Mr. FOMO Risin’

If you ever needed clear proof that the stock market does not represent the U.S. economy, today provided it.

The U.S. Department of Labor announced that 6.6 million Americans filed for first-time unemployment benefits last week. The latest data bring the total of new claims to more than 16 million for the past three weeks.

That’s 10% of the U.S. workforce gone. Poof. Vanished into the novel coronavirus tainted air.

How did Wall Street react to this economic travesty? With a rally, of course.

But, in Wall Street’s defense, it was distracted by shiny objects — $2.3 trillion worth of shiny objects, to be precise.

To keep investors from looking behind the curtain, the Federal Reserve announced a $2.3 trillion lending package to support the economy. Fed Chairman Oz — er, Jerome Powell declared that the central bank will “provide as much relief and stability as we can.”

You can read all the nitty-gritty details here — including the Fed’s plan to buy junk corporate bonds. (This literally can’t go belly up, right?)

But Powell wasn’t alone in defending the U.S. economy. Treasury Secretary Steven Mnuchin told CNBC’s Squawk on the Street that the U.S. could open back up in May. Mnuchin noted that the Trump administration was doing “everything necessary that American companies and American workers can be open for business and that they have the liquidity that they need to operate their business in the interim.”

The Takeaway:

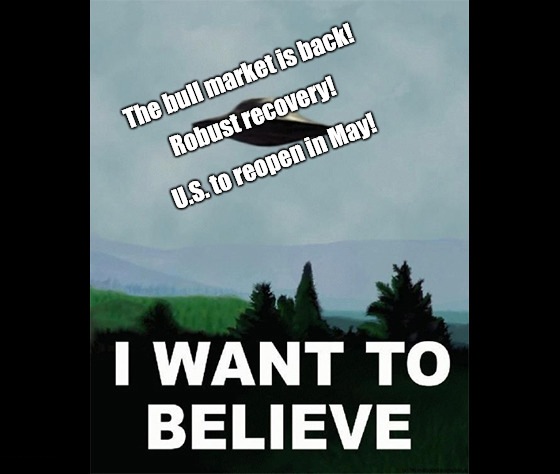

I want to believe, dear readers. I truly do.

I want to believe that, once the COVID-19 threat passes, everything will magically return to normal … that businesses will quickly rehire 16 million Americans and get us all back to work.

I want to believe that the Fed’s $2.3 trillion announcement, the Treasury Secretary’s appearance on a major financial TV show and the revelation of 6.6 million new jobless claims happening on the same day is just a coincidence. (Hint: It’s not.)

I also want to believe that the recent market rally is the start of a new bull market … that there’s no more risk left in the system … and that rainbows and monkeys will fly out of my … well, you get the picture.

Right now, if you’re following Great Stuff’s recommendations, you’re likely experiencing a heavy dose of “fear of missing out,” or FOMO. You’ve got that FOMO risin’. And it’s gonna keep on risin’.

But you and I, we didn’t just get into town about an hour ago. We know which way the wind blows.

We know that the economic bill for the COVID-19 shutdown has to come due sooner or later. Wall Street can ignore weekly jobless claims. It can ignore a trickle of economic data here and there — especially when the Fed chair and the Treasury Secretary are giving stump speeches.

What Wall Street can’t ignore is the flood of bad economic data that’s coming … or the wave of horrendous corporate earnings reports that will follow.

It will be interesting to see how much ammunition the Fed has left when the inevitable comes.

Editor’s Note: With the whole biotech sector screaming “pandemic!” there’s never been a better time to find undiscovered biotech diamonds. Today, expert Jeff Yastine has his eye on one biotech stock that he believes is set to soar. Click here now to learn more!

The Good: Disney Plus Ultra

My wife jokingly refers to The Walt Disney Co. (NYSE: DIS) as a “people trap built by a mouse.” Judging by how crowded the company’s theme parks were before the COVID-19 shutdown, she’s not wrong.

With the launch of Disney+ last year, the mouse now has a digital trap as well. And boy, is it effective. According to Disney, its new streaming service now has 50 million paid subscribers, up from just 28.6 million in February. That’s a 75% jump in roughly two months!

The surprising growth even put the most bullish of analyst projections to shame. JPMorgan Chase & Co. (NYSE: JPM) predicted 40 million subs by the end of 2020. The end of 2020.

Disney is now on pace to easily top its original estimate of 60 million to 90 million Disney+ subscribers by 2024.

What’s more, the service just launched in India in February, and it expanded heavily across Europe in late March. That means more subscriber growth will come this year — especially with launches in Japan, Western Europe and Latin America coming later in 2020.

While Disney+ revenue won’t replace lost park revenue due to COVID-19, it puts the company in a leading position in the streaming market heading into a post-quarantine world.

DIS is high on Great Stuff’s list for a potential buy once things settle down.

The Bad: Not Enough Panic-Buying?

The COVID-19 outbreak was initially illustrated with images of shopping carts filled to the breaking point — mostly with toilet paper. Retailers clearly stood to benefit from the panic-buying, and today, we got a glimpse at one of panic-buyers’ biggest targets: Costco Wholesale Corp. (Nasdaq: COST).

Sales skyrocketed for Costco in March, with same-store sales spiking 12.1% on the month.

But analysts had their hopes set higher … much higher. The average consensus estimate for Costco’s March sales growth sits at 24.1%. So, despite seriously impressive sales growth, Costco still missed expectations.

Furthermore, Costco said that sales of non-essential products, such as electronics and apparel, hurt overall sales figures. Store hours and store closures due to COVID-19 also negatively impacted sales.

Now, if COST stock was down just because it missed some overinflated analyst figures, I’d say the shares are a bargain on today’s sell-off. However, we all know that 12.1% sales growth isn’t sustainable.

This is doubly true when you consider that 16 million Americans have now filed for unemployment. Costco will likely see sales growth decline — slowly due to stimulus efforts, but they will still decline.

In fact, we may have seen the peak for consumer spending this year, and that doesn’t bode well for COST.

The Ugly: Grounded

Airline stocks soared today. Investors likely banked on hopes that the U.S. will be open for business by next month — thanks Mnuchin!

But, if investors think that there won’t be plenty of turbulence ahead, they’re sorely mistaken.

Right now, airlines such as Delta Air Lines Inc. (NYSE: DAL), American Airlines Group Inc. (Nasdaq: AAL) and United Airlines Holdings Inc. (Nasdaq: UAL) are all counting on a government bailout. They’re losing tens of millions of dollars a day due to COVID-19 quarantines and travel bans.

Roughly $29 billion was earmarked for the airline bailout, but none of that cash is flowing. According to reports, the Department of the Treasury is asking for more financial information before letting the spice flow.

In fact, the data requested appear more akin to a loan process than a cash grant application, according to sources.

There are two takeaways here: First, bailout cash for airlines isn’t flowing out right now, and it probably won’t for a while longer. Second, that cash will come with more strings attached than airlines and investors expect.

This isn’t a carte blanche bailout. And with traffic expected to remain low even after the all-clear sounds, airline stocks will certainly get hammered once again.

It’s that time again! Today, we dive headfirst into the Great Stuff inbox and see what you and your fellow readers are pondering this week.

Are you pondering what I’m pondering?

I think so, Mr. Great Stuff, but if they called them “sad meals” no one would buy them.

Let’s get right to it:

Quick Climbs for Fast Times

Just a quick thought- If it’s the fastest time to reach a bear market, what is stopping it from turning into the fastest time to reach a bull market? After the virus issues subside of course. Everything appears to be happening at such a faster pace these days.

— Bill M.

Thank you for sharing your thoughts, Bill! Now, as time has lost all meaning and distinction since my kids started staying home from school, everything’s passing faster and slower at the same time.

Anyway, here’s the one thing that can prevent an even faster leap back into a bull market: uncertainty. It’s a day trader’s delight but an investor’s kryptonite. We just hit 10% unemployment at the end of a supposed “relief rally” that included a 50% Dow retracement.

If that doesn’t scream “uncertainty” ahead, nothing does.

On Idiots and Followers

We have alot of idiots fallowing the leader of the idiots.

— Tom D.

The best part is that I can’t tell which political, economic or health figure you’re talking about … and yet, I’m still strangely inclined to agree with you, Tom.

Crown Castles Made of Sand

Hello. Some of my most recession resistant stocks: AMT and CCI are holding steady … at least so far. Both also pay dividends.

— Brent J.

I want to hark back to an older email, dated March 17. Back in the thick of March madness, we were talking about crash-proof stocks and how to weather the storm.

Don’t worry, I won’t spoil the rest of your ultra secret picks, Brent! (They’re good dogs, Brent! It’s an old meme, sir, but it checks out.) Though, I see you have the 5G trend covered from the cell tower side of things. And I sure hope you held on — if not added to your position!

Both American Tower Corp. (NYSE: AMT) and Crown Castle International Corp. (NYSE: CCI) have already bounced back to February’s pre-devastation levels. If any of you readers out there timed that rebound, nicely done! If not, you might want to wait for more volatility (and oh, it’s a-comin’) to find a better entry price.

(Not sure where to start with investing in 5G? Click here now!)

Thank you to Bill, Tom, Brent and everyone else who wrote in!

Have you written to us yet? If not, what’s stopping you?! We always look forward to hearing your market takes, stock ideas, rants, raves, recipes, conspiracy theories and whatever else you’ve been cooking up while quarantined.

Drop us a line at GreatStuffToday@BanyanHill.com and feel free to speak your mind.

As always, remember that the Great Stuff action never ends. You can also find us on social media: Facebook and Twitter.

Until next time, be Great!

Regards,

Joseph Hargett

Editor, Great Stuff