One of the biggest phenomenon in the investing world recently has been the current cryptocurrency bubble burst.

During the impressive display that bitcoin, along with thousands of new “altcoins,” put on during 2017, it seemed like people everywhere were comparing the event to the dot-com bubble that occurred in the late ‘90s into 2000s, only to be followed by a crash that lasted for over two years.

Events like this almost always have two things in common: They’re polarizing, and they deal with a new technology.

It’s typically a type of technology that’s so revolutionary that nobody knows exactly how it will pan out or how long it will have an effect on society. While the dot-com bubble is usually the go-to for people to reference, 2014 saw the start of another bubble burst that sent an entire industry into a tailspin.

An Unsustainable Rally | An Ignored Tech Sector

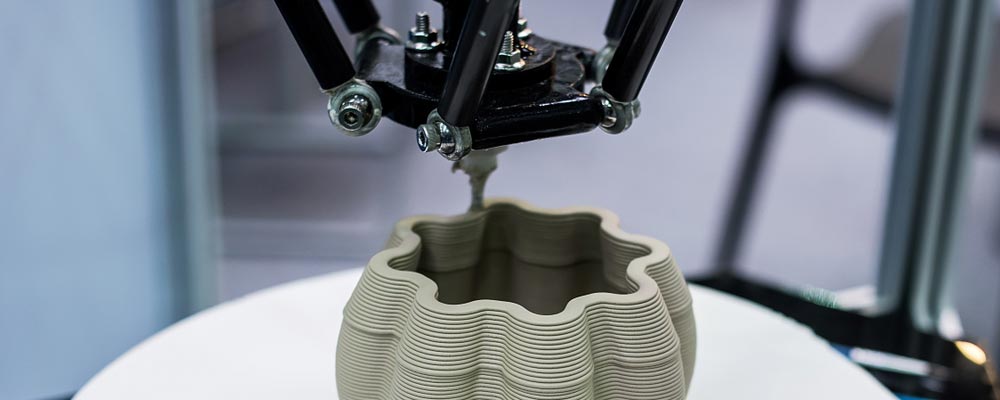

From 2011 through 2013, the hype that surrounded the 3-D printing industry was amazing. There were talks of huge companies like Microsoft and Adobe buying small 3-D printing companies and making the technology one of their top priorities going forward.

One research firm forecasted the 3-D printing industry to grow from $2.5 billion in 2013 to $16.2 billion in 2018. Just for reference, it was valued at about $8.3 billion last year, falling way short of the expected mark.

3-D printed houses, cars, artificial limbs and furniture all became the future. And while these types of goals are not unreasonable over the long term, investors were buying up the stocks as if it would happen over the next couple of years.

From 2009 through 2013, the revenue of 3D Systems Corp. (NYSE: DDD), the largest publicly traded pure-play 3-D printing company, grew from $113 million to $513 million, or about 354%. While this is a very impressive number, the stock price grew from $2.65 to $92.93 per share, a gain of over 3,400%.

The price topped out around $97 before crashing 94% all the way down to $6 just two years later.

Management got too far ahead of itself and planned for much larger growth than realistically possible, and 3D Systems fell way short of expectations. That caused analysts’ forecasts for sales to go way down as well.

For example, one analyst had a forecast of over $1.5 billion in sales for 3D Systems in 2018. That forecast was made back in March 2014, while the hype was still near its peak. Now, that analyst’s estimate is $681 million, less than half of what it was four years ago.

Due to reality setting in after the unsustainable rally, 3-D printing stock prices are now at an area that actually makes more sense. In fact, they may be slightly cheap.

One of the main ratios that investors use for companies when determining a fair value for the stock is price to sales, which measures the value of the company against the past year’s worth of sales revenue.

At its peak, 3D Systems was worth about 24 times its past year of sales, which is extremely high for any type of company. But now, the entire company is only worth two times its past year of sales. That’s because the price has gone so far down, and sales have stayed about the same.

3-D Printing’s Sweet Spot

A unique company in the 3-D printing industry is Proto Labs Inc. (NYSE: PRLB). What makes it unique is that it doesn’t actually make and sell printers. Its business model is making prototypes and test models of products for other companies.

Proto Labs has quietly been doing very well over the past year, as its stock has generated a return of about 140% during that time. And even though 3-D printing revenue growth has slowed in the past couple years, Proto Labs has been seeing double-digit sales growth.

In fact, its sales growth for 2018 is expected to be 27%, which would be its highest growth since 2014.

The reason I bring PRLB up is that it could be used as a proxy for demand in the 3-D printing industry. If a lot of companies are making orders for 3-D printing-based models for product prototypes, it suggests that the demand for the technology is still there.

The process of creating prototypes and models, what’s known as the product development stage, seems to be the sweet spot for using 3-D printing technology right now, and if the demand is there, we could be seeing a rebound in industry-wide growth starting in the next year or two.

This suggestion could be backed up by comments from management of companies around the world that seem very bullish about 3-D printing.

In a survey done by Sculpteo, a French 3-D printing company, about 1,000 companies from 62 countries around the world that use 3-D printing as part of their business operations gave their take on the technology.

About 90% of the companies said that they consider it an advantage over their competitors that don’t use it. Even better, 72% of the companies said that they expect to spend more on the technology in 2018 than they did in 2017, even after their average budget for 3-D printing technology grew by 55% in 2017.

The Future of 3-D Printing

The key to the success of 3-D printing in the future is its mass adoption by big companies. Even though some 3-D printer manufacturers make printers that can be used by people at home, there is much more money to be made by selling millions of industrial-grade printers to companies around the world.

And the technology can be extremely interesting and fun to talk about, but if companies aren’t using it, there’s no point in investing in the companies that make it.

So, those stats are both very promising for the future of 3-D printing because they suggest that manufacturing companies are not only using the products, but they consider it an advantage and plan on expanding their use in the future.

Two stocks that I’ve already mentioned here that would benefit from another upward trend in 3-D printing stocks are 3D Systems and Proto Labs.

However, this is a relatively risky area to invest in right now, because nobody knows exactly when investors will jump back on the bandwagon and push 3-D printing stocks up again.

A more conservative approach would be investing in ARK Invest’s 3D Printing ETF (PRNT), which holds a portfolio of 47 stocks in the 3-D printing industry.

Regards,

Ian Dyer

Internal Analyst, Banyan Hill Publishing

Editor’s Note: Matt Badiali’s Front Line Profits has a three-part strategy that anyone can follow — even if they’re completely green when it comes to natural resource stocks — to turn $5,000 into $625,000 within three years. In fact, Matt recently used this strategy to grab a personal return of 4,400% within a mere 12 months … but to join him in making massive gains in the resource sector, you must be signed up for Front Line Profits by tonight, April 17, at midnight EDT. To see how Matt finds companies that have what it takes to turn a newfound discovery into a grand-slam payday, simply click here now.