The Great Rebalancing

Great Ones, I’m no high-flying, high-profile Wall Street talking head. If I was, you probably wouldn’t be getting Great Stuff for free. Like Zaphod Beeblebrox … I’m just this guy, you know?

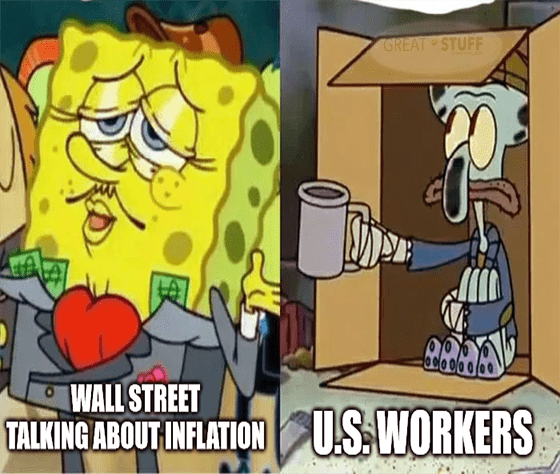

But even I can see the writing on the wall when it comes to the U.S. economy and Wall Street’s massive inflation infatuation. I’ve said for some time that the center cannot hold on inflationary pressures, and today, we received proof of that.

We all know why prices are rising … why inflation is a concern. Millions of consumers are moving back into the market, creating impressive demand. Meanwhile, suppliers are still ramping back up after pandemic shutdowns and are having trouble meeting that demand.

It’s a simple enough equation: High demand + limited supply = inflation.

Since it’s easier to walk out your door, get in your car and go buy something than it is to rehire workers, acquire raw materials and reopen production lines, the U.S. economy is currently facing short-term inflationary pressures.

This supply/demand imbalance is exacerbated by the fact that many consumers are flush with stimulus cash and savings after not going anywhere or doing anything in the past year.

Thanks for the Econ 101 lesson, but I think we all get this. So, what’s your point?

My point, Great Ones, is that today you were fed an economic headline that perpetuates the inflation narrative while downplaying data that undermines that takeaway.

Specifically, the U.S. Labor Department reported that the producer price index jumped 6.6% — its fastest pace in more than 11 years!

As CNBC put it: “Producer prices climb 6.6% in May on annual basis, largest 12-month increase on record.”

The largest 12-month increase on record. On. Record!

That’s certainly scary. And it reaffirms all the inflationary fearmongering the financial media has peddled since January.

But what if I told you there was another data point in that report that gives credence to all I’ve said about inflation so far this year?

Retail sales fell 1.3% in May, more than double economists’ expectations.

Riddle me this, Great Ones: What happens when you have limited funds and the things you typically buy rise in price?

You stop buying; that’s what you do. You cut back on expenses and limit your purchases to necessities.

That’s what’s going on right now in the U.S. economy. Millions remain unemployed. Many people are riding on stimulus checks and expanded unemployment benefits. And while both of these economic support systems help millions make ends meet, those funds aren’t forever.

Several states have already rejected expanded federal unemployment aid, forcing many unemployed workers back to jobs that often pay less than the government benefits they were receiving.

I’m not telling you this to bemoan or support government aid or bitch and moan about lazy workers. I’m telling you this so that you understand how constrained demand in the U.S. is right now.

Yes, we saw a massive burst during the reopening. Consumers were rabid for the great outdoors, lattes and all the amenities they had been denied for months on end. But that money is going to run out. Savings will run out. Stimulus will run out. Unemployment benefits will run out.

As such, demand will normalize, and inflationary pressure will subside. We’re already seeing this trend in the housing market — see today’s Quote of the Week below for more on that — and we’ll soon begin seeing it in the rest of the U.S. economy.

And this, Great Ones … this eventual normalization in supply and demand is why I’m not worried about inflation.

In fact, I’m more worried about deflation when Wall Street realizes that current demand is superficial due to low employment — and everything from lumber prices to stock prices is artificially inflated due to easy money and sluggish supply chains.

Chew on that one for a bit, and then let me know your thoughts: GreatStuffToday@BanyanHill.com.

Editor’s Note: Have You Heard of the “Miracle on Main Street?”

Despite the wild times we’re living in, 100,000 Americans are defying the odds … rising up and taking control of their financial future. Click here to discover why one governor is calling it a “Miracle on Main Street.”

The Good: The Enemy Of My Enemy…

Good news, Great Stuff Picks readers!

The U.S. and EU just announced that they ended a 17-year trade dispute over aircraft subsidies. That means the $11.5 billion in “harmful tariffs” levied against Boeing (NYSE: BA) and Airbus are gone … for now, at least.

The two sides agreed to suspend the tariffs for five years, allowing both sides to “overcome long-standing differences in order to avoid future litigation and preserve a level playing field between our aircraft manufacturers and will also work to prevent new differences from arising.”

This means no more tariffs for Boeing … and that’s a good thing, in case you were wondering.

Now, some investors see this as a negative for Boeing. After all, the company will no longer benefit from punitive tariffs against Airbus and will probably receive less aid from the U.S. government. But the deal doesn’t rule out all government subsidies … just ones that give an unfair advantage. That seems like a pretty big loophole to me.

And I would expect both the U.S. and EU will use that loophole generously, especially given that both sides also “agreed to work together to challenge and counter China’s non-market practices in this sector that give China’s companies an unfair advantage,” according to President Biden.

In short, both the EU and the U.S. are more concerned about China’s growing influence than their own trade spat. And that, Great Ones, can only benefit Boeing and the returns on your Great Stuff Picks position in BA stock — which is up nearly 14% since we recommended it back on December 30.

The Bad: Depressing Results

When is a success not a success? Ask Sage Therapeutics (Nasdaq: SAGE).

The biopharma finally unveiled Phase 3 results for its major depression drug Zuranolone. Apparently, the Zuranolone trial hit its main endpoint in treating depression symptoms, which is good.

However, the trial indicated that Zuranolone’s effects might not last all that long, which is bad.

Specifically, results showed that the once-a-day drug lost effectiveness during a two-week period. By day 15, all improvements failed to reach a statistical significance.

In other words, Zuranolone works fast at treating depression symptoms … but the effect fades over time.

This “lack of durability” has many analysts questioning whether Zuranolone will receive FDA approval. And, even if it does, the short effective time frame could hurt the drug’s commercial viability.

Those concerns prompted a 17% plunge in SAGE shares, while shares of co-developer Biogen (Nasdaq: BIIB) were down more than 1%. Is it just me, or are things looking decidedly weird for BIIB this year?

That said, Dr. Anita Clayton, Chair of Psychiatry and Neurobehavioral Sciences with the University of Virginia School of Medicine, believes the drug could be effective as a “short-course” for major depression therapy.

“This will empower my patients to think differently about their depression and treatment and to rapidly return to their life,” Clayton said.

So, basically, SAGE is dropping because Zuranolone is not the miracle cure for depression many thought it would be. However, I have a feeling the drug will be approved and will contribute more revenue than analysts expect right now.

There are very few effective “short-course” depression treatments out there, and this could be a rather profitable niche for Sage.

The Ugly: Still Better Than Webistics

Another day, another new short selling mud-slinging fest.

Lemme guess: Hindenburg?

Yup. It’s always Hindenburg. For today, at least, the short selling firm’s target is sports-betting company DraftKings (Nasdaq: DKNG).

DraftKings isn’t necessarily the problem, per se — that dishonor goes to SBTech, which DraftKings merged with as part of its three-way SPAC deal with Diamond Acquisition.

If you believe Hindenburg — and that’s a big ask — SBTech has “systemically skirted the law and taken elaborate steps to obfuscate its black-market operations and ties to organized crime.” SBTech allegedly tried to clean up its business before the SPAC merger by moving illicit operations and customer relationships over to a new entity called BTi/CoreTech.

Allegedly, more than half of SBTech’s revenue still comes from markets where gambling is banned. To Hindenburg, this shell game of hiding backdoor gambling is a front to shield DraftKings from reputational damage. I mean, DraftKings is out here making deals with the NBA and NFL — you know how they’d react to reports of illicit gambling…

What can I say? Hindenburg knows hype. That’s why it latches onto literally every headline-making upstart it sees. And compared to Nikola’s downhill-rolling theatrics or Lordstown’s looming doom, black-market gambling is much juicier for investors than another failed electric vehicle play.

If we’re going to point fingers about black-market operations, money laundering and obfuscating business behind vaguely named corporate entities … Hindenburg went for the lowest-hanging fruit on Wall Street.

You only get in trouble for black-market money … if you don’t have enough black-market money. Just ask Deutsche Bank about how much a slap on the wrist it received over “suspicious flows.” Corruption? On Wall Street? Why, I never!

I’m going to stop here before the Great Stuff team gets black bagged, but suffice it to say, I don’t think DKNG investors have all that much to worry about … depending on who all gets involved in this alleged black-market kerfuffle.

Money laundering and mob ties aren’t, ahem, the best optics for a growing startup. But unless the SEC and other alphabet agencies get involved and find wrongdoing on DraftKings’ part, Hindenburg’s claims sound like they were hashed out halfway through a rewatch of The Sopranos.

In that case, it’s just a question of how much money DraftKings has to dig itself out of that hole and away from the legal limelight. Either way, skittish investors cashed in their chips today, sending DKNG down 6% by the close. I’m just wondering — help me out here — who invests in sports betting expecting perfectly clean money, honestly?

Here we are, everyone: Our Quote of the Year. Pack it up — this is the one quote to rule them all.

Never has one line summed up … well, practically everything we’ve been talking about in Great Stuff over these past months. You didn’t just skim on through my whole inflation infatuation rant at the top … right?

So, what’s Mr. Kettle getting at? Which prices went too far, too fast? Take a guess … I’ll wait. (I am virtual, untethered by time.)

Kettle was actually talking about a recent collapse in copper prices, but that’s beside the point.

My takeaway (and Kettle’s unintentional one) is that the fundamentals don’t justify the price on pretty much anything right now.

Not copper, not housing, not lumber. Not stocks or other assets. Nada. They’re all artificially high because of the pandemic. So … what’s next?

Just as record-high copper prices are now slipping, all of these overblown valuations and propped-up prices will have their own individual days of reckoning. A point where either supply catches up to demand, supply gets too expensive for demand, demand drops off … or a mix of all of the above.

Case in point: Right now, the lumber market — and the housing market, by extension — is at an inflection point.

Lumber prices came careening down from their lofty canopies over the past few days, plunging more than 40%. But for once, it’s not a supply-side problem:

Gasp! Trouble afoot in Sherwood forest? If the supply is there and prices are falling, that means demand for lumber must be crashing through the floor, right?

Deflation is here, oh noes!

Are people … finally waking up to the fact they’re getting hosed on houses?

This backslide in lumber prices, and demand is exactly what you’d see at the onset of a retreat in the housing market.

Next, you’re going to tell me that homebuilder confidence is starting to crater and — oh, wait, homebuilder confidence is faltering. Because of high prices, you say?

Ain’t that something. It’s almost like … everything’s connected? Like supply and demand are a convoluted yet crucial equation, with prices and cross-sector headwinds all hanging in the balance.

I’m shook. What else is new? Black-market money in gambling? Gimme a break.

Anyway … this took a much more caustic and snarky turn than I anticipated. How are you doing? Everything groovy in your neck of the woods, Great Ones? Any rants on your mind or trades in your sights?

Let me know in the ol’ inbox-a-roo: GreatStuffToday@BanyanHill.com is where you can let your words fly like the wind and join in the Great Stuff conversation. And in the meantime, here’s where else you can find us:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff