Friday Four Play: Snackin’ at the Symposium

Hello from sunny Florida, Great Stuff readers!

Day 1 of the 2019 Banyan Hill Total Wealth Symposium is in the books … and what a day it was.

Attendees enjoyed everything from “Options 101” classes from Banyan Hill expert Michael Carr, to crucial investment ideas for the new world of power and money from Paul . Paul even gave conferencegoers (and live-streamers) exclusive stock picks to go along with his latest vision on the new power market.

(On a side note, “new power market” sounds like a Prince band from the 80s … but I digress.)

I’d like to tell you what those stock picks are … but they’re a secret held only for Total Wealth Symposium attendees. If I told you, they wouldn’t be a secret, now would they?

By the time you read this, I’ll be neck-deep in day 2 of the conference presentations. I’m expecting great things from today’s Banyan Hill experts, including Ted Bauman, Chad Shoop, Ian King and a return performance from Paul .

It’s crunch time at the conference, so here’s a truncated Friday Four Play to hold you over for the weekend:

No. 1: Cloudflare’s Notorious IPO Surges 24%

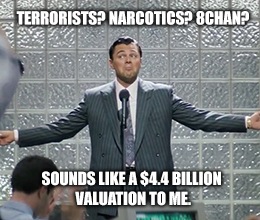

It’s not often you have a company admit to breaking U.S. federal law right before its initial public offering (IPO). But that’s just what Cloudflare Inc. (NYSE: NET) did ahead of today’s offering.

The cybersecurity firm amended its S-1 filing this week to state that it may have broken U.S. law by doing business with drug dealers and terrorists. That’s quite a list of clientele, especially when you remember that Cloudflare was already in the hot seat for providing an online haven for white supremacists via the website 8chan.

Dirty hands aren’t slowing down Cloudflare’s IPO, however. The company sold 35 million shares for $15 each, giving Cloudflare a $4.4 billion valuation. The company will begin trading today under the symbol NET.

No. 2: The Grocery Wars

Walmart Inc. (NYSE: WMT) has one-upped Amazon.com Inc. (Nasdaq: AMZN) once again.

The world’s largest brick-and-mortar retailer announced subscription pricing for its grocery delivery service … and it’s way cheaper than the online leader. For a mere $98 per year, Walmart will deliver groceries ordered online direct to your door.

By comparison, AmazonFresh’s will run you $180 per year … and that’s on top of a $119-per-year Amazon Prime subscription.

Granted, you don’t get a movie-streaming platform — or anything else, really — with Walmart’s grocery service. But if that’s all you’re looking for, Walmart’s service is a no-brainer. It will be interesting to see how this plays out.

No. 3: Trillion-Dollar No More

You may have seen the hype earlier in the week about how Apple Inc. (Nasdaq: AAPL) was once again a trillion-dollar company. As of today, the iPhone-maker no longer holds that title.

As I predicted earlier this week, the hype surrounding Apple’s new product announcements would push AAPL shares briefly higher. Wall Street loves Apple announcements, after all. But that hype has quickly faded, and AAPL is now pulling back as a result.

You know who is still a trillion-dollar company and has been since June? Microsoft Corp. (Nasdaq: MSFT). I hate to say I told you so, but … who am I kidding? I love saying: “I told you so.”

No. 4: (╯°□°)╯︵ ┻━┻

I had to amend yesterday’s edition of Great Stuff … twice. Why?

First, because Bloomberg reported that President Trump was considering an interim trade deal with China. Second, because the White House said it was “absolutely not” considering an interim trade deal with China.

Fine … we’ve seen this before. I happily made edits so you would have accurate information. However, not less than an hour or so after I sent greatness to your inboxes, President Trump told reporters: “A lot of people are talking about it, I see a lot of analysts are saying an interim deal — meaning we’ll do pieces of it, the easy ones first. But there’s no easy or hard. There’s a deal or there’s not a deal. But it’s something we would consider, I guess.”

I was ready to flip a table. So, in the end, Trump might be considering a piecemeal interim trade deal with China — or he might not. Are we clear now? We’re clear … I’m done.

Great Stuff: Leavin’ on a Jet Plane

The Banyan Hill Total Wealth Symposium runs through tomorrow evening. I’ve got some good pictures and more information to share with you, but you’ll have to wait until Monday’s edition of Great Stuff.

I’m going to go hobnob with the experts now.

In the meantime, you can drop me a line at GreatStuffToday@banyanhill.com, or check out all the Great Stuff greatest hits online.

Until next time, good trading!

Regards,

Joseph Hargett

Great Stuff Managing Editor, Banyan Hill Publishing