Class struggle has a bad reputation in this country.

The term conjures up images of rampaging Bolsheviks evicting Russian nobles from their factories and dachas … wild-eyed revolutionaries hurling cobblestones at some European gendarmerie or Latin American guardia civil.

When I was growing up, we were taught that there’s no class struggle in the U.S. — because there are no classes. We’re all Americans, and there’s no barrier to mobility from the poorest ranks of society to the richest. So even if you’re a working stiff right now, you don’t have to remain one … you must just apply yourself.

But if that’s the case, why does America’s most famous and respected investor say: “There’s class warfare, all right, but it’s my class, the rich class, that’s making war, and we’re winning”?

The answer is distressing … and bad for you, even if you’re in the investing class.

Viva Capitalism!

The capitalist system of economic organization is the most dynamic and productive in human history. It has produced staggering gains in human welfare by generating an endless stream of innovations.

Capital is the stuff that produces the things we consume — machines, factories, patents. Capitalism’s dynamism is based on the incentive that private ownership of capital gives to capitalists to invent new ways to meet human needs and wants. In return for bringing new and better things to the market, capitalists get profit.

But capital can’t produce anything on its own. It always requires human workers to operate it. Even the most advanced automated factories need technicians, managers and other workers to support them. These workers get wages and salaries.

The split between profit and wages is zero-sum. The more workers get in wages, the less profit capitalists get, and vice versa.

Something Happened in the Mid-‘70s

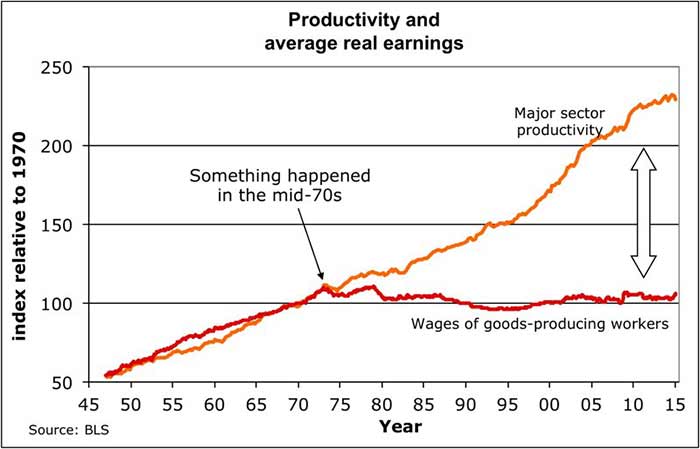

From World War II to the mid-‘70s, U.S. wage-earners shared in the increased productivity and wealth produced by constant innovation. Real hourly earnings rose at the same rate as productivity:

During this period, U.S. workers’ living standards rose steadily since they were getting a fair share of the return to increased productivity.

After the mid-‘70s, that stopped dead in its tracks. U.S. wage-earners stopped getting real income increases even though their productivity continued to rise. Instead, all the benefits of productivity growth went to owners of capital.

But U.S. workers didn’t want to give up the habit of increasing living standards over time. So, they saved less and borrowed more:

Since U.S. capitalists were keeping more of the returns to increasing productivity, they had plenty of money to lend to U.S. wage-earners. The glut of money in the financial system kept interest rates low, so for a while, everything seemed just fine.

Until, in 2008-2009, it wasn’t.

Be Careful What You Wish For

There are many reasons for the trend reversal in wage growth in the 1970s. I wrote about them in my Bauman Letter report for August.

On this Labor Day, however, the important thing isn’t the causes, but the effects. Those effects aren’t good for anyone … including investors.

Every investor loves profits. But every cent of profit ultimately comes from someone who spent that cent to buy the products of the firms whose shares we own. If people can’t afford to buy things, eventually profits stop growing.

That’s one reason why U.S. corporations are increasingly liquidating their capital through share buybacks rather than investing in innovation and increasing production capacity. With the incomes of the majority stagnating, the future doesn’t look good, so it’s better to cash out now.

Sure, there are sectors of the economy experiencing job growth. But when you examine those numbers, you find that they are low-wage, dead-end jobs with no benefits and irregular schedules that disrupt workers’ lives.

Out of those meagre wages, they must pay inflated prices for shoddy goods and services thanks to the increasingly uncompetitive U.S. economy.

Eventually, those people are going to get tired of waiting for their lives to improve. When they do, they will start to act out politically in ways that will destabilize the country.

Unstable societies are terrible places to invest.

Returning to Our Roots

The United States was designed around the ideal of equality amongst people, even if that ideal was limited to property-owning men at first. Everyone had a right to participate and share in the fruits of living in a free society.

For much of the 20th century, that idea was expressed in a proper balance between the interest of the owners of capital and wage-earners. The prosperity and stability that brought enabled America to become the greatest power on Earth … a society envied by the rest of the planet.

It was the society that made Warren Buffett rich. When the Oracle of Omaha begins to worry openly that “class war” in the form of increasing inequality threatens it, we should pay careful attention.

Before it’s too late.

Kind regards,

Ted Bauman

Editor, The Bauman Letter