What’s The Deal With GameStop?

Ah, GameStop (NYSE: GME). Is there anything left to say about this video game retailer turned meme stock?

Well, if GameStop’s showing up in Great Stuff’s weekend edition … you can bet there is!

But where to begin? How about GameStop’s first-quarter earnings report? Cause you know GME stock’s rally is all about fundamentals…

GameStop’s fundamentals? That’s the best joke I’ve heard all weekend!

Right? Believe it or not, there are quite a few financial rags and analysts out there still harping on silly things like fundamentals. Take this Yahoo Finance article from Thursday, for example: “GameStop shares fall as ‘investors are getting tired of waiting,’ analyst says.”

Now, you might think that investors are getting tired of waiting for earnings to turn around. But after last week’s report, that’s a Texas-sized hard no. Revenue jumped 25% to $1.28 billion, while GameStop’s losses narrowed to just $0.45 per share — less than half of last year’s loss of $1.61 per share.

Both figures destroyed Wall Street’s expectations. So, earnings turnaround? Check.

But what about GameStop’s plans to shake up its leadership to become a lean, mean online retailing machine? Well, there was news on that front last week as well. GameStop announced that two former Amazon executives would take over the company’s CEO and CFO roles.

I have a hunch that these two Amazonians know how to sell a thing or two online. So, big-time leadership shakeup? Check.

So, if it’s not fundamentals or corporate leadership, what exactly are investors tired of waiting for?

According to Yahoo Finance and Wedbush Analyst Michael Pachter, investors are tired of waiting for GameStop’s big plan. You know, the one where newly elected chairman of the board Ryan Cohen magically transforms GameStop into Amazon Part 2: Electric Boogaloo?

Let’s hear directly from Mr. Pachter:

We don’t know where GameStop is headed, but it’s clear that they intend to remake themselves as an Amazon-lite. And Ryan Cohen promised investors a strategy back in mid-January. It’s been nearly five months, and we haven’t seen that yet. I think the pullback in the stock is investors are getting tired of waiting for him to tell us what the strategy is. I’m getting tired of waiting. And there’s no chance I’m taking my target up unless he shows me the path to massive profit growth. I just don’t see it.

First, I have to thank Mr. Pachter for pointing out the painfully obvious — that analysts are looking for real facts, hard plans and massive profit growth from GameStop.

Personally, I think those expectations are hilarious. And it’s even more hilarious that Pachter thinks Ryan Cohen is so magical that he can come in and turn the GameStop ship around in just five months.

I mean, GameStop was on the verge of going completely bankrupt about two years ago. The fact that the company is now showing revenue growth is impressive all on its own. But that’s not good enough for Mr. Pachter or the analyst community. They want massive gains, and they want them now.

The big question is: Why?

GameStop: Attack Of The Fundamentals

Why do analysts and stodgy old Wall Street talking heads want massive gains from GameStop? The answer is that they’re still operating under the ol’ valuation rules of the Street.

If a stock is worth X, then the company must bring in Y dollars in revenue to justify that price.

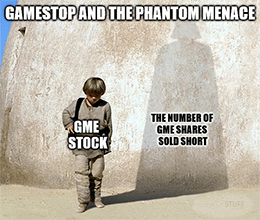

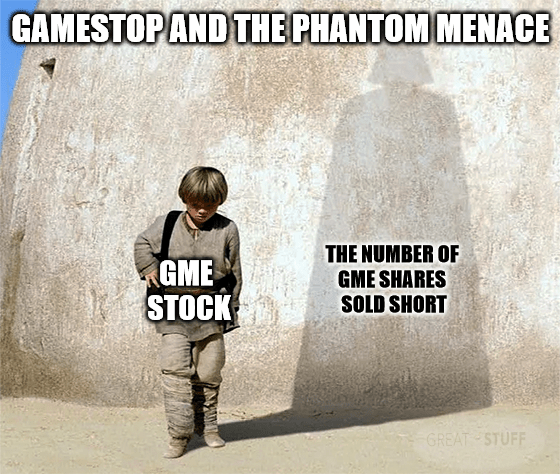

I can’t help but be reminded of the Jedi council in the Star Wars prequels. By sticking to the old ways, many analysts and old-school investors are missing the Phantom Menace lurking right beneath their feet.

By expecting GameStop’s stock price to match up with their valuation models, they’re missing the point completely.

I mean, if the Jedi council had just rescued Anakin’s mom from slavery, the story would’ve ended right there! Come on!

Similarly, if analysts and Wall Street regulatory bodies like the SEC had just paid attention, the short-selling nightmare that spawned the great Meme Stock Revolution would’ve ended with a whimper.

Heck, even the short sellers themselves could’ve ended this insanity months ago just by letting go and moving on.

That’s because the real reason that GME stock has rallied 4,560% in the past year is short interest.

Bored retail investors, emboldened by millions in government stimulus cash, caught wind that GME was extremely heavily shorted. In fact, at one point, there were more shorted shares outstanding for GME than there were shares available for public trading.

Explain that one, Mr. SEC?

GME: Revenge Of The Retail Investors

So, these bored retail investors started buying GME … and buying GME … and buying more GME until short sellers got really nervous.

This actual scenario plays out on Wall Street all the time. The squeeze play on GME is nothing new in that sense. Shorting stocks and squeezing those stocks is just daily business on Wall Street.

What is new, however, is that retail investors don’t play by the same rules — especially when it comes to GME.

In a typical Street scenario, the GME squeeze play would’ve been over back on January 29 when the stock skyrocketed due to extreme pressure on short sellers to stem their losses.

In this typical case, GME bulls would’ve taken their profits quickly and, having milked the GameStop trade for millions, moved on to another target.

But retail investors didn’t go that route. They caught wind that short sellers were playing funny behind the scenes and even potentially breaking the rules — see the fact that more GME stock was shorted than shares available.

Seeing this, those retail investors doubled down. They didn’t want the basic level prize that short sellers were handing out. They wanted the whole enchilada. And so, those retail investors, flush with more stimulus cash this time around, bought even more GME stock.

So, Mr. Pachter — sorry to pick on you, but you made it so convenient — fundamentals have absolutely nothing to do with GME stock’s price. Nothing. Nada. Zip. Zilch.

GameStop will never see massive gains in revenue. Well, I shouldn’t say never. There is a chance Ryan Cohen actually pulls this Amazon Part 2 thing off. But I wager we won’t see that kind of growth for years, maybe even a decade.

Editor’s Note: “Imperium” Is The No. 1 Investment Of The 2020s

Elon Musk calls it “amazing…” A former Apple CEO says: “[It will] have a far bigger impact on humanity than the Internet.” While a Harvard Ph.D. says it could “[surpass] the space, atomic and electronic revolutions in its significance.”

It’s a technology my colleague Adam O’Dell calls “Imperium.” And it’s about to spark the biggest investment mega trend in history, with one small Silicon Valley company at the center of it all.

To get all the details, click here now.

Don’t Be a Rogue One

By Pachter’s logic and the logic of traditional investing rules dating back centuries, GameStop is simply not worth its current price.

On that point, I completely agree … and I have for some time.

By the same right, GME stock will likely never see the big short-squeeze explosion retail investors are hoping for.

Why? Because short-selling institutions are just too big, too well funded and too well connected for them to ever lose that much money on a single trade.

Here’s how I see this playing out: Eventually — like the tortoise in that old hare-raising tale — the SEC will take firm action.

It will likely go after low-hanging fruit like retail investors or no-fees trading platforms like Robinhood. And that will be the end of the GME meme stock era, thus dashing the hopes of thousands of retail investors piling into the GameStop gold rush.

Or … the SEC could actually grow a pair and target big-time short players like Citadel Securities and Virtu Financial. After all, you aren’t supposed to be able to short more of a stock than is actually available. I’m not saying these two are responsible, but someone is, and the SEC should probably look into that.

But even if the SEC goes this route, those retail investors are still going to get screwed … or, at least, they won’t rake in the massive amounts of cash many are dreaming about.

A New Hope?

Now, this is the part where I tell you not to invest in GME stock. But, seeing as how I get so many messages in the Great Stuff inbox thanking me for recommending this stock — Wut? — some of y’all clearly aren’t listening.

You’re going to do what you want anyway. And that’s fine … I guess … since you’re not using my money to do it with.

I’ll leave you with this one parting bit of advice: If you are trading GME stock, buy the dip, set your target profit and get out immediately when you hit it.

Sooner or later, every single other retail GME stock trader WILL do the exact same thing … and you definitely do not want to be the one left holding the bag when the feces hits the rotating air circulator.

Thank you all for coming to my TED Talk. Have a tremendous weekend, Great Ones! And if you have that burning yearning that only more Great Stuff can satisfy, you should check out our deets here:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff