal With Plug Power?

Plug Power Inc. (Nasdaq: PLUG) is the most exciting renewable energy stock I’ve come across in my 15 years of investing.

That’s a bold statement, I know … especially when you consider that the renewable energy market also includes heavy-hitters like Tesla (Nasdaq: TSLA), QuantumScape (NYSE: QS) and First Solar (Nasdaq: FSLR).

However, if you’re an investor and you don’t already own or plan to buy Plug Power stock, you’re about to miss out on one of the biggest investment opportunities ever. And it’s all because of hydrogen power and fuel cells. Let me explain why…

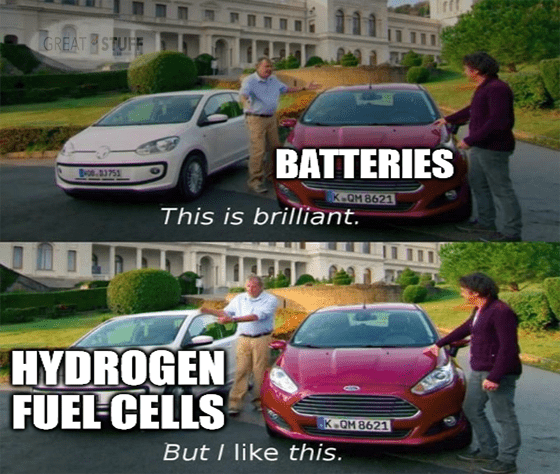

Since Tesla came onto the scene, battery-powered electric vehicles (EV) have been all the rage. But battery-powered EVs are old news at this point.

They’re clunky, need to be plugged in, can take hours to fully charge, put a strain on existing power networks and have limited range.

But hydrogen fuel cells are the new hotness. And Plug Power is a vertically integrated powerhouse of hydrogen energy just waiting for Wall Street to wake up and smell coffee.

The company not only makes hydrogen fuel cells and hydrogen fuel cell accessories — sup, Hank Hill! — it also provides parts and maintenance for fuel cell vehicles and sells service contracts for mobile and stationary fuel cell power plants. Not to mention, Plug also generates, delivers and stores hydrogen fuel.

But, Mr. Great Stuff, why would I want a hydrogen fuel cell powered car?

I’m glad you asked! How about this: Aside from the cost of buying a new car, why aren’t you already driving an EV?

I know, some of you are thinking: “You can have my Ford F-150 when you pry it from my cold dead hands!”

And some of you might also think that this whole green energy thing is a fad. It’s not. 15 countries — including Germany, China, Japan and the U.K. — and 12 U.S. states have all pledged to either ban fossil fuel vehicles or only allow the sale of zero-emission vehicles.

The real reason most people give for not driving an EV is the combination of limited range and charging time. The last thing anyone wants is to be stranded in the middle of nowhere with no way to charge their car.

Plug Power’s hydrogen fuel cells solve that problem. Hydrogen fuel cells work just like EV batteries, except instead of plugging them in and waiting around for hours, you can refuel them at the pump just like any old gas-driven vehicle … but with hydrogen instead of gas, of course.

And it’s not just EVs. Every single piece of equipment, electronics or machinery that requires electricity can make use of hydrogen fuel cells. You want a hydrogen-powered forklift? You got it. Hydrogen-powered lawn mowers? Sure, why not!

Even better? That equipment doesn’t need to be anywhere near an outlet plug or a power grid — leave those extension cords in the gas-powered past. Your gear just needs to be refueled with hydrogen.

OK, I’m starting to see the advantages. But why Plug Power stock?

Well, you could ask Plug Power’s customers, which include Boeing, NASA, BMW, Home Depot, Whole Foods, Amazon, AT&T and CSX. That’s quite the A-list of big-name customers.

But if flashy Fortune 500 customers doesn’t do it for you … how about this? Plug Power saw revenue grow 85% to $169 million in the first half of 2021. That, Great Ones, is impressive growth — and it’ll only get bigger as the industry realizes the ease, power and convenience of hydrogen fuel cells.

Now, some of you — like Great Stuff Picks readers Dick K. and Jeff N. — have grown concerned about PLUG’s decline this year. And rightfully so. Plug Power stock is down about 75% from its January highs. There are two issues behind this massive decline:

- Due to inflation concerns, Wall Street underwent a major shift away from high-growth stocks like Plug Power. Value is now king for many investors.

- Plug Power is in the middle of working through accounting restatements due to how it handled stock warrants and contract sales.

Addressing the first point: As I’ve said before, inflation concerns are overblown. This is a short-term blip in the economy due to the “Great Reopening” from the pandemic. Supply and demand will even out in a quarter or two once supply lines are fully reopened, and we’ll be right back in serious growth mode again.

The second point is also a temporary blip — but it is a big one. Financial restatements make investors very nervous, especially when they come from high-growth companies like Plug Power.

For the record, Plug Power is reassessing its financials because it took advantage of an accounting rule that allowed it “to recognize revenues and gross profits from multi-year sale-and-leaseback refinancing arrangements upfront.”

In other words, Plug Power is rearranging how it accounts for revenue from certain contracts. The restatement isn’t expected to have any material impact on Plug’s cash position or its business operations. Furthermore, according to J.P. Morgan Analyst Paul Coster, Plug Power’s financial restatement “should draw a line under the uncertainty associated with the accounting issues.”

So, once Plug Power clears the air on its financial restatement — which is expected to happen soon — all the uncertainty surrounding this issue will evaporate and Plug Power stock can once again trade without all this baggage.

Now’s The Time To PLUG In!

Great Ones, I’ve saved the best for last. There’s a big reason why now is the best time to buy PLUG stock if you don’t already own it or if you want to add to your existing position.

Bear with me, this gets a bit interesting … and it involves implied volatility.

Now, implied volatility is a critical part of pricing options. Don’t let that word scare you. In layman’s terms, when implied volatility rises, it means that options traders expect a move in the underlying stock. That move could be up or down … but the higher implied volatility goes, the bigger the expected move.

Last week, implied volatility on several Plug Power options hit impressive highs. On Thursday, the June $30 PLUG call option, which rises in value when PLUG stock rises, had some of the highest implied volatility of all options traded that day. What’s more, implied volatility has remained extremely high on all of PLUG’s call options.

What this means is that PLUG’s options traders are pricing in a big move in the stock. Given that we’re talking about call options — bets that the stock will rise — that move should be to the upside. Combine this with the fact that PLUG stock has been oversold since the beginning of May, and we have a very bullish setup.

You lost me somewhere around “pricing options,” Mr. Great Stuff. Come again?

Let me spell this out more clearly: Plug Power’s stock is on the verge of ending its painful decline and is about to reverse sharply higher. And the catalyst for this move will likely be the company’s financial restatement.

For those Great Stuff Picks readers already holding PLUG, this is welcome news. You guys are already up between 48% and 59%, depending on when you got in.

And it’s only going to get better from here. If you’re not already holding PLUG shares, well, save that for your Monday to-do list!

But for right now? If you’re not ready to take the plunge into the hydrogen high life — it’s OK. I don’t necessarily get why … but it’s OK! We’ve got all y’all die-hard battery fans covered too. Your action to take is clicking right here.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff