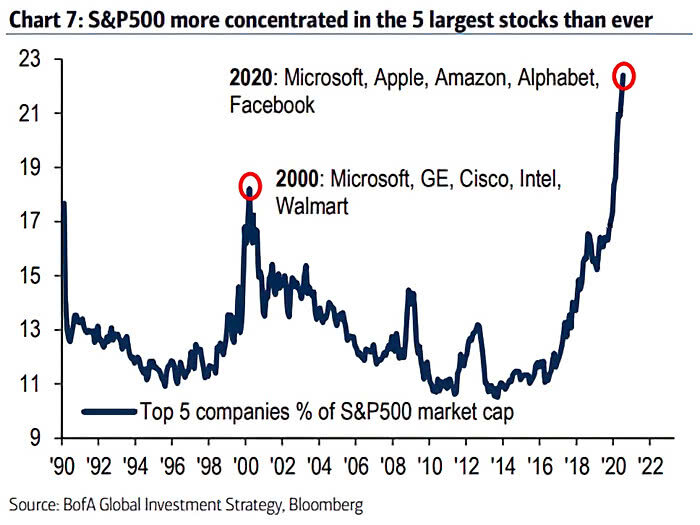

The last time investors were so concentrated in five stocks was at the peak of the tech bubble.

We all know what happened after that.

The S&P 500 Index fell by 41% in two years. Five trillion dollars were wiped out in the stock market during that time.

Twenty years later, one of those stocks has risen back into that exclusive club: Microsoft Corp. (Nasdaq: MSFT) is once again one of the top five most-invested-in stocks.

The always-popular FAANG stocks are the rest of the market’s top stocks today: Facebook Inc. (Nasdaq: FB), Amazon.com Inc. (Nasdaq: AMZN), Apple Inc. (Nasdaq: AAPL), Netflix Inc. (Nasdaq: NFLX) and Alphabet Inc. (Nasdaq: GOOGL).

Here’s the chart that’s been making the rounds on social media:

Excluding Netflix, because it’s a little outside of these numbers, today’s top five stocks make up about 22% of the S&P 500 Index’s total market capitalization.

In 2000, the top five accounted for 18% of the index.

The S&P 500 Index is an index of 500 of the largest U.S.-listed stocks. Market capitalization, or market cap, is a stock’s share price multiplied by its shares outstanding.

By this measure, a fifth of the index’s value comes from just 1% of stocks.

That’s a huge concentration of investment dollars in a tiny sliver of the stock market. It tells us investors don’t feel comfortable investing anywhere else.

This concentration is not the death knell for these stocks or the broad market. But it’s not healthy either.

A lopsided market is more easily toppled when things start to shake.

Here’s what I mean…

It’s Hard for Mega-Cap Stocks to Stay on Top

The stock market is forward looking. That means investors make decisions based on what they expect will happen in three, six or nine months down the road.

When the stock of a large company finds its way atop the market cap leaderboard, it’s hard to stay there.

That’s because a company must deliver financial results to justify its stock’s value. Big companies typically cannot grow fast enough to sustain investors’ forward-looking exuberance.

It’s been noted in financial media that a stock is doomed to underperformance once it accounts for more than 4% of the S&P 500’s market cap.

That’s a constructive way to look at it. But the number 4% is arbitrary.

Apple broke above 4% in 2018, and look at it today:

Clearly, the 4% limit is not make or break.

But three stocks — Apple, Microsoft and Amazon — are above 4% of the S&P’s market cap at the same time. That’s certainly rare. Apple and Microsoft are nearing 6%!

Crazy.

That investors have such an appetite for these stocks speaks to the environment we’re in. Investors think that these companies will keep doing well into the future.

The nature of our economic response to COVID-19 bodes well for businesses serving the rush to digitalize everything we need to do life remotely.

This is no secret. Barron’s notes that these six stocks “trade at 36 times earnings and six times sales, the latter the highest on record.”

That these companies make up such a large piece of the S&P 500 is not sell signal.

But it will be hard for investors to justify these valuations in the near term.

Narrow Fortunes: 32% Climb in 5 Stocks Isn’t All Good

Coming into this week, FAANGM stocks (what we’re calling the FAANG stocks plus Microsoft) gained 32% this year.

The S&P 500 is about flat.

That means the other 494 stocks in the index have fallen more than 6% on the year.

Yes, the world was hit by a pandemic. A 6% drop isn’t horrible considering much of the U.S. economy was shut down and tens of millions of Americans lost jobs.

The blistering outperformance of FAANGM stocks has much to do with the pandemic’s impact. These businesses have been helped by the economic shift during lockdown.

That’s good for those stocks and others like them.

But the performance gap between FAANGM and pretty much everything else is still concerning.

On Monday, the S&P 500 climbed almost 1% to finish the day in the green.

Yet 70% of stocks in the index finished the day in the red.

We call that “bad breadth” since a whole lot of stocks are not participating in the market’s rally.

It is a reminder that the economy is not healthy, and investors have fewer and fewer places they can find a reasonable return.

That’s not good news. As we said, the last time this happened, $5 trillion were wiped out.

I know that 2020 is not a cardboard cutout of 2000.

But, be cautious anyway. We recommend keeping a close eye on your investments. You should make sure that you’re pruning investments that you’ve been meaning to sell and make sure that any new positions have an exit strategy.

We at Winning Investor Daily are committed to making sure that you have everything you need to keep your portfolio safe and growing. That means giving you our best research when you need it. We will be following this trend as it develops, and we will guide you through this volatility.

Good investing,

Editor, Apex Profit Alert