Natural resource cycles usually last a few years. For example, the zinc bear market that began in early 2011 lasted for five years.

Few investors sit through those last years. Once a bear market gets rolling, it doesn’t take long for most investors to sell out in disgust. They move to other sectors where they can make money.

However, when a bull market comes to natural resources, it’s a constant source of worry. I know that in part from emails sent from readers of my Real Wealth Strategist newsletter.

Every day the price doesn’t go up makes them nervous. Every dip in the share prices of the miners in that sector is a source of panic.

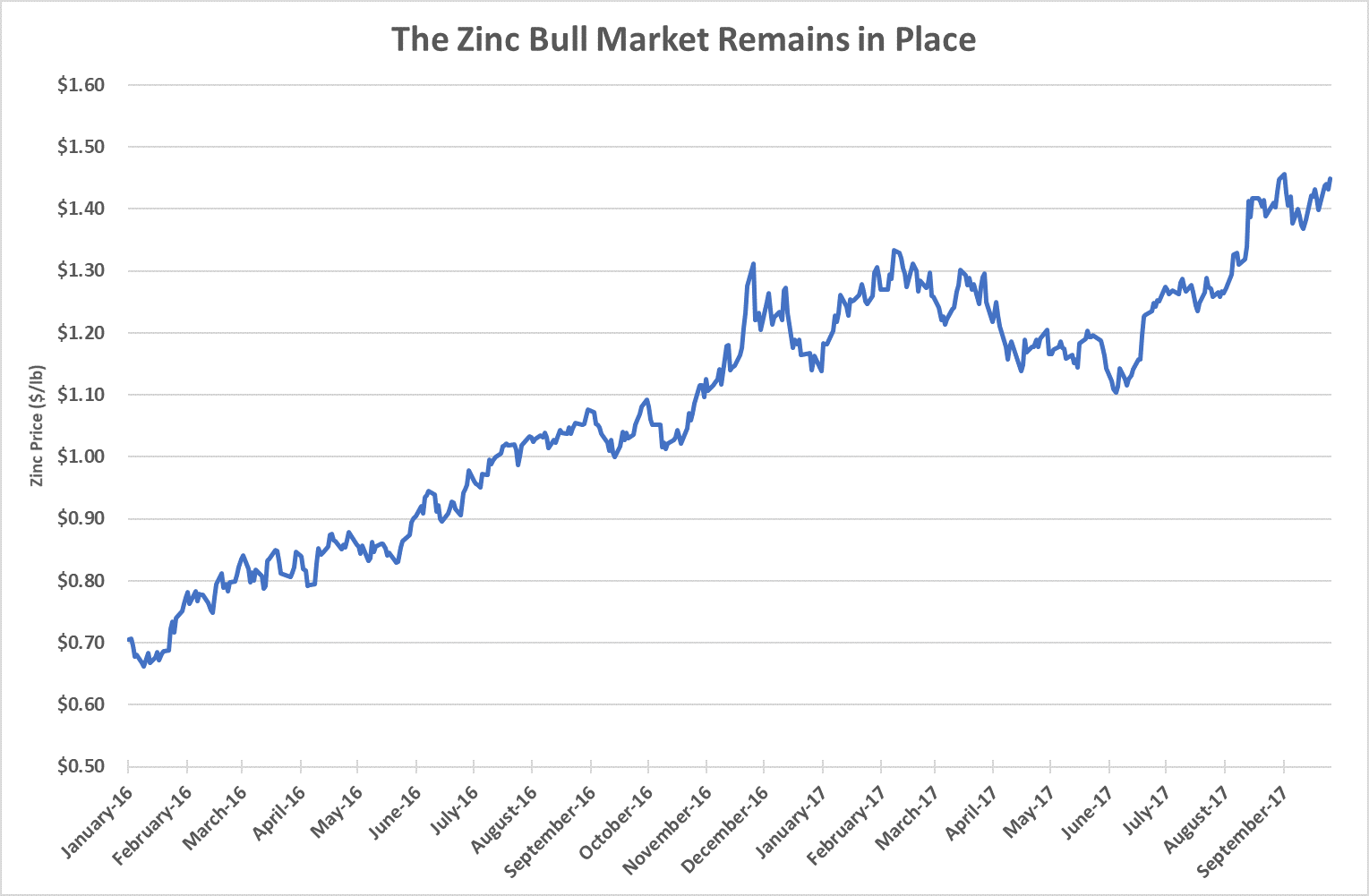

The truth is, no bull market goes straight up. That’s certainly true of the current zinc bull market. You can see what I mean in the chart below:

The price of zinc went from $0.66 per pound in January 2016 to $1.45 per pound today. That’s a 120% gain in 21 months. That’s a big gain, but it isn’t unique.

From December 2008 to January 2010, the price of zinc rose from $0.48 per pound to $1.22 per pound. That’s a 154% gain in 25 months.

The huge gains happened earlier this decade. From July 2005 to December 2006, the price of zinc rose from $0.53 per pound to $2.09 per pound. That’s a 294% gain over a shorter time span.

However, that was just part of a much longer uptrend. In August 2002, the price of a pound of zinc was just $0.33. The zinc price peaked in November 2006 at $2.09 per pound.

The total bull market lasted four years. From bottom to top, the price of zinc rose 533%.

That’s the sort of market we’re hoping to see right now. A 500% gain from the recent low would mean the price of zinc hits $3.96 per pound … and early investors would make a fortune on zinc producers.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist