Mayer Amschel Rothschild (1744-1812), founder of the Rothschild fortune, opened his famous German bank in the 1760s. From 1815 to 1914, it was the world’s largest bank.

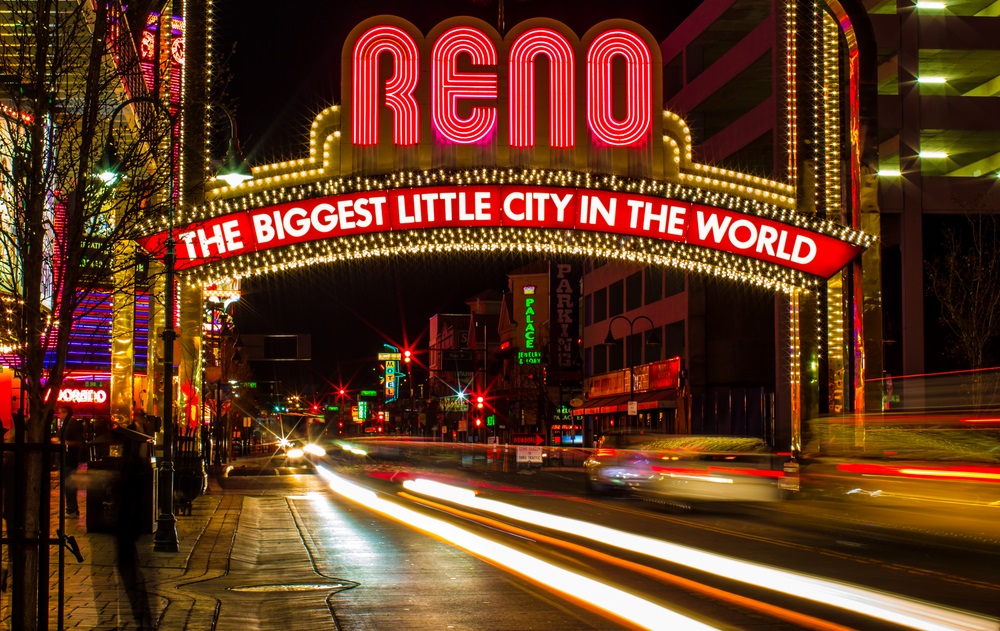

Today, based in London, Rothschild & Co. manages $21 billion in assets, with offices in nine leading offshore financial centers — and in Reno, Nevada!

Why, you might ask, would Rothschild, with over 650 wealthy clients, each averaging $6.4 million in investible assets, have an office in the gambling mecca of Reno, of all places?

For the same reason that in Cheyenne, Wyoming, a small brick house, wedged between a Greek Orthodox church and a rundown barbershop, has been described as “a little Cayman Island on the Great Plains.”

The explanation behind these unlikely locations reveals something else: how and why the anti-offshore crowd of high-tax, deficit-spending politicians are trying to smear Delaware, Nevada, Wyoming and South Dakota as international money laundering centers.

A Dirty War for Your Money

Governments of the major high-tax, high-deficit nations — especially the United States, Germany and France — along with the Organisation for Economic Co-operation and Development and allied leftist groups have waged war on legitimate offshore financial and banking jurisdictions worldwide for the last two decades. “Tax havens are evil” is the drumbeat.

Desperate tax collectors trying to finance multitrillions in official sovereign debt — the U.S. owes nearly $20 trillion — successfully redefined “tax havens” and “offshore” as a dark world of tax evasion, drug dealers, dirty money and political corruption.

Personal privacy and financial freedom suffered greatly. Examples of this include the so-called Patriot Act and the Foreign Account Tax Compliance Act that have given the IRS secret access to every American’s financial affairs.

U.S. and international advocates of Big Brother government righteously have done their best to equate financial privacy with crime; ergo, there is no right to privacy that hides crime. Instead of individual prosecutions, everyone is presumed to be crooks.

A major official justification for destroying your individual privacy has been combating “money laundering,” loosely defined as concealing sources of illegally obtained money by using foreign banks or legitimate businesses to cover crimes.

The result after 20 years has been a global system of total automatic tax information exchange among nations that begins in 2018. The Automatic Exchange of Information (AEOI) standard requires automatic sharing of foreign bank account information of citizens of over 100 countries. Switzerland has just signed on.

Attacks on Your Privacy

AEOI has abolished bank secrecy, but even that’s not enough. Now comes the latest round in the anti-privacy war: the demand for a radical change in American state corporation laws, especially in “easy incorporation” states such as Delaware, Nevada, Wyoming and South Dakota, where officials support privacy over unlimited transparency. That demand includes a national registry identifying true owners of companies registered anywhere in the U.S., like the United Kingdom’s central online register of companies.

Reportedly, billions in cash have already flowed into the U.S., where states are competing for a share of the offshore business. One-third of top-end property purchases in major American cities are suspect, according to the Financial Crimes Enforcement Network, the U.S. Treasury anti-crime unit. A 2015 study claims that non-U.S. individuals can easily conceal information in the U.S. corporate state system.

That’s why Rothschild opened the office in Reno for superrich clients who aren’t American.

And that little brick house in Wyoming?

It is home to a shell company that owned $72 million in Ukrainian real estate assets connected to Pavlo Lazarenko, the former prime minister of Ukraine, who allegedly stole $200 million during his time in office. Corporate law reformers cite a litany of corrupt foreign officials and others who use American corporations as fronts, including questionable Russian money invested in President Donald Trump’s development projects.

Legal Asset Protection

With the current administration in Washington, and with conservative majorities in most state legislatures, it is unlikely that organized demands for an end to traditional and reasonable American corporate privacy will succeed.

But there is no reason why you can’t take advantage of the same available American state legal entities I have discussed. Ted Bauman tells you how right here.

Yours for liberty,

Bob Bauman, JD

Chairman, Freedom Alliance

P.S. You have many options for protecting your assets from threats, whether it’s our own government or your next-door neighbor. That’s why I’ve recently updated my book, Lawyer-Proof Your Life. Click here to claim your copy now and learn what you can do to safeguard your wealth.